- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

3 European Growth Companies With High Insider Ownership Expecting Up To 70% Earnings Growth

Reviewed by Simply Wall St

As European markets experience a lift from the prospect of lower U.S. borrowing costs, with indices like the STOXX Europe 600 and UK’s FTSE 100 reaching new highs, investors are increasingly keen on identifying growth opportunities within this optimistic landscape. In such an environment, companies that combine robust growth prospects with high insider ownership can be particularly appealing, as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 91% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 92% |

| Circus (XTRA:CA1) | 24.7% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.6% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's dive into some prime choices out of the screener.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm specializing in various investment strategies including middle market secondaries, infrastructure, credit, and management buyouts, with a market cap of €18.62 billion.

Operations: The company's revenue segments include Credit (€135.64 million), Secondaries (€94.99 million), Infrastructure (€89.56 million), and Private Equity (€861.04 million).

Insider Ownership: 20.2%

Earnings Growth Forecast: 31.5% p.a.

CVC Capital Partners is experiencing significant earnings growth, forecasted at 31.53% annually, outpacing the Dutch market's 8.5%. However, its profit margins have decreased to 14.4% from last year’s 28.3%. The company is actively involved in several M&A activities across Europe and Asia-Pacific, including potential sales of stakes in PT Soho Global Health and AHAM Asset Management Berhad. CVC's strategic joint venture with Therme Group highlights its focus on expanding wellness offerings across Europe.

- Dive into the specifics of CVC Capital Partners here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that CVC Capital Partners is priced higher than what may be justified by its financials.

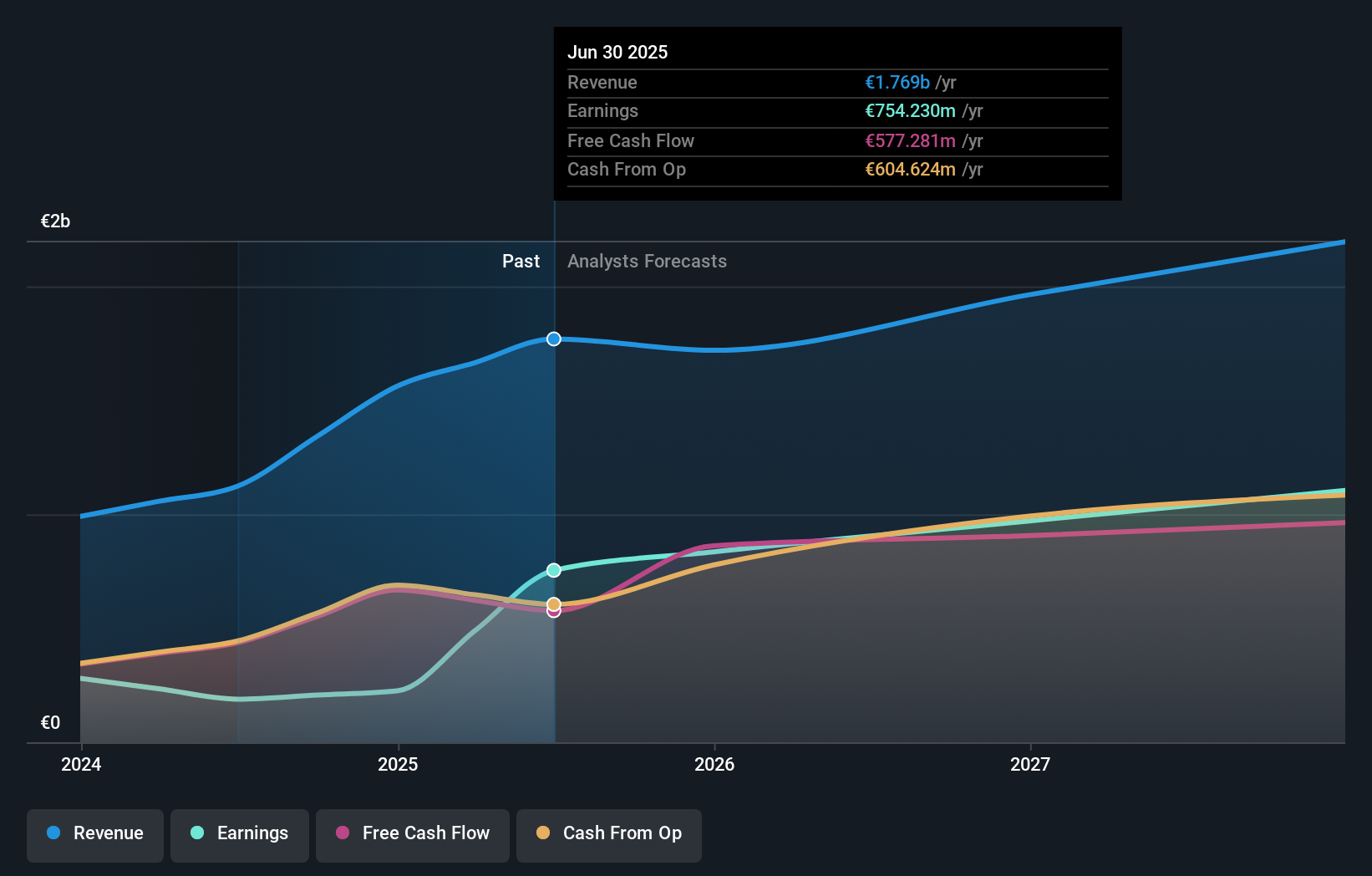

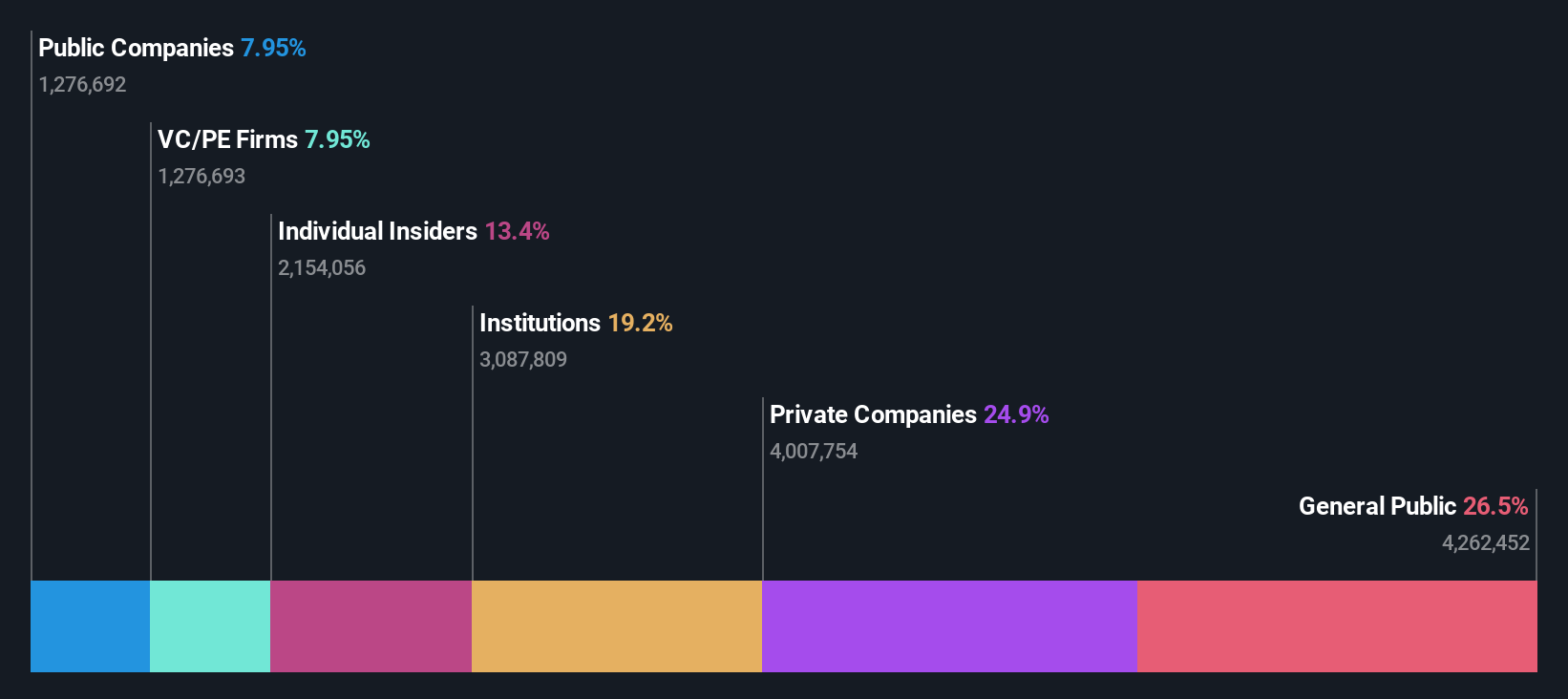

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of €3.45 billion.

Operations: The company generates revenue primarily from installing and maintaining electronic shelf labels, totaling €954.71 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 70.6% p.a.

VusionGroup is poised for robust growth, with revenue expected to increase by 20.6% annually, surpassing the French market's average. The company has forged strategic alliances with major retailers like Carrefour and Eroski, integrating innovative solutions such as EdgeSense and smart Electronic Shelf Labels to enhance store operations. Recent guidance confirms a sales growth target of approximately 40% for 2025 compared to 2024, underscoring its strong market position despite no substantial insider buying or selling activity recently.

- Click to explore a detailed breakdown of our findings in VusionGroup's earnings growth report.

- Upon reviewing our latest valuation report, VusionGroup's share price might be too optimistic.

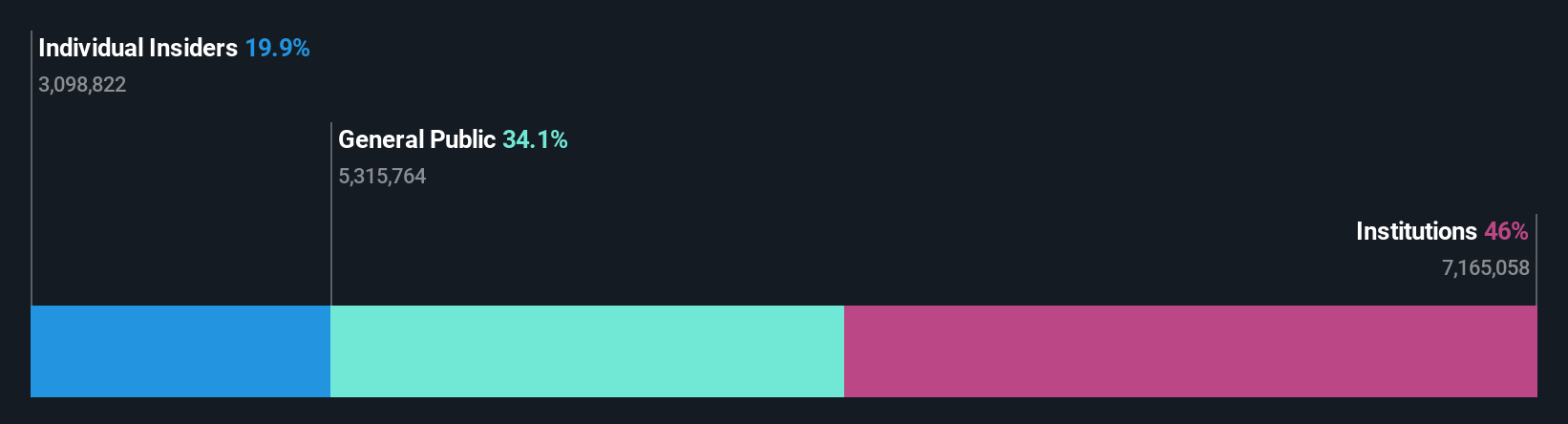

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components across various regions including Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF1.05 billion.

Operations: The company's revenue segment, focused on sensor systems, modules, and components, generated CHF333.08 million.

Insider Ownership: 19.9%

Earnings Growth Forecast: 30.2% p.a.

Sensirion Holding is on a promising growth trajectory, with earnings expected to rise significantly at 30.2% annually, outpacing the Swiss market. Recent financial results show a turnaround to profitability, with half-year sales reaching CHF 184.55 million and net income hitting CHF 10.44 million compared to a loss previously. The company reaffirmed its revenue guidance for 2025 between CHF 320-340 million, reflecting organic growth of up to 23%, supported by strategic collaborations like the one with Sintropy.ai for advanced automation solutions.

- Navigate through the intricacies of Sensirion Holding with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Sensirion Holding is trading beyond its estimated value.

Where To Now?

- Click through to start exploring the rest of the 212 Fast Growing European Companies With High Insider Ownership now.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives