- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LACR

LACROIX Group SA (EPA:LACR) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

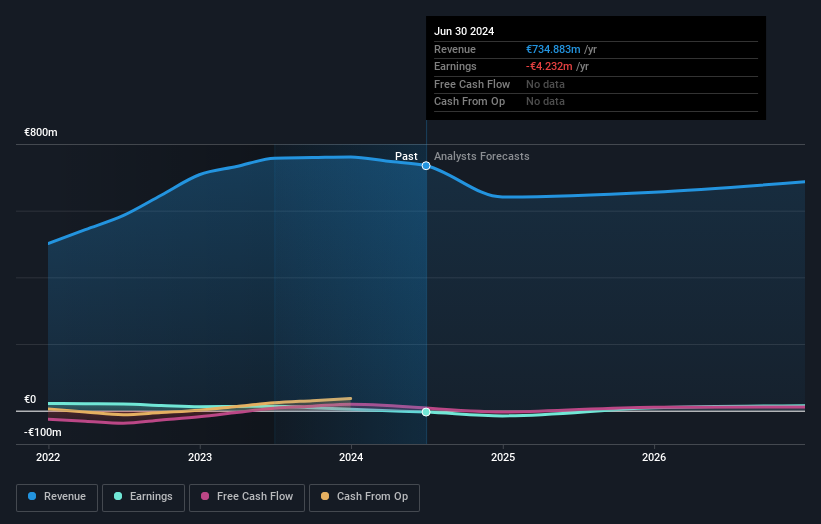

It's been a sad week for LACROIX Group SA (EPA:LACR), who've watched their investment drop 12% to €15.80 in the week since the company reported its half-year result. Results were roughly in line with estimates, with revenues of €363m and statutory earnings per share of €0.91. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for LACROIX Group

Taking into account the latest results, the twin analysts covering LACROIX Group provided consensus estimates of €641.0m revenue in 2024, which would reflect a not inconsiderable 13% decline over the past 12 months. In the lead-up to this report, the analysts had been modelling revenues of €702.7m and earnings per share (EPS) of €1.70 in 2024. Overall, while there's been a small dip in revenue estimates, the consensus now no longer provides an EPS estimate. This implies that the market believes revenue is more important following the latest results.

The average price target fell 32% to €18.75, withthe analysts clearly having become less optimistic about LACROIX Group'sprospects following its latest earnings.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 24% by the end of 2024. This indicates a significant reduction from annual growth of 11% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 24% per year. It's pretty clear that LACROIX Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The clear low-light was that the analysts cut their forecast revenue estimates for LACROIX Group next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

At least one of LACROIX Group's twin analysts has provided estimates out to 2026, which can be seen for free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for LACROIX Group (1 is potentially serious) you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LACR

LACROIX Group

Engages in the conception and supply of electronic equipment and industrial IoT solutions in France, Germany, the United States, Poland, and Tunisia.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026