- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2172

VusionGroup Among 3 Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, global markets experienced volatility, with major U.S. indexes declining despite initial gains. Amid this uncertainty, investors are increasingly seeking stocks that offer potential value by trading below their intrinsic worth. Identifying such opportunities requires careful analysis of market conditions and company fundamentals to ensure alignment with long-term investment goals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | US$20.68 | US$41.04 | 49.6% |

| Vimi Fasteners (BIT:VIM) | €0.96 | €1.91 | 49.8% |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥1860.00 | ¥3696.77 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$113.50 | NT$226.14 | 49.8% |

| CD Projekt (WSE:CDR) | PLN220.70 | PLN441.19 | 50% |

| Vestas Wind Systems (CPSE:VWS) | DKK102.40 | DKK204.54 | 49.9% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.69 | CA$3.36 | 49.6% |

| Hanwha Aerospace (KOSE:A012450) | ₩680000.00 | ₩1356955.59 | 49.9% |

| CGN Mining (SEHK:1164) | HK$1.43 | HK$2.85 | 49.8% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.69 | CN¥37.15 | 49.7% |

Let's review some notable picks from our screened stocks.

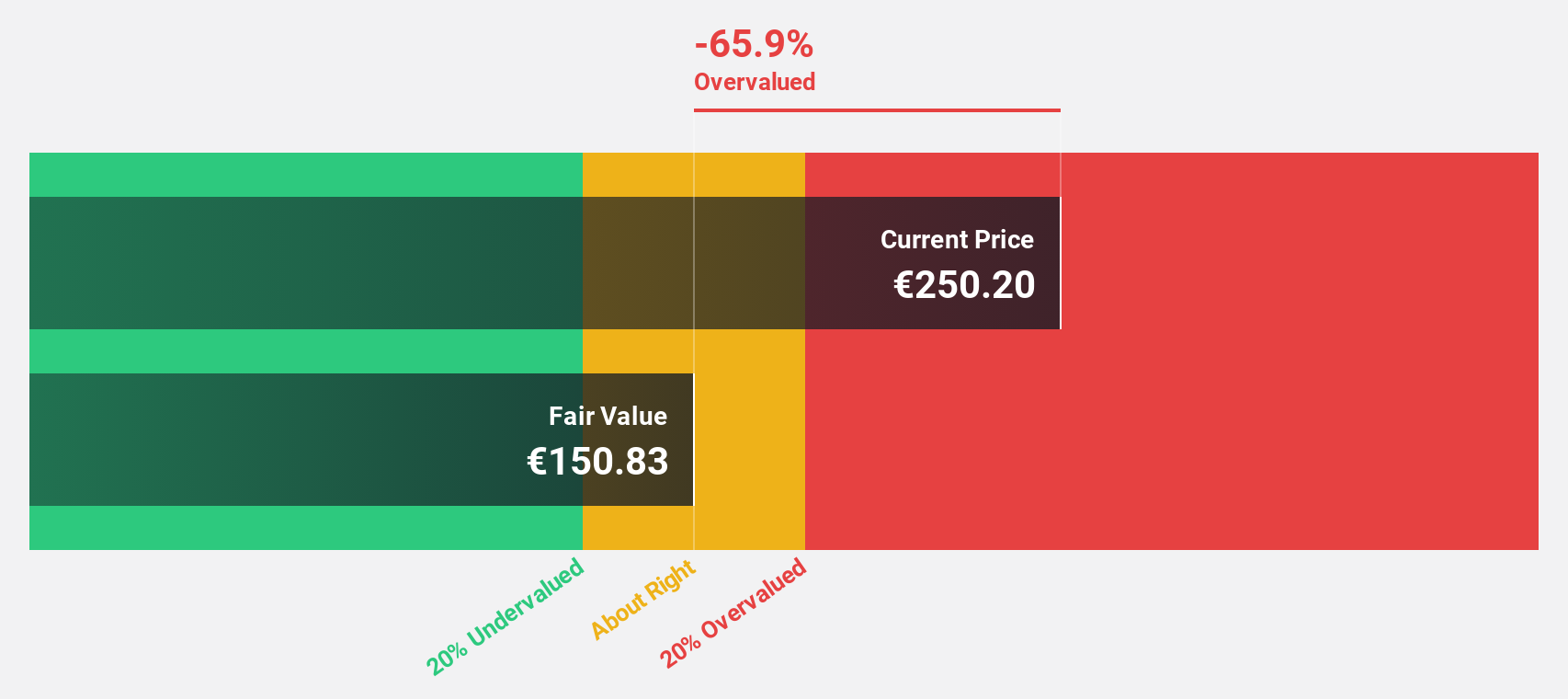

VusionGroup (ENXTPA:VU)

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.64 billion.

Operations: The company generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million.

Estimated Discount To Fair Value: 27.1%

VusionGroup, trading at €165, is significantly undervalued with an estimated fair value of €226.24 and analysts predicting a 27% price rise. Revenue growth is expected to outpace the French market significantly, and earnings are projected to grow rapidly by 73.12% annually. VusionGroup's recent partnership with The Fresh Market for digitalizing store operations in North America highlights its technological capabilities and potential for future revenue enhancement through innovative solutions like Vusion 360 technology.

- The analysis detailed in our VusionGroup growth report hints at robust future financial performance.

- Get an in-depth perspective on VusionGroup's balance sheet by reading our health report here.

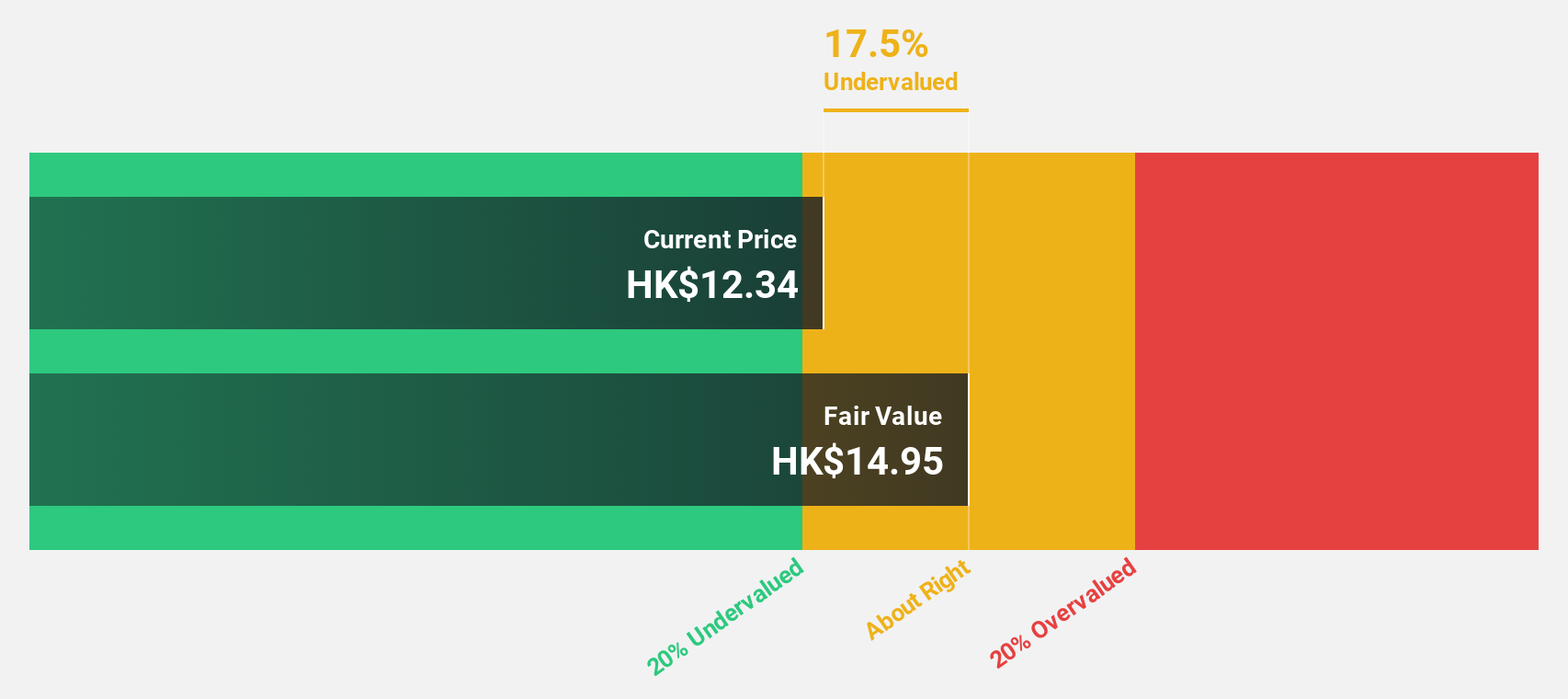

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of HK$6.70 billion.

Operations: The company generates revenue from its neuro-interventional medical devices segment, amounting to CN¥774.66 million.

Estimated Discount To Fair Value: 37.7%

MicroPort NeuroScientific, trading at HK$11.6, is significantly undervalued with an estimated fair value of HK$18.62. Its earnings are forecast to grow 20.4% annually, outpacing the Hong Kong market's growth rate of 11.8%. Recent guidance indicates a net profit increase between RMB 236 million and RMB 270 million for 2024 due to expanded hospital coverage and overseas revenue growth, alongside improved operating efficiency from cost-saving measures and supply chain enhancements.

- Upon reviewing our latest growth report, MicroPort NeuroScientific's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of MicroPort NeuroScientific.

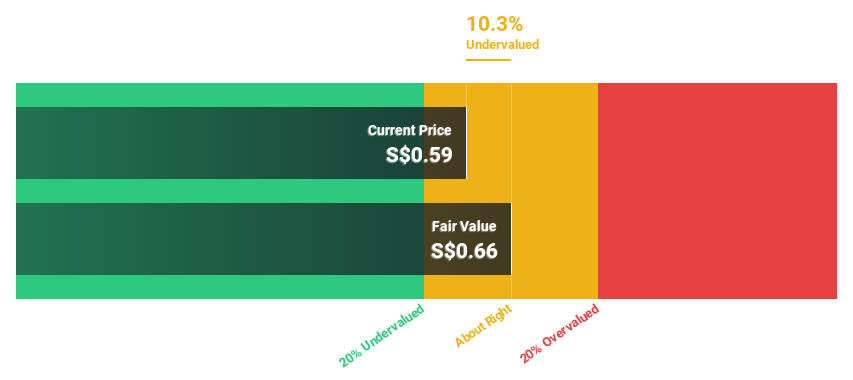

Yangzijiang Financial Holding (SGX:YF8)

Overview: Yangzijiang Financial Holding Ltd. is an investment holding company involved in investment-related activities in the People's Republic of China and Singapore, with a market cap of SGD1.97 billion.

Operations: The company generates revenue of SGD303.66 million from its investment business activities in China and Singapore.

Estimated Discount To Fair Value: 14.2%

Yangzijiang Financial Holding, trading at S$0.57, is undervalued compared to its estimated fair value of S$0.66. Its earnings are projected to grow significantly at 22.5% annually, surpassing the Singapore market's growth rate of 9.5%. Despite a low forecasted return on equity of 7.1%, the stock offers good relative value within its industry and peers, although large one-off items have impacted recent financial results.

- Our expertly prepared growth report on Yangzijiang Financial Holding implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Yangzijiang Financial Holding here with our thorough financial health report.

Where To Now?

- Investigate our full lineup of 925 Undervalued Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2172

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)