- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LBIRD

High Growth Tech Stocks in Europe for July 2025

Reviewed by Simply Wall St

As Europe navigates a cautiously optimistic market environment, buoyed by potential EU-U.S. trade deals and steady economic indicators such as the pan-European STOXX Europe 600 Index's rise, investors are keeping a close eye on high-growth sectors like technology. In this context, identifying strong tech stocks involves assessing companies that are well-positioned to leverage ongoing technological advancements and exhibit resilience amid evolving trade dynamics and economic policies.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We'll examine a selection from our screener results.

Lumibird (ENXTPA:LBIRD)

Simply Wall St Growth Rating: ★★★★☆☆

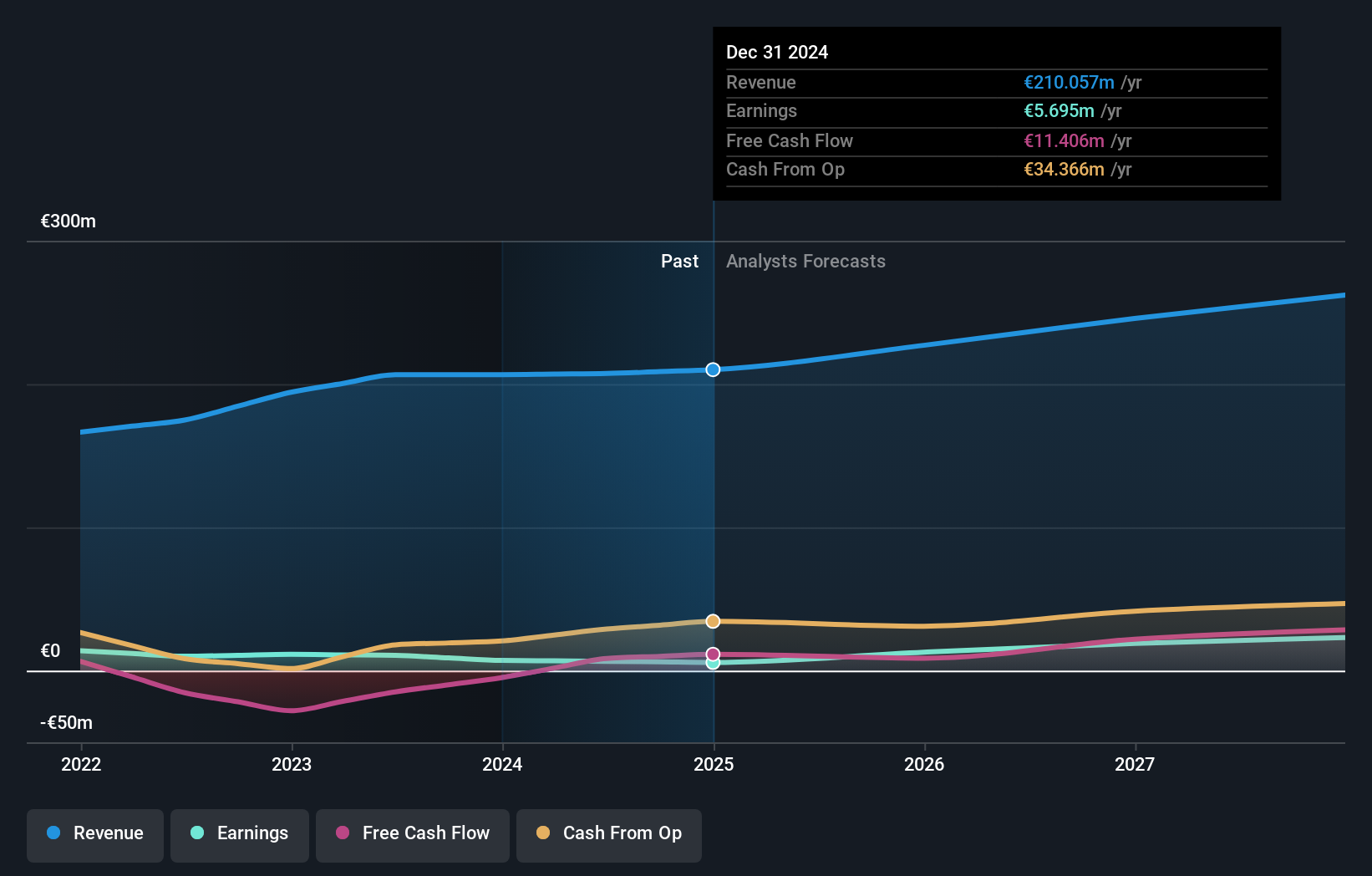

Overview: Lumibird SA is a company that specializes in the design, manufacture, and sale of lasers for scientific, industrial, and medical applications with a market capitalization of approximately €434.68 million.

Operations: The company's revenue is primarily derived from two segments: Medical (€107.75 million) and Photonic (€99.37 million).

Lumibird, a player in the European tech landscape, demonstrates a mixed financial trajectory with its earnings forecast to grow by 38.5% annually, outpacing the French market's average of 12.7%. Despite this robust growth in earnings, revenue projections are modest at 7.4% per year, slightly ahead of the broader market expectation of 5.1%. Challenges include a highly volatile share price and significant one-off losses totaling €3.4M last year which skewed financial results. Nevertheless, Lumibird's consistent investment in R&D could catalyze future innovations and maintain its competitive edge in a rapidly evolving industry.

- Get an in-depth perspective on Lumibird's performance by reading our health report here.

Assess Lumibird's past performance with our detailed historical performance reports.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

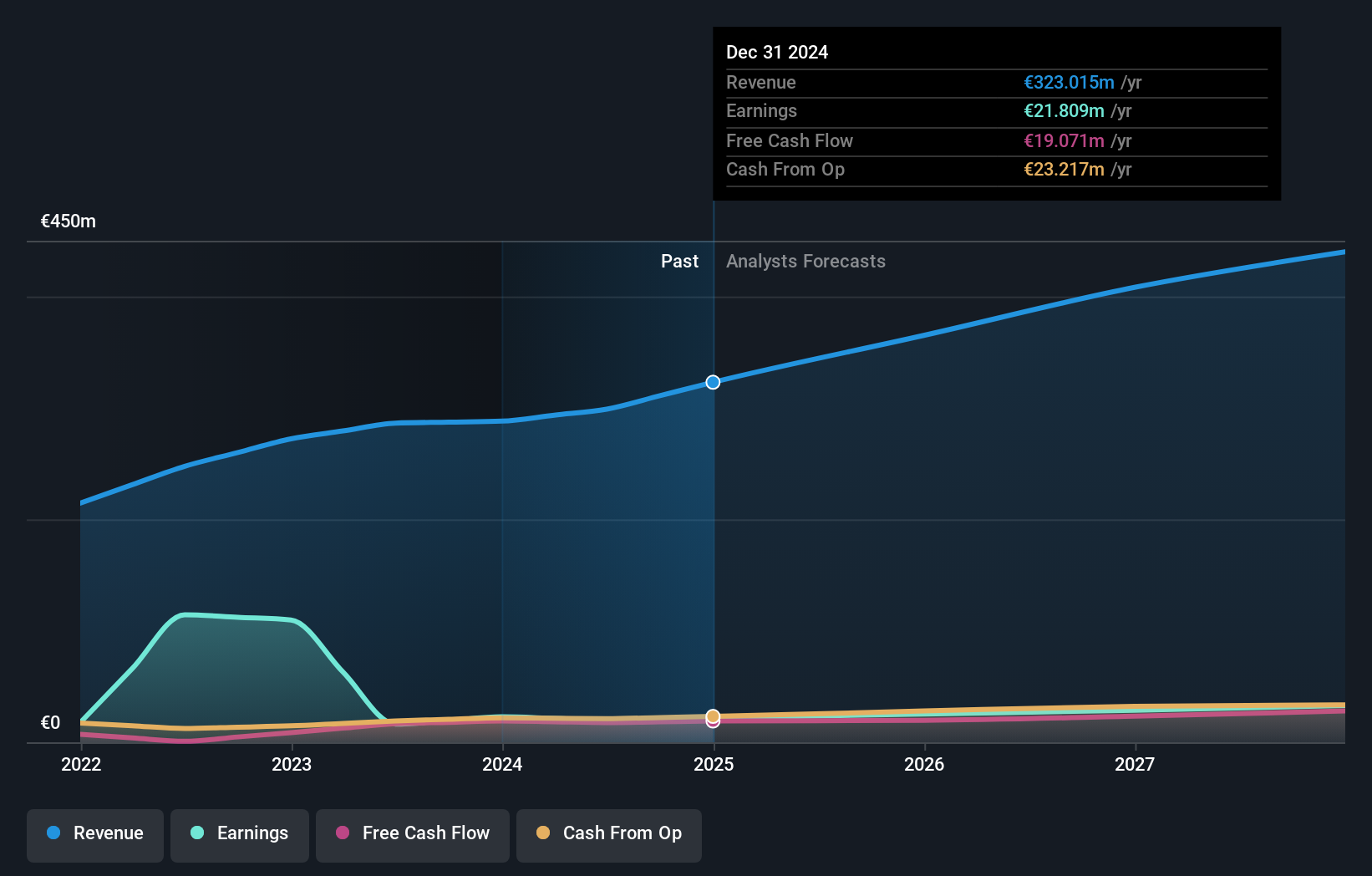

Overview: Sword Group S.E. is a company that delivers IT and software solutions on a global scale, with a market capitalization of €369.41 million.

Operations: Sword Group S.E. generates revenue through its IT and software services across key regions, with €116.37 million from Switzerland, €109.25 million from Belux, and €97.39 million from the United Kingdom.

Sword Group's recent strategic contract signings, totaling a potential EUR 200 million, underscore its robust positioning in cybersecurity and AI sectors. With an annual revenue growth of 10.9% and earnings expansion at 13.2%, it outpaces the French market averages significantly. Notably, its R&D commitment is reflected in a substantial allocation of resources toward innovation, crucial for maintaining competitive advantage in the tech industry. These factors collectively enhance Sword Group's prospects in high-growth technology sectors across Europe, promising sustained performance amidst evolving digital landscapes.

- Navigate through the intricacies of Sword Group with our comprehensive health report here.

Explore historical data to track Sword Group's performance over time in our Past section.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

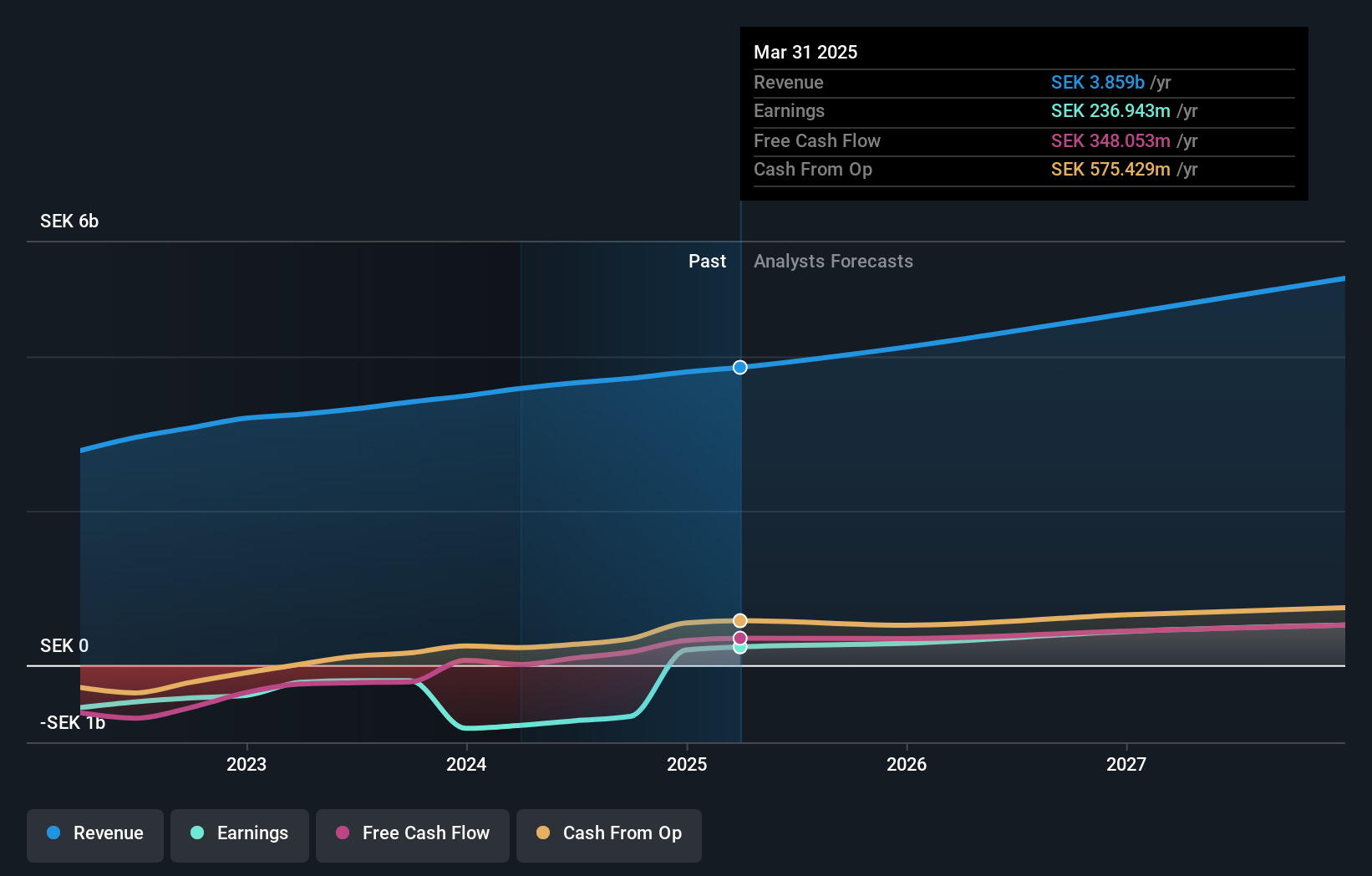

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services and has a market cap of approximately SEK7.36 billion.

Operations: Storytel AB (publ) generates revenue primarily through its Streaming and Publishing segments, with the Streaming segment contributing SEK3.43 billion and the Publishing segment adding SEK1.16 billion.

Storytel's recent trajectory in the tech sector is marked by robust growth and strategic expansions. With a forecasted annual revenue increase of 9.1% and earnings growth at an impressive 23.1%, the company outstrips Swedish market averages significantly, showcasing its competitive edge in high-growth environments. Notably, its R&D commitment is substantial, aligning with industry trends towards enhanced digital offerings in media and publishing. Recent strategic moves include the acquisition of Bokfabriken, bolstering its content distribution capabilities— a critical factor as Storytel strengthens its position within Europe's tech landscape amidst evolving consumer preferences and technological advancements.

- Click to explore a detailed breakdown of our findings in Storytel's health report.

Understand Storytel's track record by examining our Past report.

Make It Happen

- Discover the full array of 232 European High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LBIRD

Lumibird

Designs, manufactures, and sells various lasers for scientific, industrial, and medical applications.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives