What You Can Learn From ID Logistics Group SA's (EPA:IDL) P/E

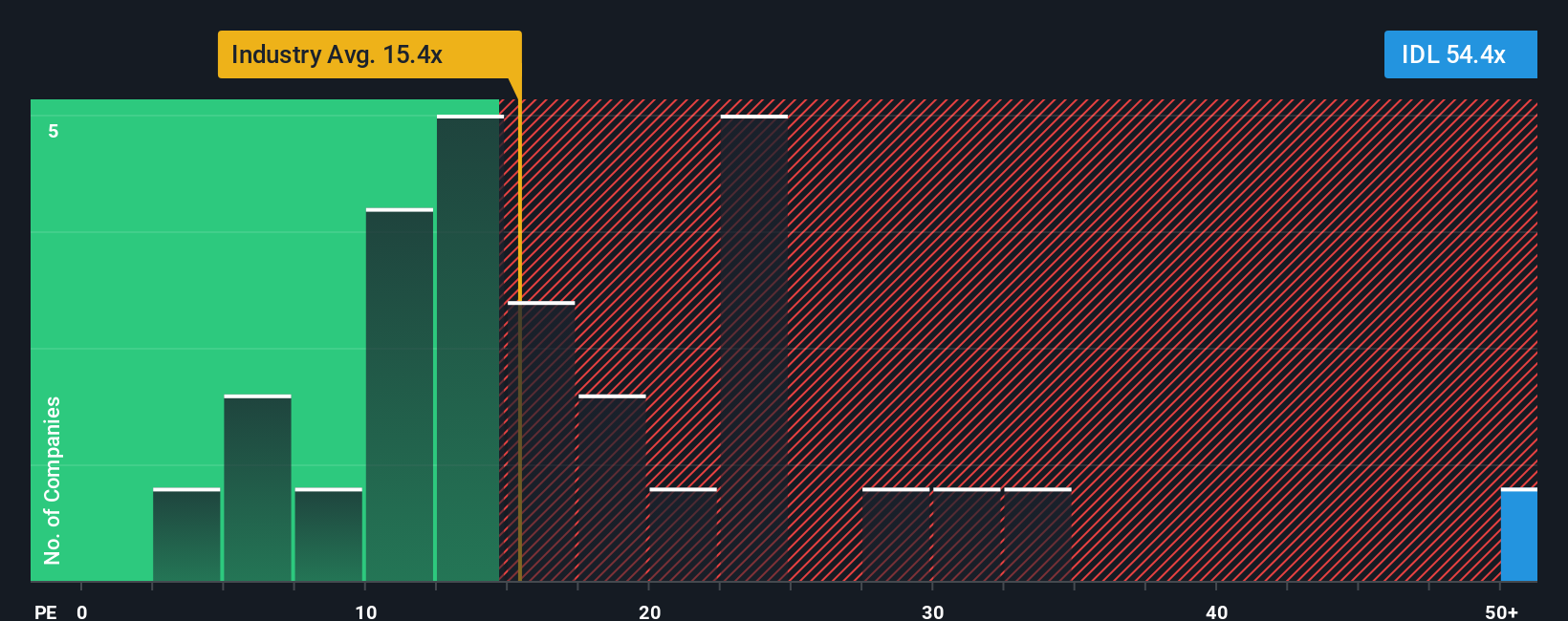

ID Logistics Group SA's (EPA:IDL) price-to-earnings (or "P/E") ratio of 54.4x might make it look like a strong sell right now compared to the market in France, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, ID Logistics Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for ID Logistics Group

How Is ID Logistics Group's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like ID Logistics Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.2%. Still, the latest three year period has seen an excellent 45% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the six analysts watching the company. With the market only predicted to deliver 13% each year, the company is positioned for a stronger earnings result.

With this information, we can see why ID Logistics Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On ID Logistics Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ID Logistics Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for ID Logistics Group with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IDL

ID Logistics Group

Provides contract logistics services in France and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026