- France

- /

- Transportation

- /

- ENXTPA:STF

3 European Dividend Stocks Yielding Up To 7.4%

Reviewed by Simply Wall St

As European stocks rally, driven by technology gains and expectations of lower U.S. borrowing costs, investors are taking a renewed interest in dividend stocks as a potential source of steady income amid the market's positive momentum. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for those looking to benefit from both capital appreciation and regular income streams.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.88% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.75% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.04% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 12.10% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.32% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 3.91% | ★★★★★★ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

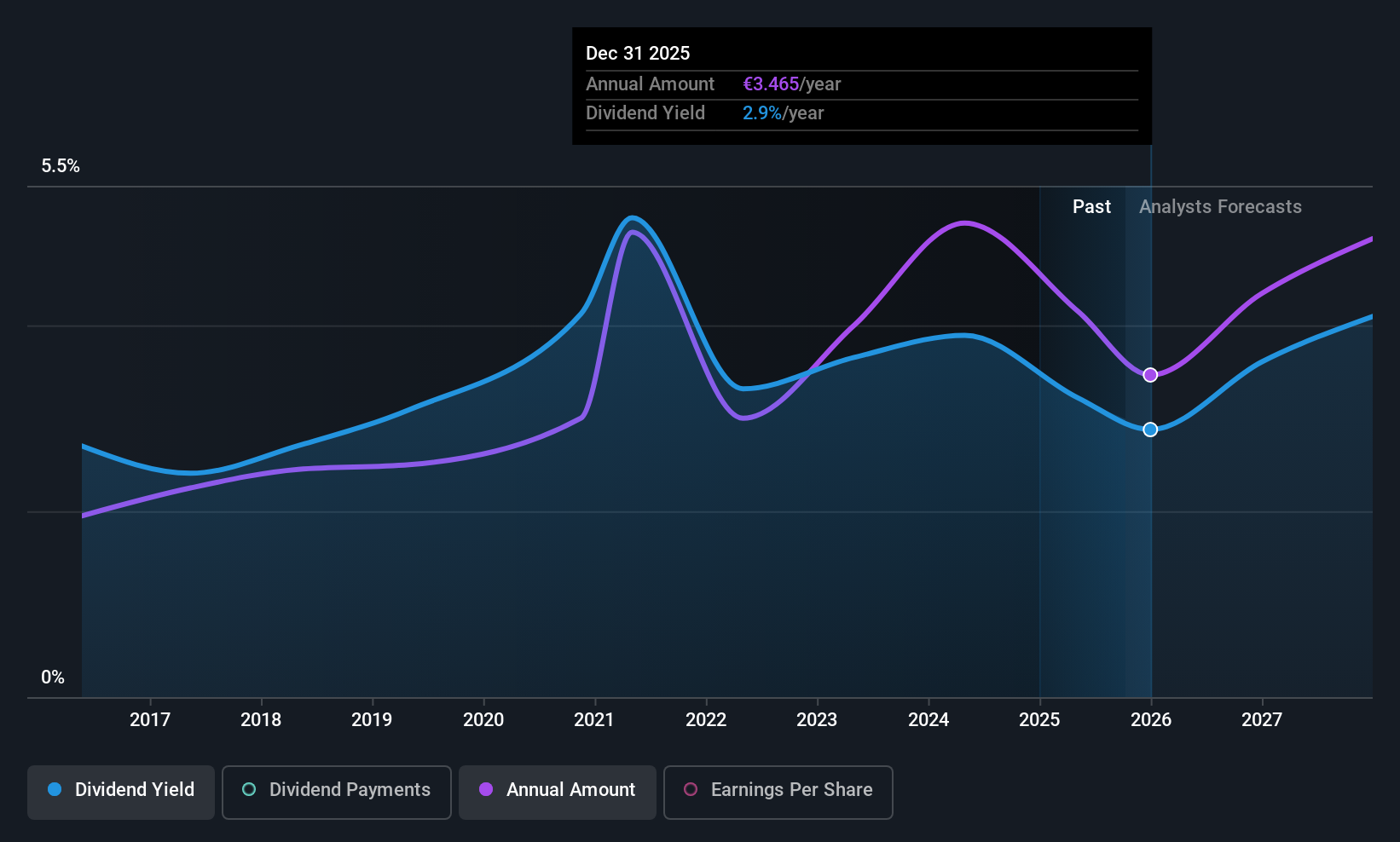

STEF (ENXTPA:STF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: STEF SA offers temperature-controlled road transport and logistics services for the agri-food industry and out-of-home foodservices, with a market cap of €1.54 billion.

Operations: STEF SA generates revenue from its segments, with STEF France contributing €2.47 billion and STEF International adding €1.92 billion.

Dividend Yield: 3.4%

STEF's dividends are covered by both earnings and cash flows, with payout ratios of 53.9% and 67.6%, respectively, suggesting sustainability despite a volatile track record over the past decade. The dividend yield of 3.39% is below the top tier in France, and recent financial results show a decline in net income to €15.83 million for H1 2025 from €67.97 million last year, potentially impacting future payouts amidst high debt levels.

- Take a closer look at STEF's potential here in our dividend report.

- Upon reviewing our latest valuation report, STEF's share price might be too pessimistic.

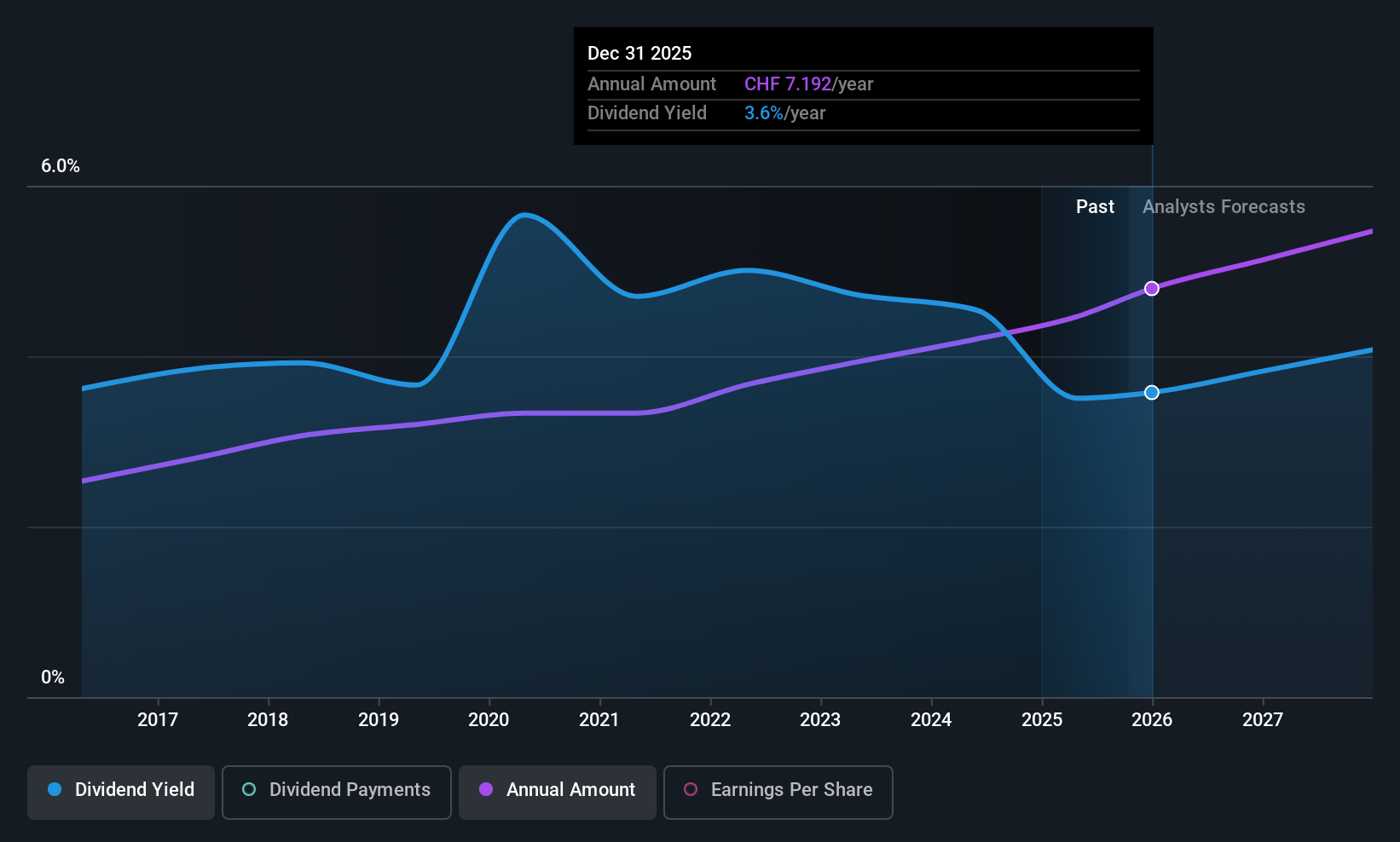

Helvetia Holding (SWX:HELN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in life, non-life insurance, and reinsurance across several European countries and internationally, with a market cap of CHF10.66 billion.

Operations: Helvetia Holding AG's revenue is derived from its life insurance segment at CHF2.11 billion, non-life insurance segment at CHF7.26 billion, and reinsurance business contributing CHF391.90 million.

Dividend Yield: 3.3%

Helvetia Holding's dividend yield of 3.32% is below the Swiss market's top quartile, but its dividends are reliably covered by earnings and cash flows, with payout ratios of 65.6% and 70.8%, respectively. The company reported a significant increase in net income to CHF 307.2 million for H1 2025 from CHF 243.1 million last year, supporting its stable and growing dividend payments over the past decade amidst ongoing executive changes and strategic developments.

- Click here to discover the nuances of Helvetia Holding with our detailed analytical dividend report.

- Our expertly prepared valuation report Helvetia Holding implies its share price may be too high.

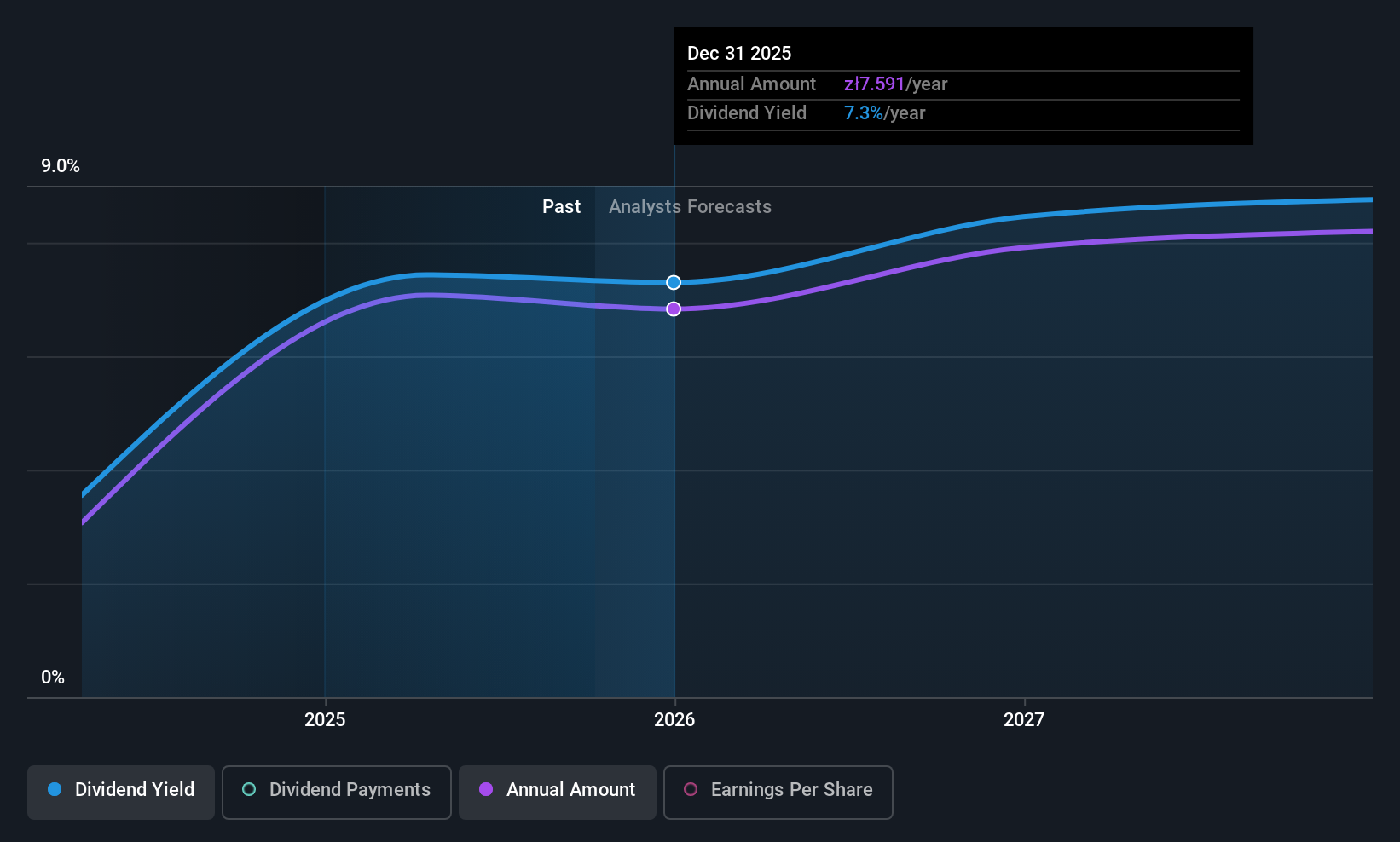

BNP Paribas Bank Polska (WSE:BNP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BNP Paribas Bank Polska S.A. offers a variety of banking products and services to both individual and institutional clients in Poland, with a market cap of PLN15.68 billion.

Operations: BNP Paribas Bank Polska S.A.'s revenue segments include Retail and Business Banking (PLN4.20 billion), Corporate Banking (PLN1.88 billion), Small and Medium-Sized Enterprises (SME) Banking (PLN822.90 million), and Investment Certificates (PLN323.17 million).

Dividend Yield: 7.4%

BNP Paribas Bank Polska's dividend yield is among the top 25% in Poland, with a payout ratio of 44.5%, indicating dividends are well covered by earnings. Despite only two years of dividend history, payments have been stable and reliable. The bank's recent earnings report showed net income growth to PLN 733.85 million for Q2 2025 from PLN 622.98 million a year prior, supporting its valuation below fair value estimates despite high bad loans at 3%.

- Unlock comprehensive insights into our analysis of BNP Paribas Bank Polska stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of BNP Paribas Bank Polska shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 221 Top European Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STF

STEF

Provides temperature-controlled road transport and logistics services for agri-food industry, and out-of-home foodservices.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives