3 Growth Companies On Euronext Paris With Up To 19% Insider Ownership

Reviewed by Simply Wall St

The French market has shown resilience, with the CAC 40 Index gaining 0.71% amid a backdrop of easing inflation and cautious optimism from the European Central Bank. As investors navigate these conditions, growth companies with significant insider ownership can be particularly appealing due to their potential for aligned interests and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| Munic (ENXTPA:ALMUN) | 29.2% | 149.2% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

We're going to check out a few of the best picks from our screener tool.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.06 billion.

Operations: The company's revenue segments are as follows: €172.65 million from the Americas and €118.54 million from the Asia-Pacific, with a segment adjustment of €209.13 million.

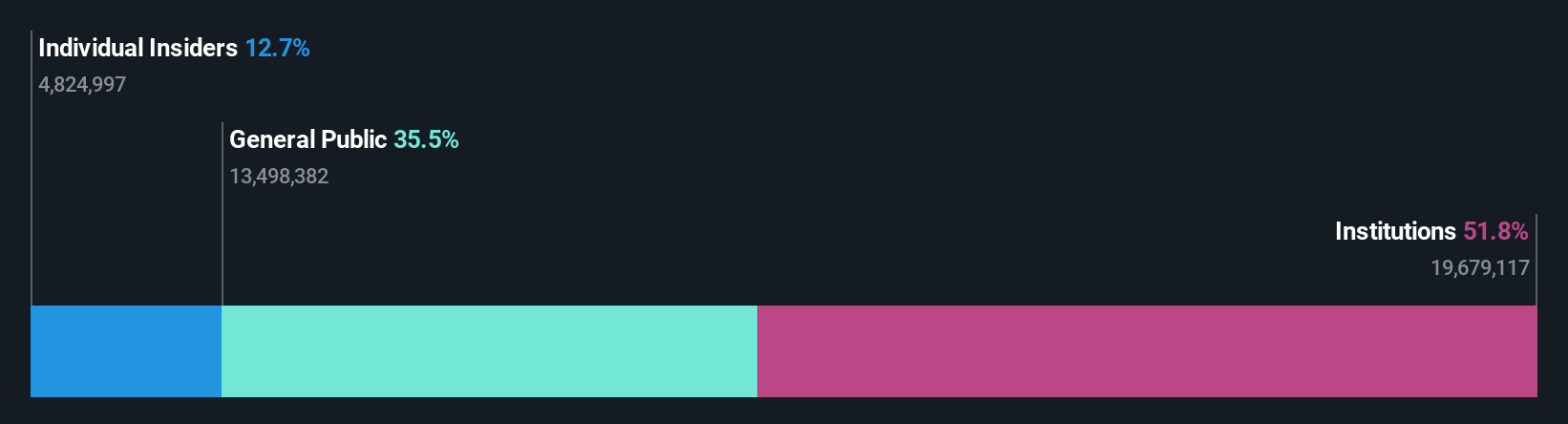

Insider Ownership: 19.6%

Lectra SA, a growth company with high insider ownership in France, reported half-year sales of €262.29 million for 2024, up from €239.55 million in 2023, though net income decreased to €12.51 million from €14.47 million. Despite this dip, earnings are forecasted to grow significantly at 29.3% annually over the next three years, outpacing the French market's 12.3%. Analysts expect a stock price increase of 23.5%, and it trades at nearly half its estimated fair value.

- Unlock comprehensive insights into our analysis of Lectra stock in this growth report.

- In light of our recent valuation report, it seems possible that Lectra is trading behind its estimated value.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A., a pharmaceutical company based in France, develops long-acting injectables across various therapeutic areas and has a market cap of €525.32 million.

Operations: MedinCell generates €11.95 million in revenue from its pharmaceuticals segment, focusing on long-acting injectables across various therapeutic areas.

Insider Ownership: 15.8%

MedinCell, with substantial insider ownership, is positioned for significant growth through strategic collaborations and innovative technology. The company recently partnered with AbbVie to develop six therapeutic products, securing a $35 million upfront payment and potential milestones up to $1.9 billion. MedinCell's BEPO® technology has led to the commercial success of UZEDY in the U.S., generating €1.7 million in royalties. Despite a net loss of €25.04 million last year, revenue is forecasted to grow at 46.2% annually, outpacing the French market's 5.8%.

- Navigate through the intricacies of MedinCell with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, MedinCell's share price might be too pessimistic.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €2.20 billion.

Operations: VusionGroup S.A. generates €801.96 million from installing and maintaining electronic shelf labels across Europe, Asia, and North America.

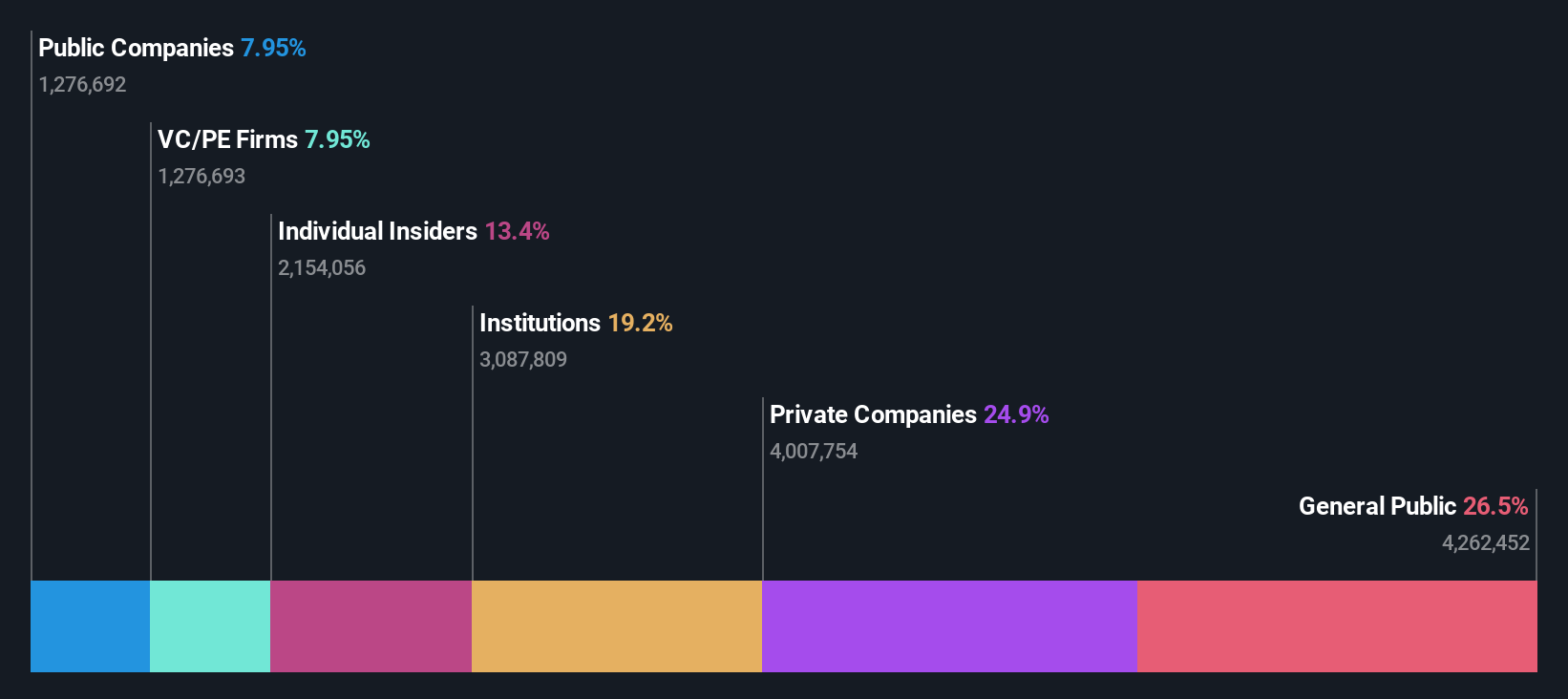

Insider Ownership: 13.4%

VusionGroup, a growth company with high insider ownership, is making strides in the retail technology sector. Recent partnerships with Ace Hardware and Hy-Vee highlight its innovative digital shelf label (DSL) technology, which enhances store operations and customer experience. Analysts forecast VusionGroup's revenue to grow at 21.3% annually, outpacing the French market. Earnings are expected to increase by 25.74% per year over the next three years, supported by high return on equity projections of 29.5%.

- Get an in-depth perspective on VusionGroup's performance by reading our analyst estimates report here.

- Our valuation report here indicates VusionGroup may be overvalued.

Seize The Opportunity

- Gain an insight into the universe of 22 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Good value with reasonable growth potential.