- Switzerland

- /

- Capital Markets

- /

- SWX:EFGN

KBC Group And 2 Other European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the European market navigates a landscape marked by hopes of increased government spending and concerns over U.S. tariffs, the pan-European STOXX Europe 600 Index has managed to end its recent losing streak with modest gains. In this context of mixed economic signals and cautious central bank policies, dividend stocks like KBC Group can offer stability and income potential, making them valuable additions to a well-rounded portfolio.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.17% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.60% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.85% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.37% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.03% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.80% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.75% | ★★★★★★ |

| VERBUND (WBAG:VER) | 6.27% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

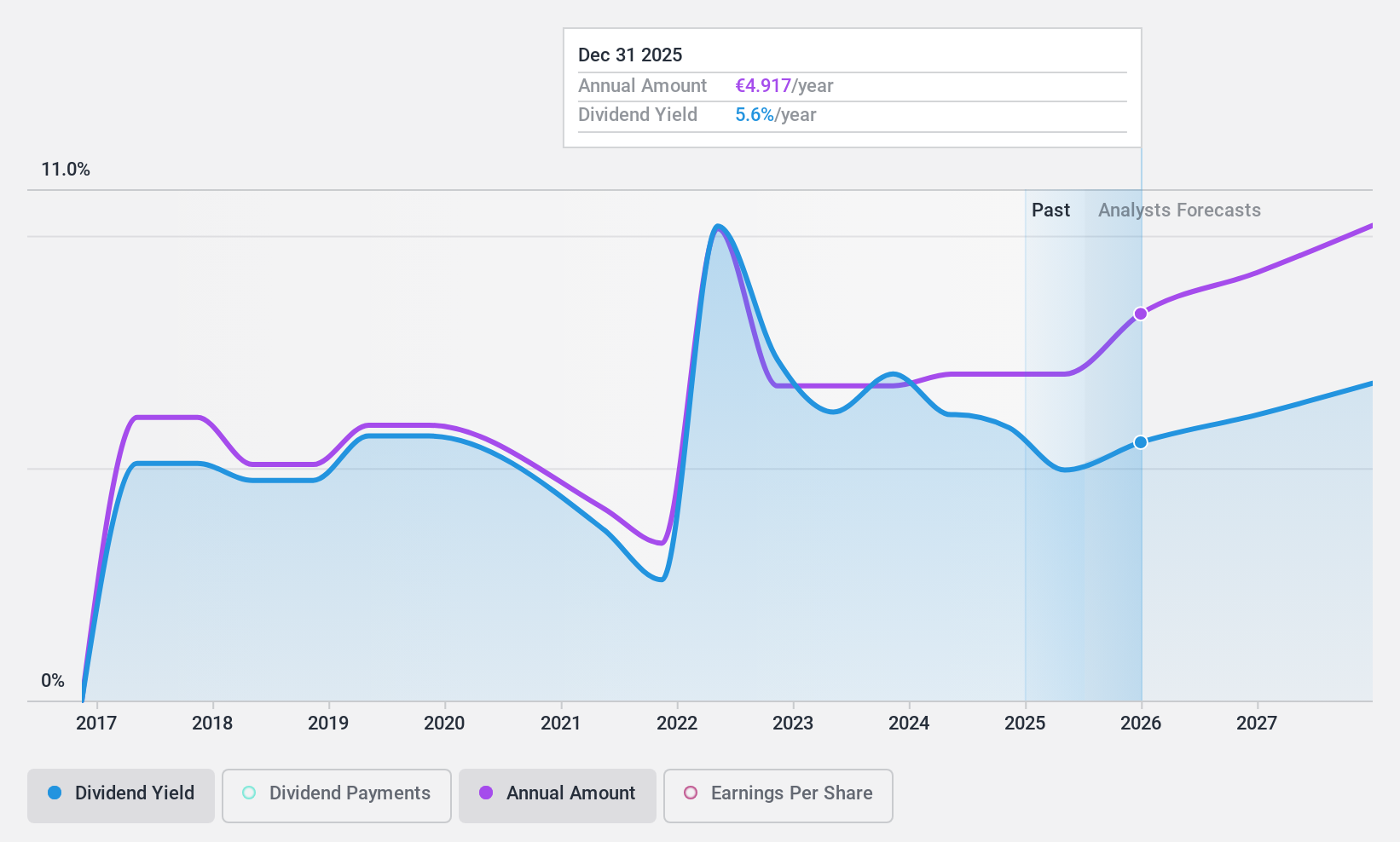

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV, with a market cap of €34.75 billion, offers integrated bank-insurance services focusing on retail, private banking, small and medium-sized enterprises, and mid-cap clients through its subsidiaries.

Operations: KBC Group's revenue is primarily derived from its Belgium Business segment (€6.46 billion), followed by the Czech Republic Business (€2.35 billion), and International Markets including Hungary (€1.13 billion), Bulgaria (€821 million), and Slovakia (€503 million).

Dividend Yield: 4.7%

KBC Group's dividend yield of 4.74% is lower than the top quartile in Belgium, but its dividends are well-covered by earnings with a current payout ratio of 49.8%, expected to rise to 63.4% in three years. Despite a volatile dividend history over the past decade, recent earnings growth—net income rose to €1.12 billion—supports sustainability prospects. However, with a high bad loans ratio of 2.1% and low allowance for these loans at 59%, caution is advised regarding financial stability risks impacting future payouts.

- Get an in-depth perspective on KBC Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that KBC Group's current price could be quite moderate.

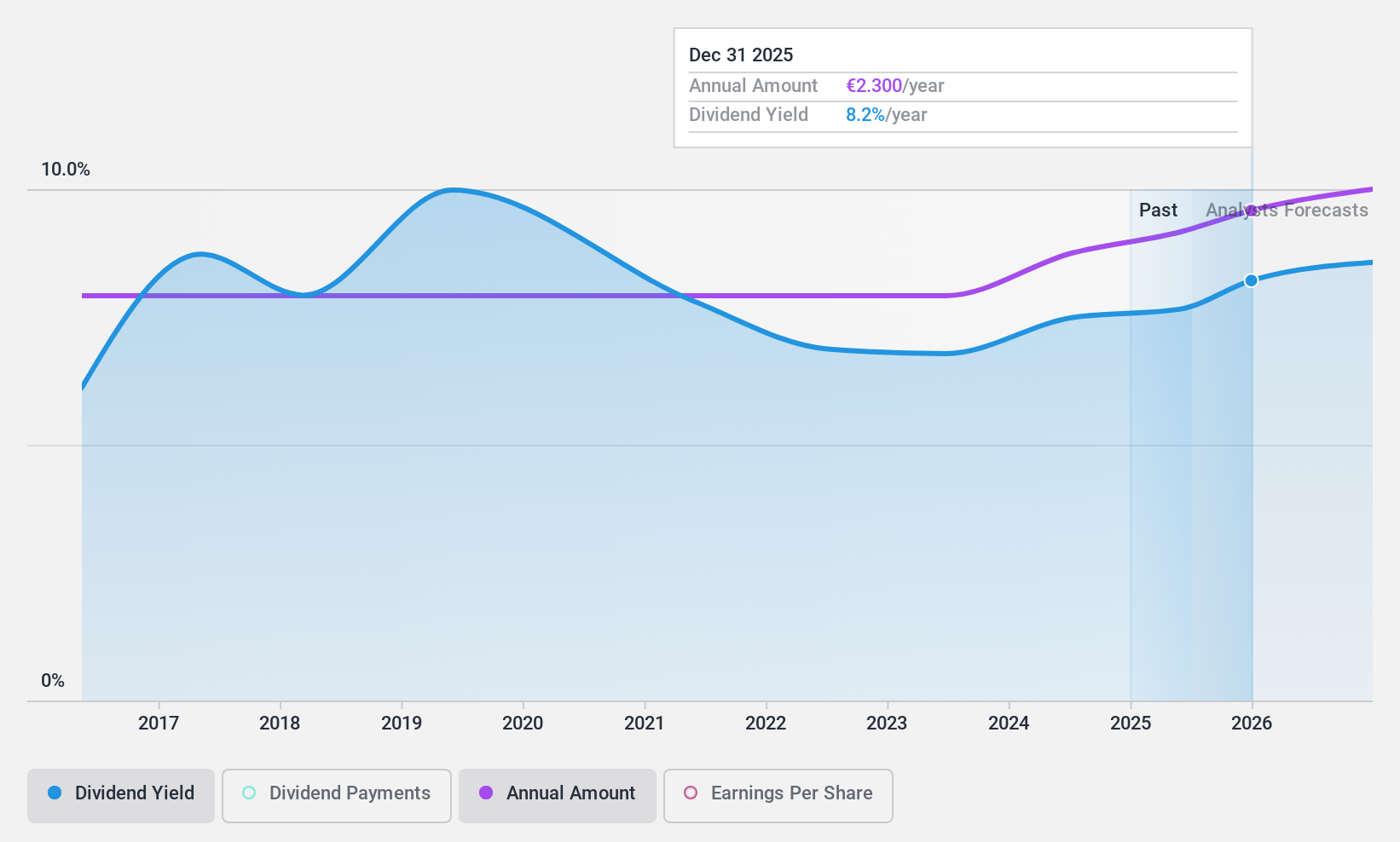

Société Marseillaise du Tunnel Prado Carénage (ENXTPA:ALTPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société Marseillaise du Tunnel Prado Carénage constructs and operates tunnels in France, with a market cap of €169.87 million.

Operations: The company's revenue is derived entirely from its Transportation Infrastructure segment, totaling €38.12 million.

Dividend Yield: 7.2%

Société Marseillaise du Tunnel Prado Carénage offers a high dividend yield of 7.22%, placing it in the top quartile of French dividend payers, but its dividends have been unreliable and volatile over the past decade. Despite trading at a significant discount to estimated fair value, its payout ratio is high at 123.7%, indicating dividends are not well covered by earnings or cash flow, raising concerns about sustainability despite some historical growth in payments.

- Click here to discover the nuances of Société Marseillaise du Tunnel Prado Carénage with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Société Marseillaise du Tunnel Prado Carénage's share price might be too pessimistic.

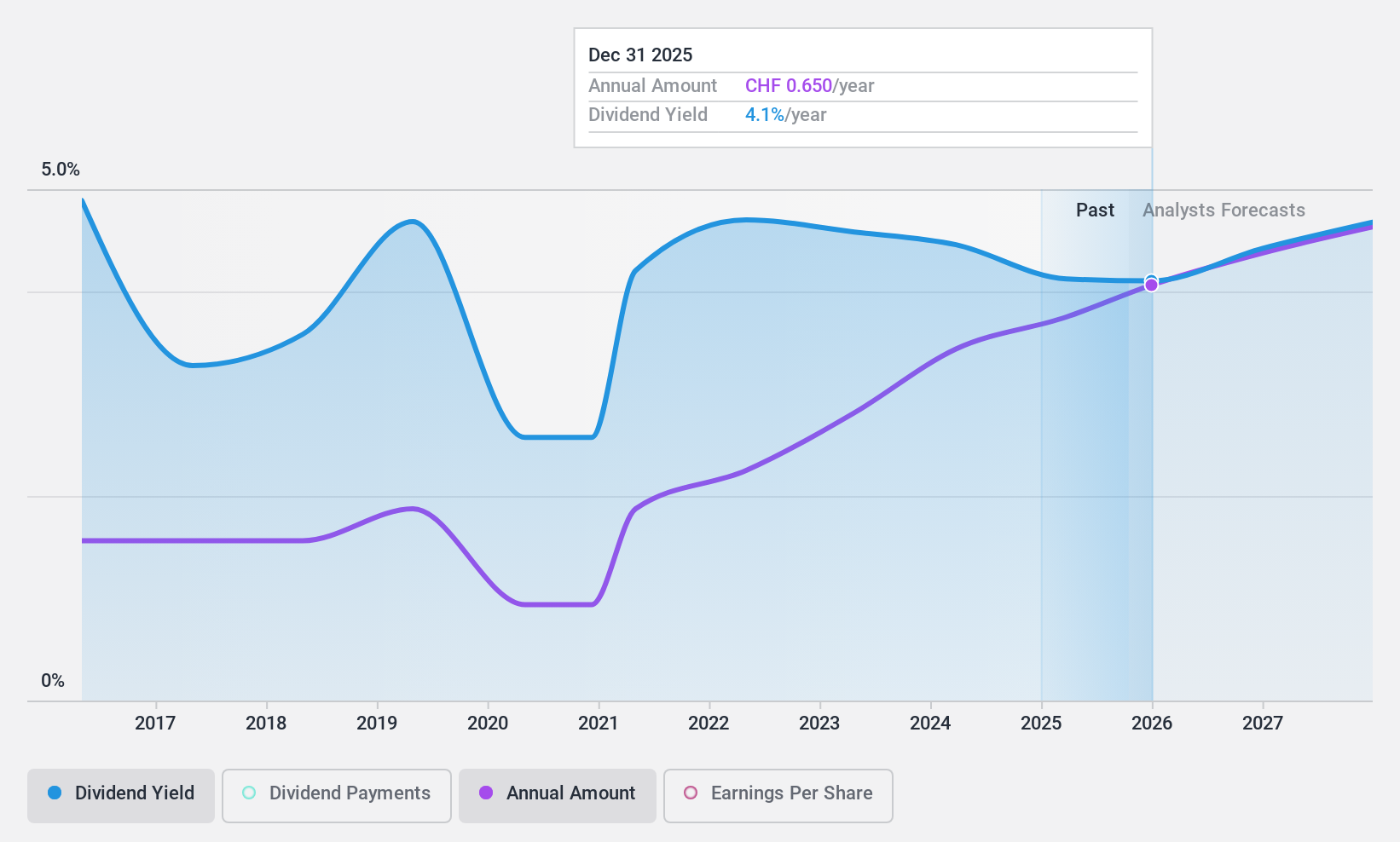

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, with a market cap of CHF4.28 billion, operates through its subsidiaries to offer private banking, wealth management, and asset management services.

Operations: EFG International AG generates revenue through several segments, including Corporate (CHF53.60 million), Global Markets & Treasury (CHF94.70 million), Investment and Wealth Solutions (CHF124.90 million), and various regional Private Banking and Wealth Management divisions: Americas (CHF128.80 million), Asia Pacific (CHF195.50 million), United Kingdom (CHF192.30 million), Switzerland & Italy (CHF452.20 million), and Continental Europe & Middle East (CHF254.80 million).

Dividend Yield: 4.2%

EFG International's dividend yield of 4.2% ranks in the top 25% of Swiss dividend payers, with a sustainable payout ratio currently at 59.9%, forecasted to remain covered at 58.5% in three years. However, its dividends have been volatile over the past decade despite recent growth in payments. The company is pursuing M&A opportunities to complement its organic growth strategy, reflecting a focus on operational efficiency and sustained profitability amidst fluctuating earnings performance.

- Unlock comprehensive insights into our analysis of EFG International stock in this dividend report.

- The analysis detailed in our EFG International valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 237 Top European Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EFG International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:EFGN

EFG International

Provides private banking, wealth management, and asset management services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives