Euronext Paris Growth Companies With High Insider Ownership And At Least 25% Earnings Growth

Reviewed by Simply Wall St

Amid a backdrop of easing inflation and rallying stock indices across Europe, the French market has shown resilience with the CAC 40 Index climbing modestly. In this environment, growth companies with high insider ownership in France present an intriguing opportunity as they often signal strong confidence from those closest to the company's operations and future.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.2% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 69.6% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Here we highlight a subset of our preferred stocks from the screener.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €424.28 million.

Operations: The company generates €11.95 million from its pharmaceuticals segment.

Insider Ownership: 16.4%

Earnings Growth Forecast: 69.6% p.a.

MedinCell S.A., a French pharmaceutical company, experienced a decrease in sales and revenue for the year ending March 2024, reporting EUR 9.03 million in sales and EUR 11.95 million in revenue, with a reduced net loss of EUR 25.04 million. Despite these financial challenges, MedinCell's innovative product pipeline shows promise, particularly with the Phase 3 trial results of F14 not meeting its primary endpoint but showing significant improvements in secondary outcomes like knee range of motion and swelling reduction post-treatment. The company's high insider ownership aligns interests but comes with the caveat of recent share dilution and highly volatile share prices.

- Get an in-depth perspective on MedinCell's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, MedinCell's share price might be too optimistic.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers a range of services including public and private cloud, shared hosting, and dedicated servers globally, with a market capitalization of approximately €1.04 billion.

Operations: The company generates revenue from three primary segments: public cloud (€169.01 million), private cloud (€589.61 million), and web cloud (€185.43 million).

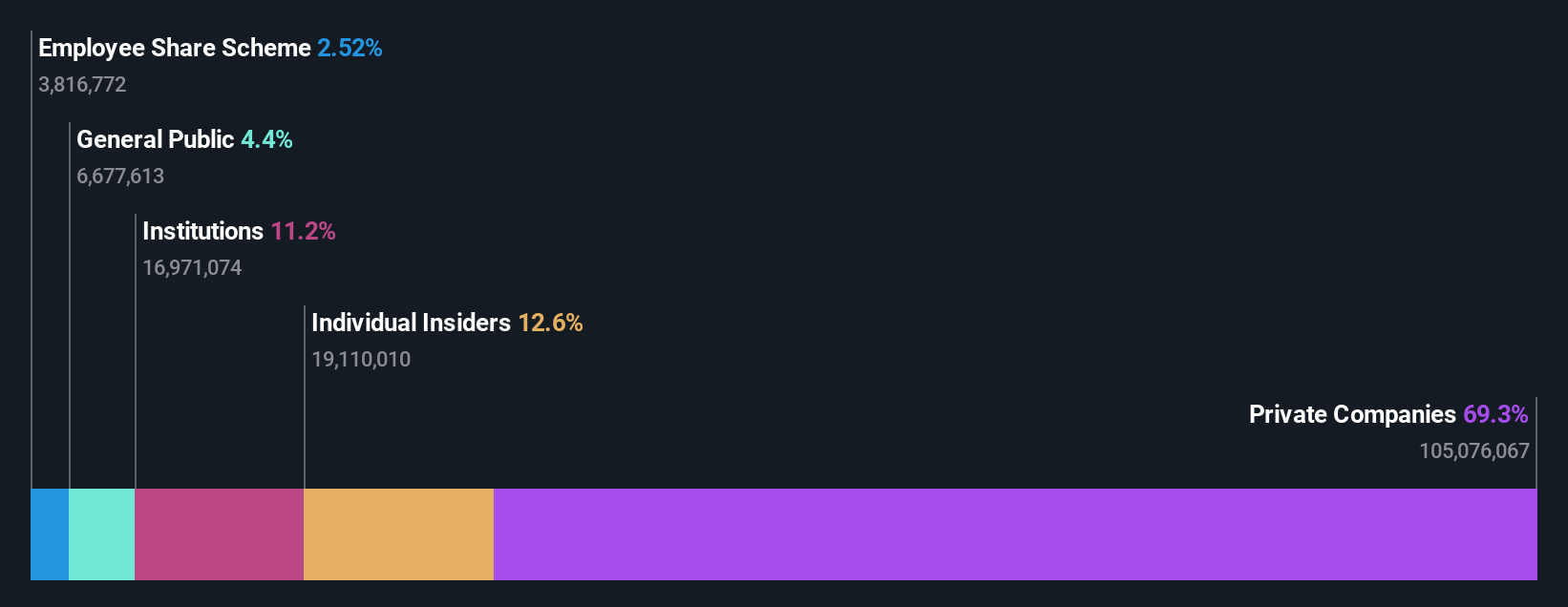

Insider Ownership: 10.5%

Earnings Growth Forecast: 103.7% p.a.

OVH Groupe, a French cloud services provider, recently introduced advanced servers featuring AMD EPYC processors, signaling robust product innovation aimed at enhancing performance and price efficiency. Despite trading 26.6% below its estimated fair value and a volatile share price, OVH's revenue growth is expected to outpace the French market average. The company's anticipated profitability over the next three years aligns with strategic leadership changes aimed at bolstering innovation and market expansion.

- Click to explore a detailed breakdown of our findings in OVH Groupe's earnings growth report.

- Our valuation report here indicates OVH Groupe may be undervalued.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.26 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, amounting to €801.96 million.

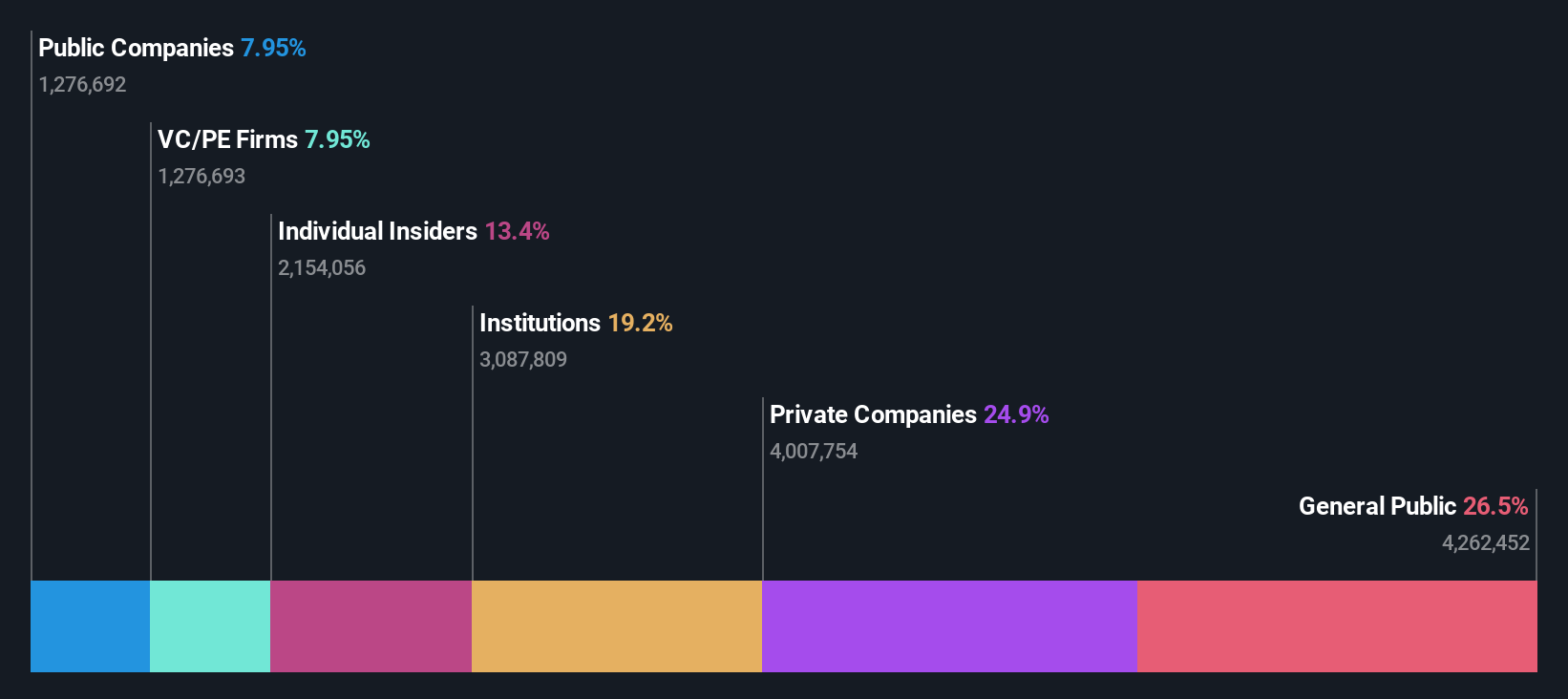

Insider Ownership: 13.5%

Earnings Growth Forecast: 25.2% p.a.

VusionGroup, a French tech firm, has shown substantial growth with its recent implementation of digital solutions in over 230 Hy-Vee stores, enhancing retail efficiency and sustainability. Despite a volatile share price recently, the company reported a significant increase in annual revenue to €801.96 million and net income to €79.77 million. Analysts predict strong future earnings growth at 25.24% annually, outpacing the French market significantly. High insider ownership underscores confidence in strategic direction and potential for sustained growth.

- Navigate through the intricacies of VusionGroup with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that VusionGroup's share price might be on the expensive side.

Turning Ideas Into Actions

- Reveal the 21 hidden gems among our Fast Growing Euronext Paris Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade OVH Groupe, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives