- Poland

- /

- Metals and Mining

- /

- WSE:BRS

European Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As European markets face headwinds from new tariff threats and unexpected contractions in business activity, investors are keenly observing how these factors influence the region's economic landscape. In such a climate, dividend stocks can offer a measure of stability through consistent income streams, making them an attractive option for those seeking to navigate market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.39% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.88% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.44% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.04% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.87% | ★★★★★★ |

| ERG (BIT:ERG) | 5.60% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.50% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

Click here to see the full list of 238 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

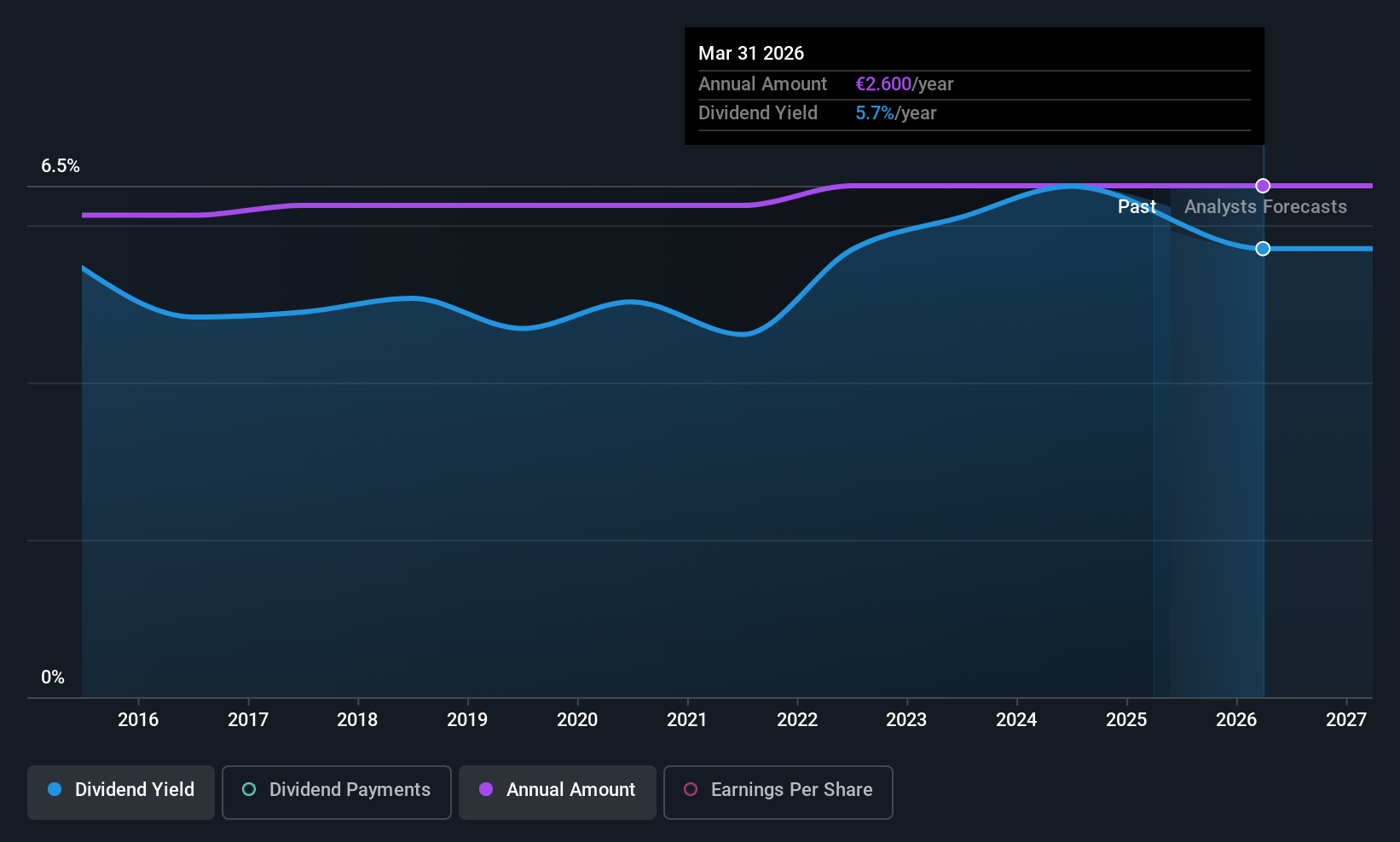

Gimv (ENXTBR:GIMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gimv NV is a private equity and venture capital firm that focuses on direct and fund of funds investments, with a market cap of €1.62 billion.

Operations: Gimv NV generates its revenue through its specialization in private equity and venture capital investments.

Dividend Yield: 5.7%

Gimv NV's dividend profile shows both strengths and weaknesses for investors. While its dividends have been stable and growing over the past decade, the current yield of 5.73% is below Belgium's top quartile. Despite a low payout ratio of 35.9%, dividends are not covered by free cash flow, raising sustainability concerns. Recent earnings report a modest increase in net income to €219 million from €217.13 million, reflecting consistent profitability amidst shareholder dilution challenges.

- Navigate through the intricacies of Gimv with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Gimv is trading behind its estimated value.

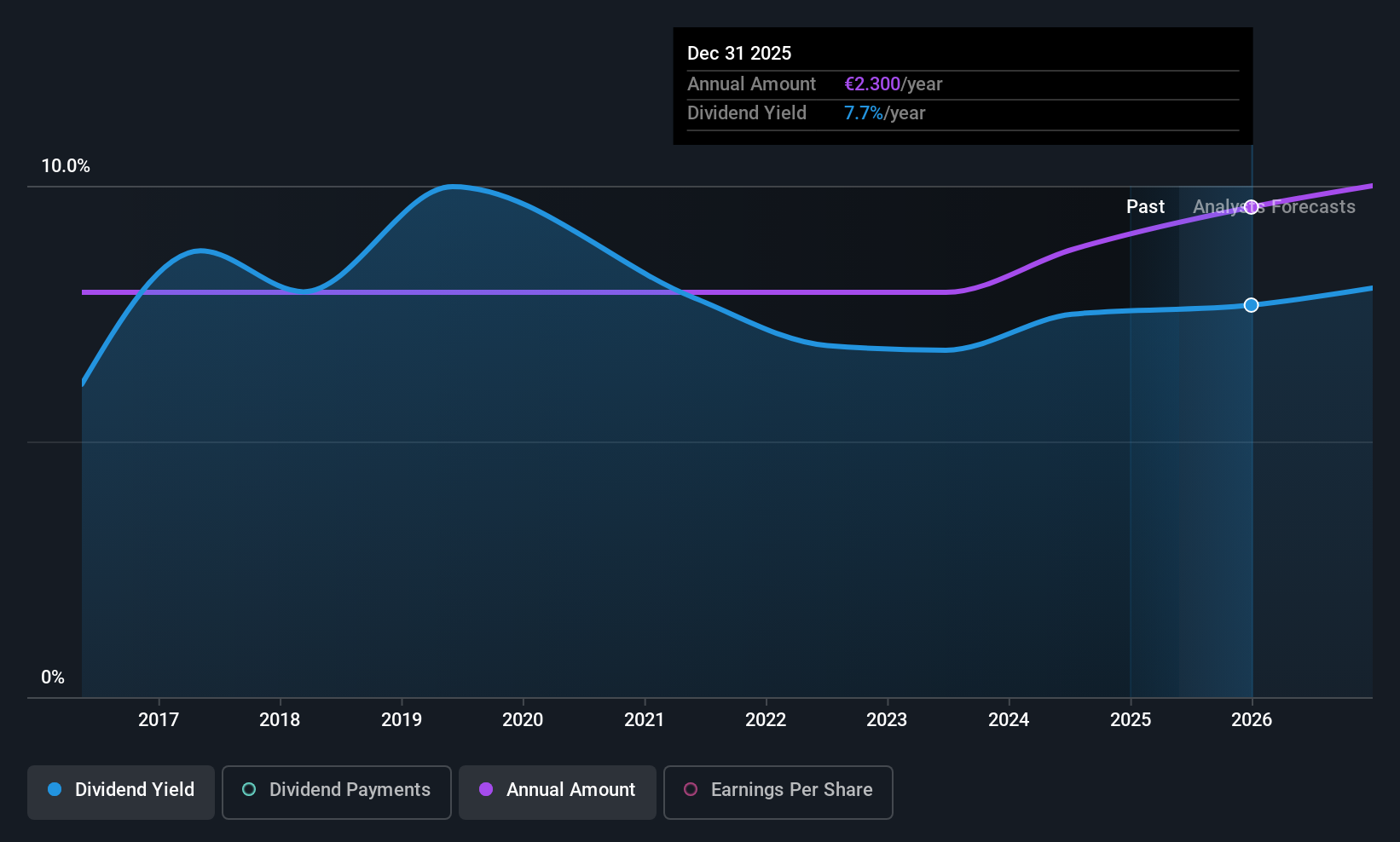

Société Marseillaise du Tunnel Prado Carénage (ENXTPA:ALTPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société Marseillaise du Tunnel Prado Carénage constructs and operates tunnels in France, with a market cap of €176.88 million.

Operations: Société Marseillaise du Tunnel Prado Carénage generates revenue of €38.05 million from its transportation infrastructure segment.

Dividend Yield: 7.3%

Société Marseillaise du Tunnel Prado Carénage offers a notable dividend yield of 7.26%, ranking it among the top 25% in France, but its sustainability is questionable due to a high payout ratio of 136%. The recent annual dividend increase to €2.20 per share reflects growth, yet past payments have been volatile and unreliable. Despite reasonable cash flow coverage, declining net income from €11.94 million to €9.44 million raises concerns about long-term dividend stability.

- Get an in-depth perspective on Société Marseillaise du Tunnel Prado Carénage's performance by reading our dividend report here.

- Our valuation report here indicates Société Marseillaise du Tunnel Prado Carénage may be overvalued.

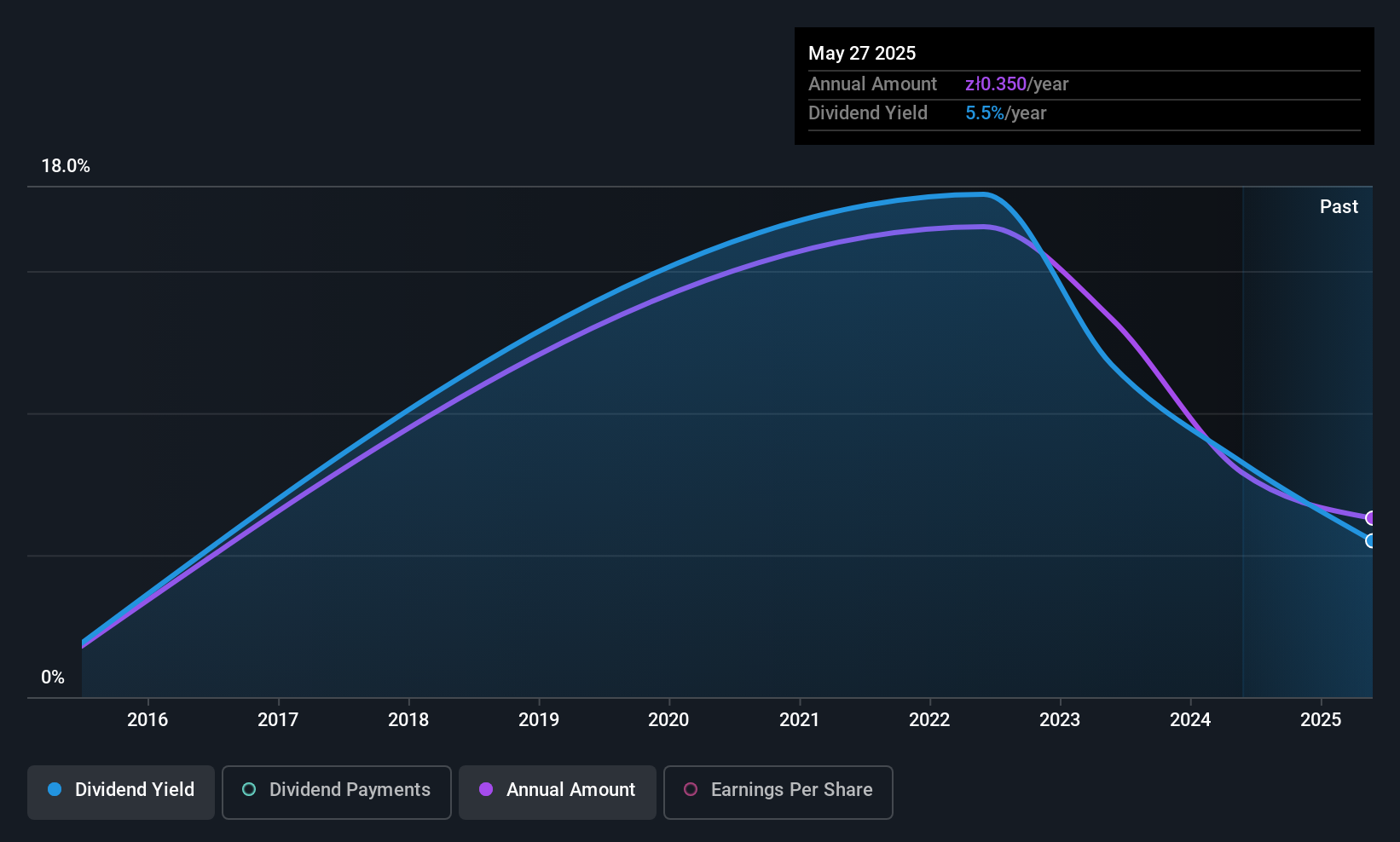

Boryszew (WSE:BRS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boryszew S.A. operates in the automotive, metals, and chemical products sectors both in Poland and internationally, with a market capitalization of PLN1.31 billion.

Operations: Boryszew S.A.'s revenue is derived from its operations in the automotive, metals, and chemical products sectors.

Dividend Yield: 5.5%

Boryszew's dividend yield of 5.49% is below the top quartile in the Polish market, and its payout has been volatile over the past decade. Despite a reasonable payout ratio of 64.3% and cash flow coverage at 43.7%, recent earnings showed a slight decline with net income dropping to PLN 5.88 million for Q1 2025 from PLN 6.43 million the previous year, alongside a decreased annual dividend to PLN 0.35 per share for June payment.

- Click here to discover the nuances of Boryszew with our detailed analytical dividend report.

- Our valuation report unveils the possibility Boryszew's shares may be trading at a premium.

Summing It All Up

- Navigate through the entire inventory of 238 Top European Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boryszew might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:BRS

Boryszew

Engages in the automotive, metals, chemical products, and other businesses in Poland and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives