- France

- /

- Tech Hardware

- /

- ENXTPA:ALLOG

A Piece Of The Puzzle Missing From Logic Instrument S.A.'s (EPA:ALLOG) 26% Share Price Climb

Logic Instrument S.A. (EPA:ALLOG) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 140% following the latest surge, making investors sit up and take notice.

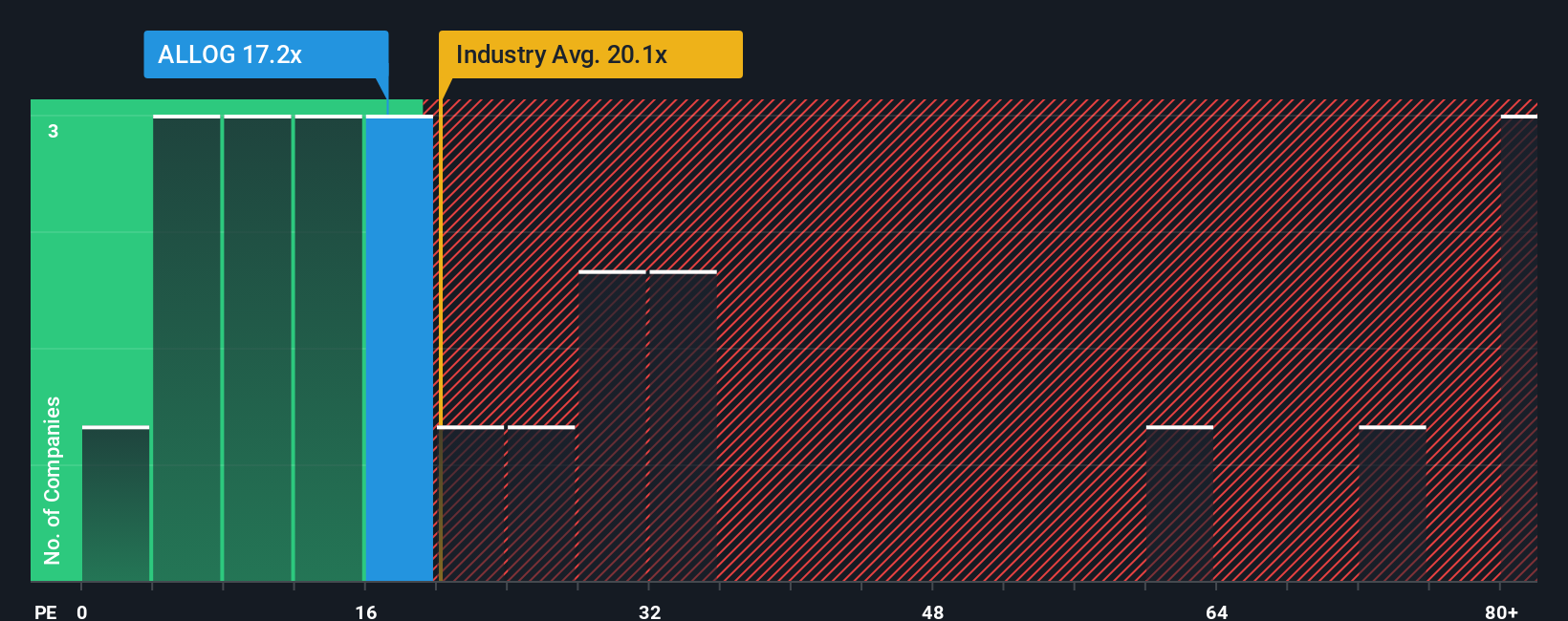

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Logic Instrument's P/E ratio of 17.2x, since the median price-to-earnings (or "P/E") ratio in France is also close to 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Logic Instrument has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Logic Instrument

Is There Some Growth For Logic Instrument?

The only time you'd be comfortable seeing a P/E like Logic Instrument's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 95% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 27% each year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% per year, which is noticeably less attractive.

With this information, we find it interesting that Logic Instrument is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Logic Instrument's P/E?

Logic Instrument appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Logic Instrument currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Logic Instrument that you should be aware of.

You might be able to find a better investment than Logic Instrument. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALLOG

Logic Instrument

Manufactures, distributes, and sells mobile computers for professional applications.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026