- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LACR

Here's What Analysts Are Forecasting For LACROIX Group SA (EPA:LACR) After Its Yearly Results

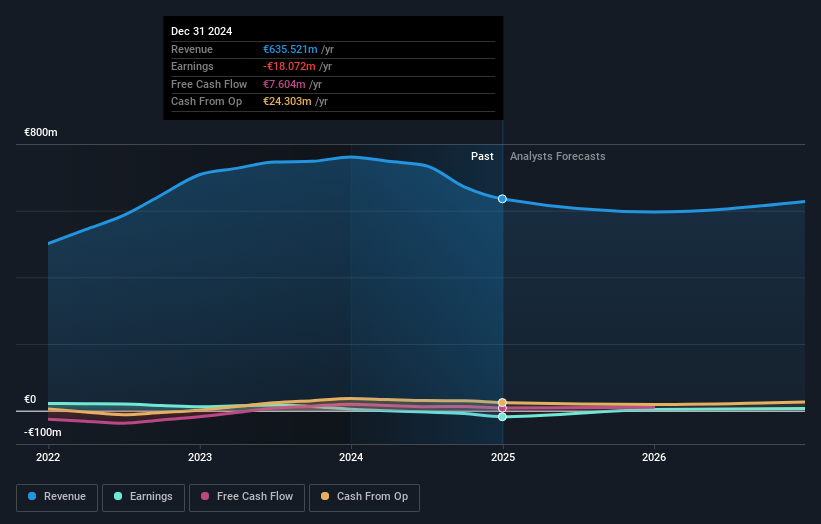

There's been a major selloff in LACROIX Group SA (EPA:LACR) shares in the week since it released its yearly report, with the stock down 21% to €7.50. Revenues were in line with expectations, at €636m, while statutory losses ballooned to €7.21 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

After the latest results, the consensus from LACROIX Group's dual analysts is for revenues of €596.3m in 2025, which would reflect a measurable 6.2% decline in revenue compared to the last year of performance. Earnings are expected to improve, with LACROIX Group forecast to report a statutory profit of €0.67 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of €611.5m and earnings per share (EPS) of €0.54 in 2025. While revenue forecasts have been revised downwards, the analysts look to have become more optimistic on the company's cost base, given the great increase in to the earnings per share numbers.

View our latest analysis for LACROIX Group

There's been no real change to the average price target of €10.05, with the lower revenue and higher earnings forecasts not expected to meaningfully impact the company's valuation over a longer timeframe.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 6.2% by the end of 2025. This indicates a significant reduction from annual growth of 9.5% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 17% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - LACROIX Group is expected to lag the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around LACROIX Group's earnings potential next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. Yet - earnings are more important to the intrinsic value of the business. The consensus price target held steady at €10.05, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

Plus, you should also learn about the 4 warning signs we've spotted with LACROIX Group (including 1 which is potentially serious) .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:LACR

LACROIX Group

Engages in the conception and supply of electronic equipment and industrial IoT solutions in France, Germany, the United States, Poland, and Tunisia.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026