Top Growth Companies With High Insider Ownership On Euronext Paris In August 2024

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and fluctuating market conditions, the French CAC 40 Index has experienced notable declines, reflecting broader European market trends. Despite this volatility, growth companies with high insider ownership on Euronext Paris present compelling opportunities for investors seeking resilience and potential upside in their portfolios.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 71.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €943.20 million.

Operations: Revenue segments (in millions of €): Americas: 172.65, Asia-Pacific: 118.54, Segment Adjustment: 209.13

Insider Ownership: 19.6%

Lectra's earnings are forecast to grow significantly at 32.59% per year, outpacing the French market's 12.2%. However, its Return on Equity is expected to be relatively low at 13.2% in three years. Despite this, Lectra trades at a good value compared to peers and industry standards, being priced 52.1% below fair value estimates with analysts projecting a potential price increase of 38.9%. Recent earnings showed sales growth but a decline in net income and EPS compared to the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Lectra.

- Our valuation report here indicates Lectra may be undervalued.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €435.15 million.

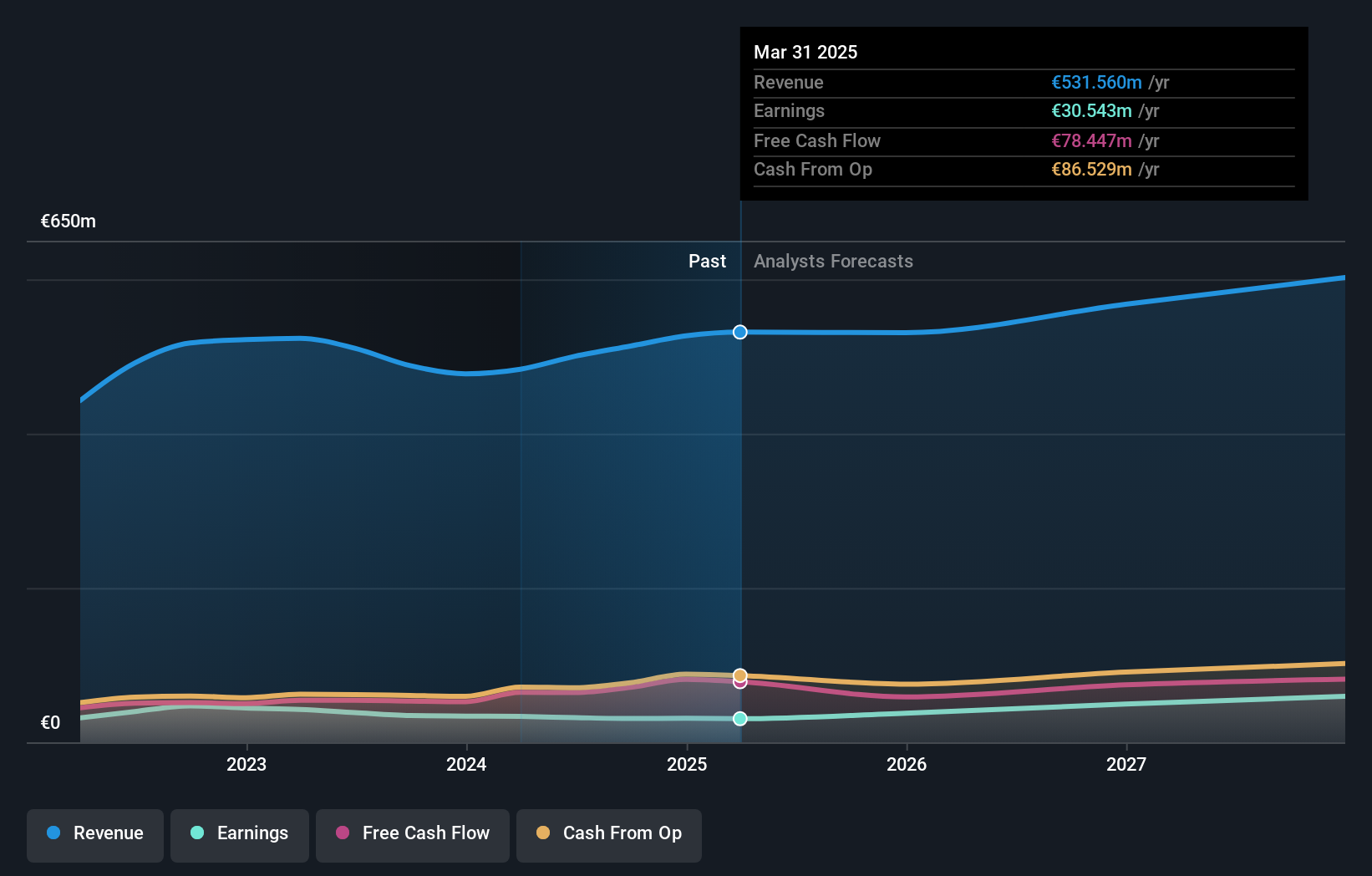

Operations: MedinCell generates revenue primarily from its pharmaceuticals segment, which amounted to €11.95 million.

Insider Ownership: 16.4%

MedinCell, a French growth company with high insider ownership, is trading at 90.1% below its estimated fair value and is expected to achieve profitability within three years. Revenue growth is forecasted at 44.7% annually, significantly outpacing the market's 5.9%. Recent earnings showed a slight decline in sales and revenue but an improvement in net loss from EUR 32.01 million to EUR 25.04 million year-over-year, highlighting ongoing financial challenges despite promising long-term growth prospects.

- Navigate through the intricacies of MedinCell with our comprehensive analyst estimates report here.

- Our valuation report here indicates MedinCell may be overvalued.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.12 billion.

Operations: The company generates revenue primarily from installing and maintaining electronic shelf labels, totaling €801.96 million.

Insider Ownership: 13.5%

VusionGroup, a French growth company with high insider ownership, is forecasted to achieve 21.3% annual revenue growth and 25.7% annual earnings growth, both surpassing market averages. Recent developments include Hy-Vee's implementation of VusionGroup's digital solutions across over 230 stores, enhancing operational efficiency and sustainability. Despite a highly volatile share price in the past three months, analysts expect the stock price to rise by 45%. Earnings grew by 320.8% last year.

- Delve into the full analysis future growth report here for a deeper understanding of VusionGroup.

- According our valuation report, there's an indication that VusionGroup's share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 23 Fast Growing Euronext Paris Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A clinical-stage and commercial biopharmaceutical licensing company, develops long acting injectables in various therapeutic areas in France.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)