- France

- /

- Tech Hardware

- /

- ENXTPA:GUI

European Penny Stocks: 3 Picks With Market Caps Under €80M

Reviewed by Simply Wall St

The European market has recently faced challenges, with the pan-European STOXX Europe 600 Index ending 1.57% lower due to renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East. Despite these hurdles, investors often look towards smaller companies for potential growth opportunities that may not be as readily available in larger firms. Penny stocks, though sometimes seen as a relic of past market eras, continue to offer intriguing possibilities when supported by solid financials and fundamentals. In this article, we explore several penny stocks that stand out for their financial strength and potential for long-term success in the European market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.98 | €62.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.55 | €17.01M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.04 | PLN10.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.56 | SEK216.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.25M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 454 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Catenon (BME:COM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catenon, S.A. is a technology-based company offering recruitment services both in Spain and internationally, with a market cap of €22.45 million.

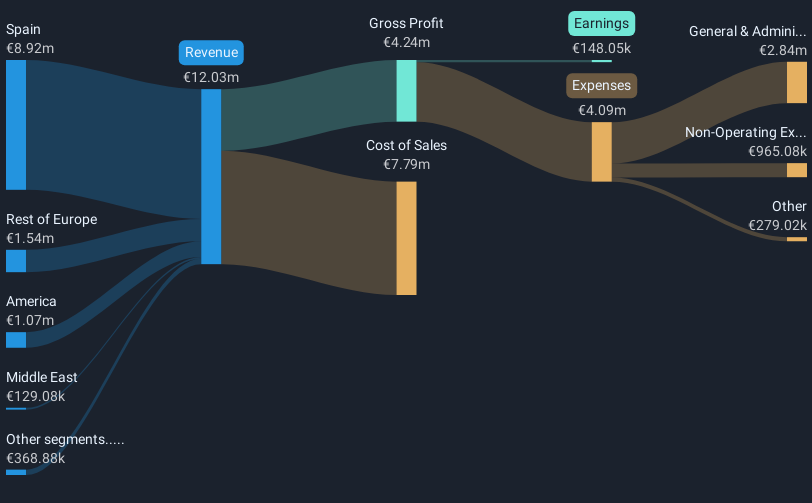

Operations: The company's revenue is derived from the application of new IT and communication technologies, amounting to €12.03 million.

Market Cap: €22.45M

Catenon, S.A. has transitioned to profitability recently, with earnings growing by 25.2% annually over the past five years. The company's net debt to equity ratio of 17.3% is satisfactory, and its short-term assets comfortably cover both short and long-term liabilities. Operating cash flow covers debt well, though return on equity remains low at 4.8%. Share price volatility is high compared to most Spanish stocks but has stabilized over the past year. Revenue growth is forecasted at 16.59% per year, reflecting potential for continued expansion in its technology-driven recruitment services sector.

- Dive into the specifics of Catenon here with our thorough balance sheet health report.

- Gain insights into Catenon's outlook and expected performance with our report on the company's earnings estimates.

Greenland Resources (DB:M0LY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenland Resources Inc. is a mining company focused on acquiring, exploring, and developing mineral projects in Greenland, with a market cap of €61.76 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: €61.76M

Greenland Resources Inc., with a market cap of €61.76 million, is pre-revenue and operates in the mining sector focusing on Greenland's mineral projects. Recently, the company signed a non-binding MOU with Cogne Acciai Speciali S.p.A., potentially securing a long-term molybdenum supply chain for European markets, which lack domestic production. The Malmbjerg project could meet 25% of EU molybdenum demand sustainably. Despite high share price volatility and limited cash runway, recent capital raises via private placements offer short-term financial relief. The company remains debt-free but unprofitable, highlighting both potential opportunities and risks typical of penny stocks.

- Get an in-depth perspective on Greenland Resources' performance by reading our balance sheet health report here.

- Gain insights into Greenland Resources' past trends and performance with our report on the company's historical track record.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment hardware and accessories across several countries including France, Germany, the UK, and the US with a market cap of €74.88 million.

Operations: The company's revenue is primarily derived from its Thrustmaster segment, contributing €113.10 million, and its Hercules segment, which adds €12.02 million.

Market Cap: €74.88M

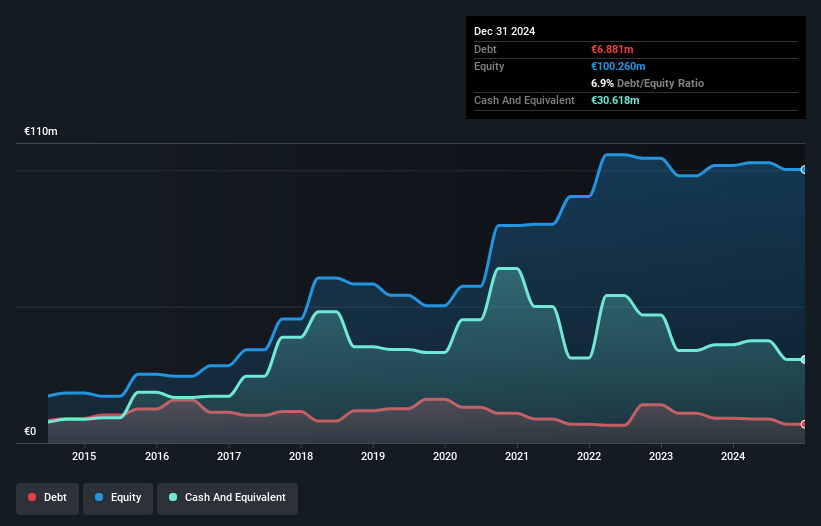

Guillemot Corporation S.A., with a market cap of €74.88 million, has shown promising financial growth in its recent earnings report, with sales reaching €125.12 million and net income rising to €1.18 million for the year ending December 31, 2024. The company benefits from a solid cash position exceeding its total debt and strong short-term asset coverage over liabilities. However, profitability is modest with a net profit margin of 0.9% and low return on equity at 1.2%. A seasoned management team supports stability, yet past one-off losses have impacted earnings quality significantly in the last year.

- Unlock comprehensive insights into our analysis of Guillemot stock in this financial health report.

- Gain insights into Guillemot's future direction by reviewing our growth report.

Key Takeaways

- Reveal the 454 hidden gems among our European Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GUI

Guillemot

Engages in the designing, manufacturing, and sells of interactive entertainment equipment and accessories in France, Germany, Spain, Great Britain, the United States, Canada, Italy, Belgium, Netherlands, Romania, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives