- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LBIRD

Lumibird (EPA:LBIRD) earnings and shareholder returns have been trending downwards for the last three years, but the stock pops 10% this past week

It's nice to see the Lumibird SA (EPA:LBIRD) share price up 10% in a week. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 64% in that time. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Lumibird

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

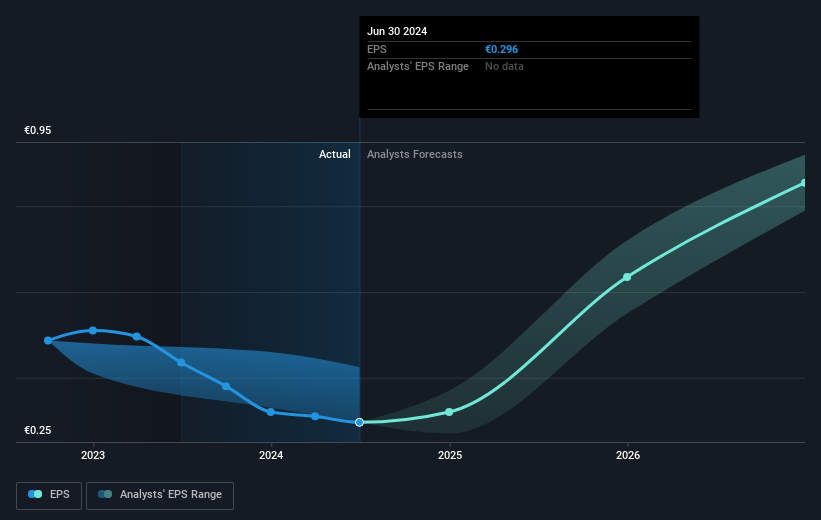

Lumibird saw its EPS decline at a compound rate of 24% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 29% per year. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Lumibird's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 7.9% in the last year, Lumibird shareholders lost 44%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Lumibird is showing 3 warning signs in our investment analysis , you should know about...

We will like Lumibird better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LBIRD

Lumibird

Designs, manufactures, and sells various lasers for the scientific, industrial, and medical applications worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives