- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:GEA

Grenobloise d'Electronique et d'Automatismes Société Anonyme's (EPA:GEA) Problems Go Beyond Weak Profit

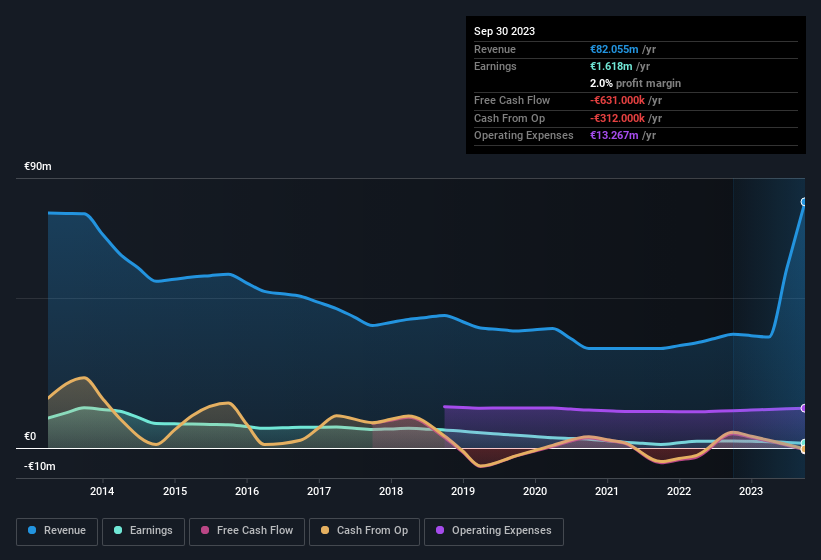

The subdued market reaction suggests that Grenobloise d'Electronique et d'Automatismes Société Anonyme's (EPA:GEA) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for Grenobloise d'Electronique et d'Automatismes Société Anonyme

Operating Revenue Or Not?

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. It's worth noting that Grenobloise d'Electronique et d'Automatismes Société Anonyme saw a big increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from €1.0 to €41.9m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Grenobloise d'Electronique et d'Automatismes Société Anonyme.

Our Take On Grenobloise d'Electronique et d'Automatismes Société Anonyme's Profit Performance

Since Grenobloise d'Electronique et d'Automatismes Société Anonyme saw a big increase in its non-operating revenue over the last twelve months, we'd be very cautious about relying too heavily on the statutory profit number, which would have benefitted from this potentially unsustainable change. For this reason, we think that Grenobloise d'Electronique et d'Automatismes Société Anonyme's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Grenobloise d'Electronique et d'Automatismes Société Anonyme as a business, it's important to be aware of any risks it's facing. To help with this, we've discovered 2 warning signs (1 is a bit unpleasant!) that you ought to be aware of before buying any shares in Grenobloise d'Electronique et d'Automatismes Société Anonyme.

This note has only looked at a single factor that sheds light on the nature of Grenobloise d'Electronique et d'Automatismes Société Anonyme's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:GEA

Grenobloise d'Electronique et d'Automatismes Société Anonyme

Provides electronic toll collection systems in France, rest of the European Union, rest of Europe, Asia, the Americas, and Africa.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026