As European markets face downward pressure, with France's CAC 40 Index dropping 1.52% amid expectations of a slower monetary policy easing by the Federal Reserve, investors are keenly observing high-growth tech sectors that could offer opportunities despite broader economic challenges. In this context, identifying promising tech stocks involves looking for companies that demonstrate robust innovation and adaptability in an environment where growth stocks have shown resilience over value counterparts.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 24.36% | 78.41% | ★★★★★☆ |

| Valneva | 22.84% | 18.29% | ★★★★★☆ |

| Valbiotis | 43.33% | 42.78% | ★★★★★☆ |

| beaconsmind | 25.00% | 85.04% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Munic | 42.94% | 174.09% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

We'll examine a selection from our screener results.

Esker (ENXTPA:ALESK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esker SA operates a cloud platform designed for finance and customer service professionals both in France and internationally, with a market capitalization of €1.55 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to €203.05 million.

Esker, a French tech firm, is navigating a dynamic growth trajectory with its recent Q3 revenue hitting €51.0 million, marking a 17% year-over-year increase. This performance is underpinned by an aggressive R&D investment strategy that not only fuels innovation but also aligns with its forward-looking growth forecasts in earnings and revenue—projected at 26.7% and 11.8% annually, respectively. Amidst this financial expansion, Esker remains at the forefront of the M&A landscape with a significant acquisition proposal valued at €1.58 billion by General Atlantic and Bridgepoint Group, highlighting its strategic market position and potential for sustained growth in the competitive software sector.

- Click here to discover the nuances of Esker with our detailed analytical health report.

Assess Esker's past performance with our detailed historical performance reports.

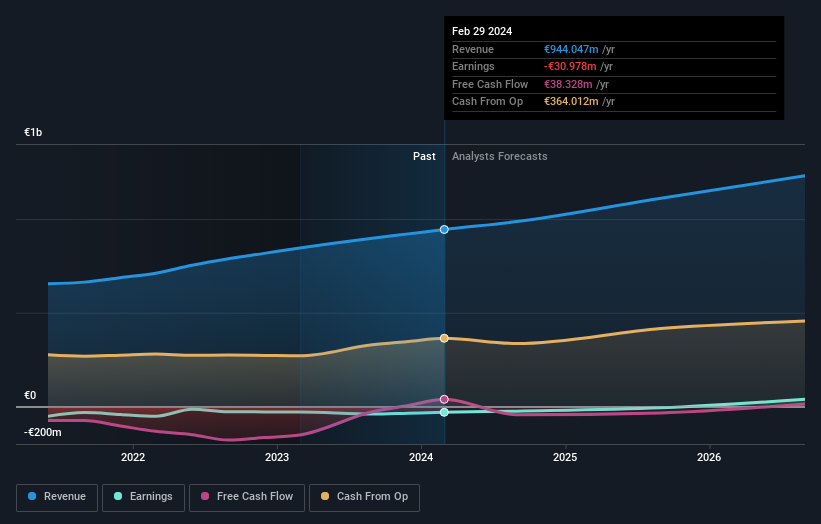

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of approximately €1.66 billion.

Operations: OVH Groupe generates revenue primarily from its private cloud services, contributing €589.61 million, followed by web cloud and public cloud services at €185.43 million and €169.01 million respectively. The company's focus on diverse cloud solutions positions it as a significant player in the global market for these services.

OVH Groupe, navigating through a challenging tech landscape, is on a trajectory to profitability with expected earnings growth of 114.6% annually. This optimistic outlook is bolstered by a robust revenue increase projected at 10.2% per year, outpacing the French market's average of 5.5%. Significantly, the company's commitment to innovation is evident from its R&D expenditures which are crucial for sustaining long-term growth in the competitive IT sector. At a recent global summit, OVH showcased its strategic initiatives aimed at enhancing technological capabilities and expanding its market reach, signaling promising prospects despite current unprofitability and share price volatility.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this health report.

Gain insights into OVH Groupe's past trends and performance with our Past report.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.28 billion.

Operations: VusionGroup S.A. focuses on installing and maintaining electronic shelf labels, generating €830.16 million in revenue from this segment.

VusionGroup, amidst a turbulent market, is steering towards profitability with an anticipated earnings growth of 81.7% annually, underpinned by a robust revenue surge at 28.4% per year—significantly outstripping the French tech sector's average. This growth trajectory is fueled by strategic R&D investments, which have consistently constituted a substantial portion of their budget, reflecting an unwavering commitment to innovation and technological advancement. Recently, VusionGroup announced a pivotal partnership with Ace Hardware to deploy advanced digital shelf label technology across numerous stores, enhancing operational efficiencies and customer engagement—a testament to its forward-thinking approach in retail tech solutions.

- Navigate through the intricacies of VusionGroup with our comprehensive health report here.

Evaluate VusionGroup's historical performance by accessing our past performance report.

Next Steps

- Gain an insight into the universe of 39 Euronext Paris High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade OVH Groupe, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.