- Spain

- /

- Electrical

- /

- BME:ART

Discover 3 European Stocks That Might Be Trading Below Fair Value

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of trade tensions between the U.S. and China, major indices such as Germany’s DAX and France’s CAC 40 have shown positive gains. In this environment, identifying stocks that may be trading below their fair value can present potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.80 | €104.47 | 49.5% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.90 | €3.70 | 48.7% |

| Lectra (ENXTPA:LSS) | €23.70 | €46.94 | 49.5% |

| adidas (XTRA:ADS) | €220.30 | €434.88 | 49.3% |

| Boreo Oyj (HLSE:BOREO) | €15.45 | €30.61 | 49.5% |

| Montana Aerospace (SWX:AERO) | CHF19.92 | CHF39.83 | 50% |

| Vestas Wind Systems (CPSE:VWS) | DKK107.80 | DKK212.34 | 49.2% |

| 3U Holding (XTRA:UUU) | €1.525 | €3.03 | 49.7% |

| Claranova (ENXTPA:CLA) | €2.825 | €5.44 | 48.1% |

| HBX Group International (BME:HBX) | €9.88 | €19.25 | 48.7% |

Underneath we present a selection of stocks filtered out by our screen.

Arteche Lantegi Elkartea (BME:ART)

Overview: Arteche Lantegi Elkartea, S.A. is involved in the design, manufacture, integration, and supply of electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market cap of €527.10 million.

Operations: Arteche Lantegi Elkartea generates revenue from three main segments: Network Reliability (€45.92 million), Systems Measurement and Monitoring (€321.55 million), and Automation of Transmission and Distribution Networks (€79.94 million).

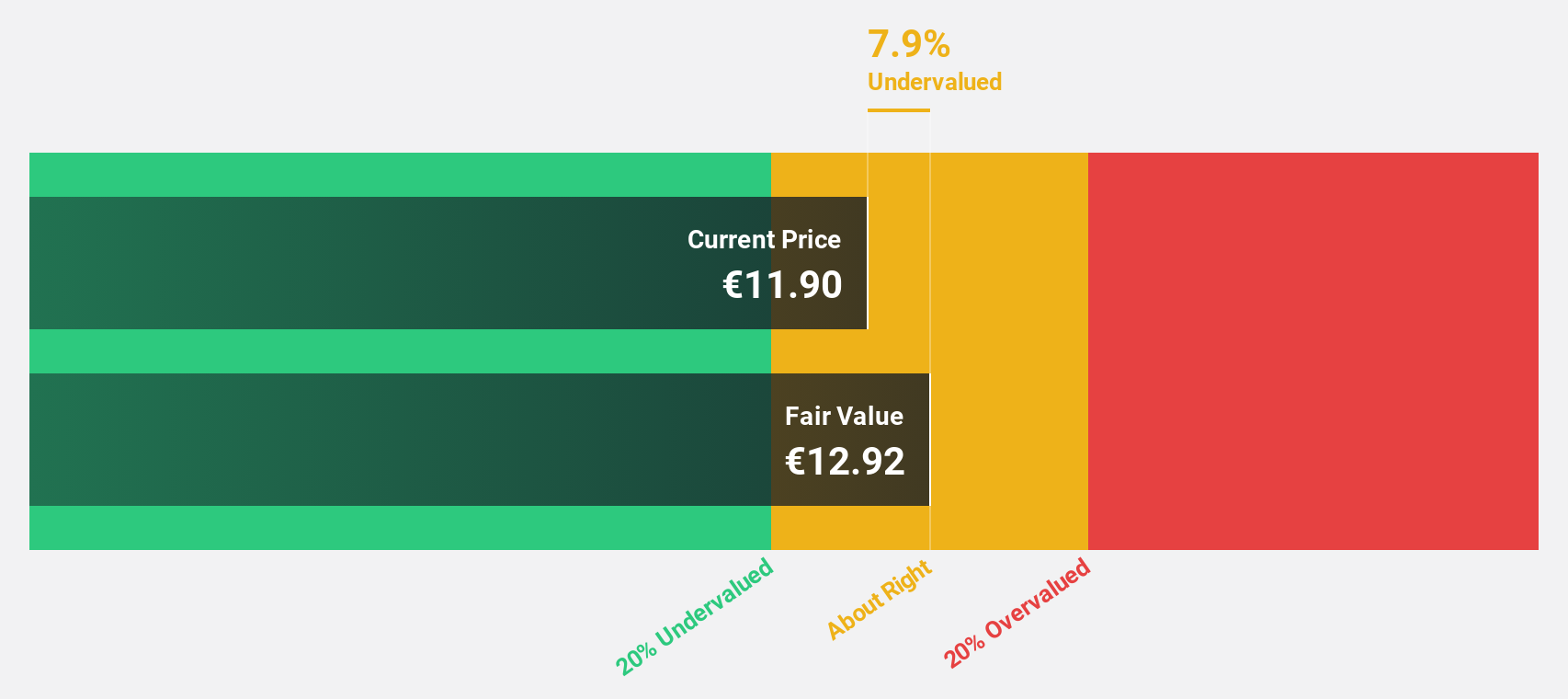

Estimated Discount To Fair Value: 23.8%

Arteche Lantegi Elkartea is trading at €9.25, significantly below its estimated fair value of €12.14, suggesting undervaluation based on cash flows. With earnings expected to grow 22.62% annually, surpassing the Spanish market's 4.8%, and revenue projected to increase by 9.3% per year, Arteche shows strong growth potential despite slower revenue growth than desired benchmarks. Recent financials reveal robust performance with net income rising to €18.9 million from €12.06 million last year.

- Upon reviewing our latest growth report, Arteche Lantegi Elkartea's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Arteche Lantegi Elkartea's balance sheet by reading our health report here.

Lumibird (ENXTPA:LBIRD)

Overview: Lumibird SA designs, manufactures, and sells a range of lasers for scientific, industrial, and medical applications globally with a market cap of €294.92 million.

Operations: The company generates revenue from two primary segments: Medical, contributing €107.75 million, and Photonic, accounting for €99.37 million.

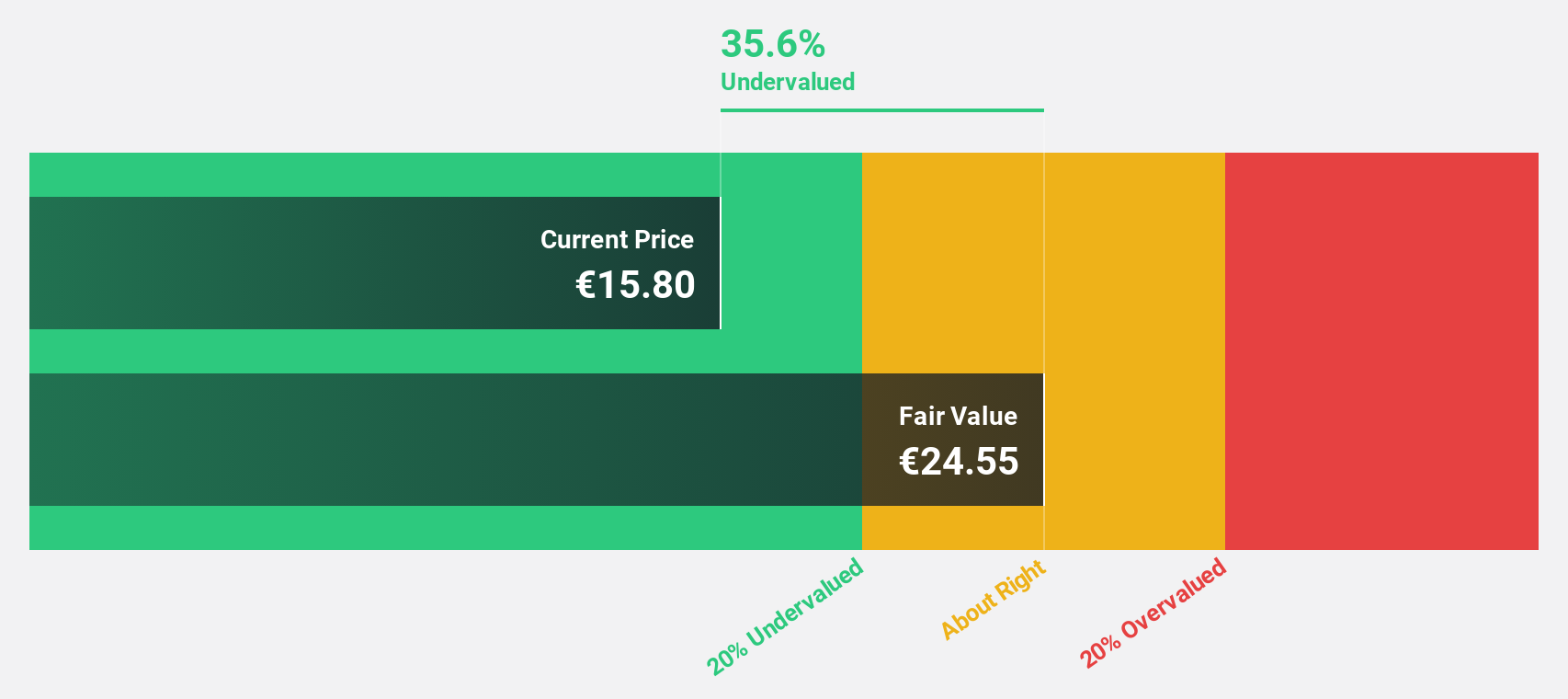

Estimated Discount To Fair Value: 44.4%

Lumibird is trading at €13.4, substantially below its estimated fair value of €24.1, highlighting undervaluation based on cash flows. Despite a volatile share price recently, the company shows promising growth prospects with earnings expected to grow significantly at 37.3% annually, outpacing the French market's 12%. However, recent financials show net income decreased to €5.7 million from €7.1 million last year due to large one-off items impacting results.

- In light of our recent growth report, it seems possible that Lumibird's financial performance will exceed current levels.

- Click here to discover the nuances of Lumibird with our detailed financial health report.

UPM-Kymmene Oyj (HLSE:UPM)

Overview: UPM-Kymmene Oyj operates in the forest-based bioindustry across Europe, North America, Asia, and internationally, with a market cap of approximately €13.29 billion.

Operations: UPM-Kymmene Oyj's revenue is primarily derived from its segments: UPM Energy (€590 million), UPM Fibres (€3.88 billion), UPM Plywood (€435 million), UPM Raflatac (€1.59 billion), UPM Specialty Papers (€1.44 billion), and UPM Communication Papers (€2.82 billion).

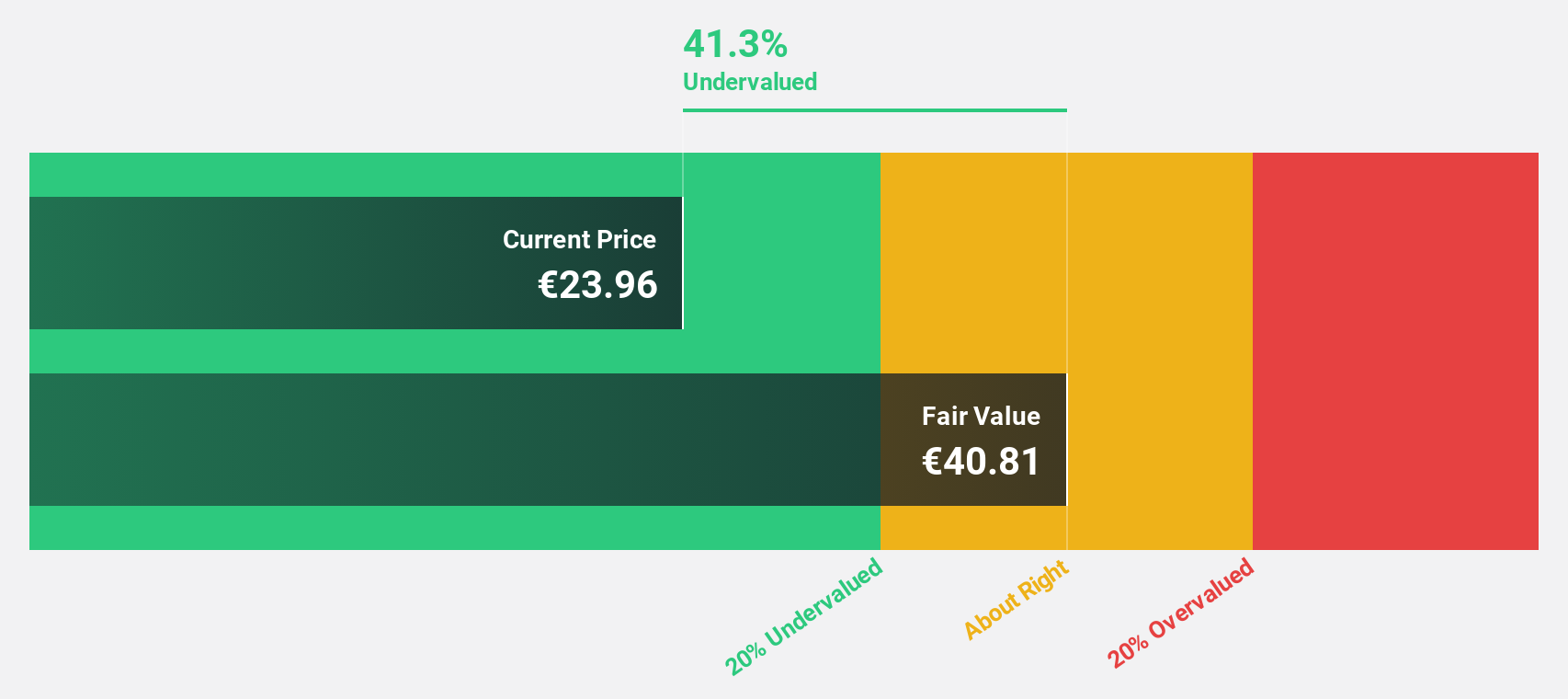

Estimated Discount To Fair Value: 42.7%

UPM-Kymmene Oyj trades at €25.2, significantly below its fair value estimate of €44.02, indicating undervaluation based on cash flows. Despite a recent drop in net income to €137 million from €272 million last year and profit margins declining from 4.7% to 2.9%, earnings are forecasted to grow substantially at 28.3% annually, surpassing the Finnish market's growth rate of 13.9%. A recent share buyback further supports potential value realization for investors.

- Insights from our recent growth report point to a promising forecast for UPM-Kymmene Oyj's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of UPM-Kymmene Oyj.

Summing It All Up

- Reveal the 184 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ART

Arteche Lantegi Elkartea

Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energy and smart grids in Spain and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives