- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:GEA

Introducing Grenobloise d'Electronique et d'Automatismes Société Anonyme (EPA:GEA), A Stock That Climbed 43% In The Last Five Years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Grenobloise d'Electronique et d'Automatismes Société Anonyme (EPA:GEA) share price is up 43% in the last 5 years, clearly besting the market return of around 31% (ignoring dividends).

See our latest analysis for Grenobloise d'Electronique et d'Automatismes Société Anonyme

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Grenobloise d'Electronique et d'Automatismes Société Anonyme's earnings per share are down 15% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

The modest 2.0% dividend yield is unlikely to be propping up the share price. It is not great to see that revenue has dropped by 8.6% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

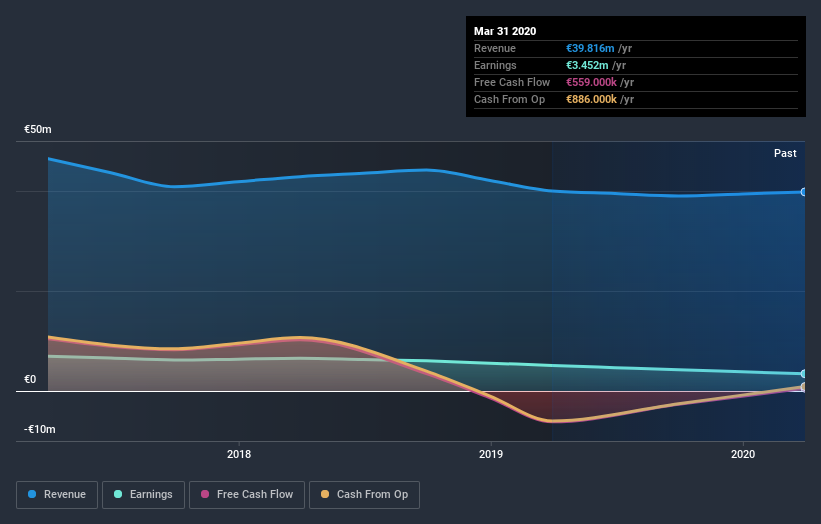

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Grenobloise d'Electronique et d'Automatismes Société Anonyme's TSR for the last 5 years was 61%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's never nice to take a loss, Grenobloise d'Electronique et d'Automatismes Société Anonyme shareholders can take comfort that , including dividends,their trailing twelve month loss of 2.1% wasn't as bad as the market loss of around 2.6%. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Grenobloise d'Electronique et d'Automatismes Société Anonyme better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Grenobloise d'Electronique et d'Automatismes Société Anonyme (of which 2 are a bit unpleasant!) you should know about.

We will like Grenobloise d'Electronique et d'Automatismes Société Anonyme better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Grenobloise d'Electronique et d'Automatismes Société Anonyme, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:GEA

Grenobloise d'Electronique et d'Automatismes Société Anonyme

Provides electronic toll collection systems in France, rest of the European Union, rest of Europe, Asia, the Americas, and Africa.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026