David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Arverne Group S.A. (EPA:ARVEN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Arverne Group's Net Debt?

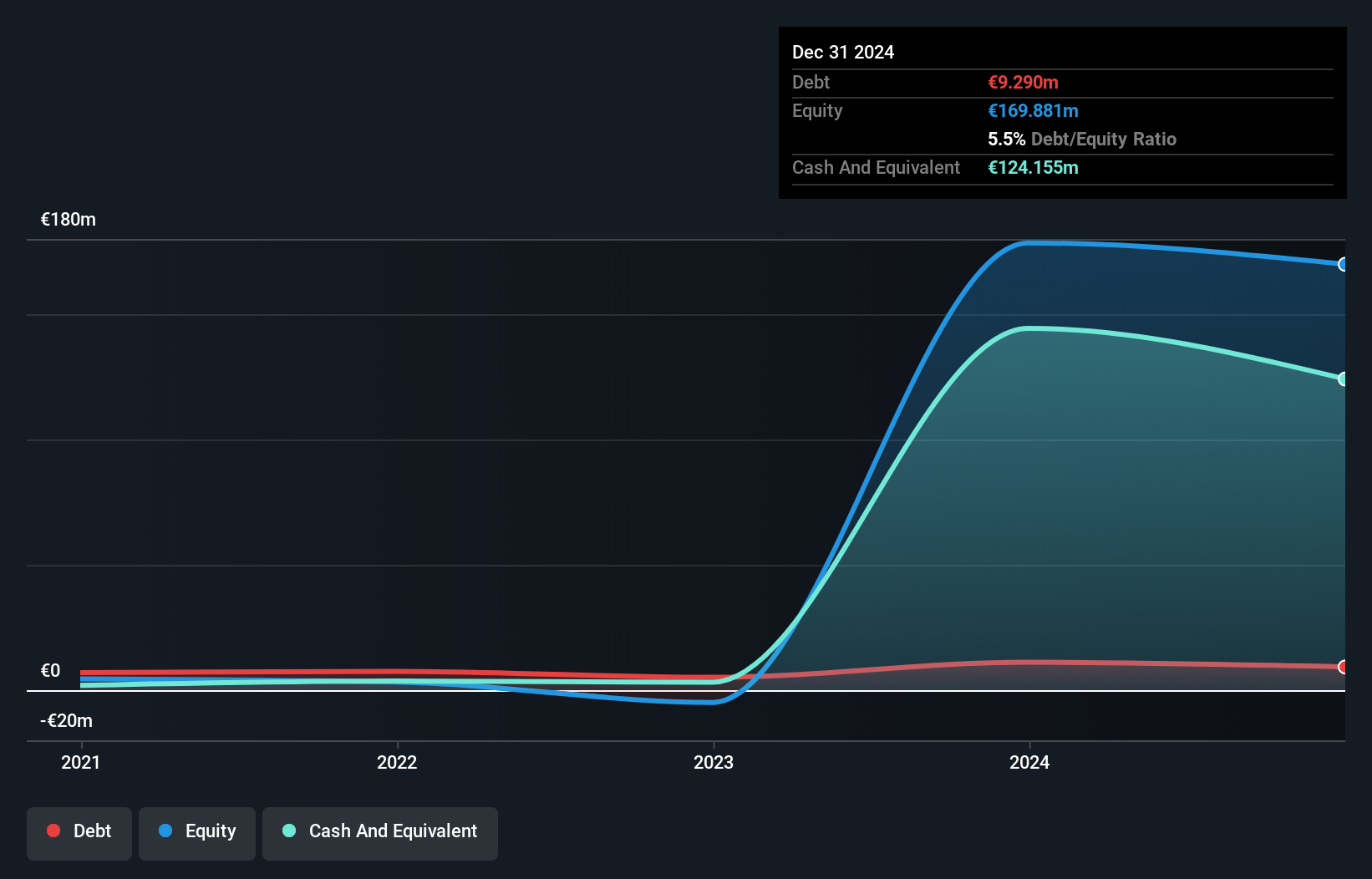

The image below, which you can click on for greater detail, shows that Arverne Group had debt of €9.29m at the end of December 2024, a reduction from €11.2m over a year. But it also has €124.2m in cash to offset that, meaning it has €114.9m net cash.

How Healthy Is Arverne Group's Balance Sheet?

The latest balance sheet data shows that Arverne Group had liabilities of €39.2m due within a year, and liabilities of €46.0m falling due after that. On the other hand, it had cash of €124.2m and €19.4m worth of receivables due within a year. So it actually has €58.3m more liquid assets than total liabilities.

This luscious liquidity implies that Arverne Group's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Arverne Group boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Arverne Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

View our latest analysis for Arverne Group

In the last year Arverne Group wasn't profitable at an EBIT level, but managed to grow its revenue by 40%, to €14m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Arverne Group?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Arverne Group had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through €27m of cash and made a loss of €10.0m. While this does make the company a bit risky, it's important to remember it has net cash of €114.9m. That kitty means the company can keep spending for growth for at least two years, at current rates. Arverne Group's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Arverne Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ARVEN

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026