- France

- /

- Entertainment

- /

- ENXTPA:BOL

High Growth Tech Stocks In Europe With Promising Potential

Reviewed by Simply Wall St

The European market has recently experienced a mix of gains and losses, with the pan-European STOXX Europe 600 Index ending slightly lower amid concerns over U.S. trade policies, although increased spending plans in Germany and the EU have provided some support. In this context of fluctuating investor sentiment, identifying high growth tech stocks with strong potential involves looking for companies that demonstrate innovation, resilience to economic uncertainties, and alignment with broader technological advancements.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Truecaller | 20.10% | 24.70% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Devyser Diagnostics | 27.27% | 98.23% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across France, Europe, the Americas, Asia, Oceania, and Africa with a market cap of €16.16 billion.

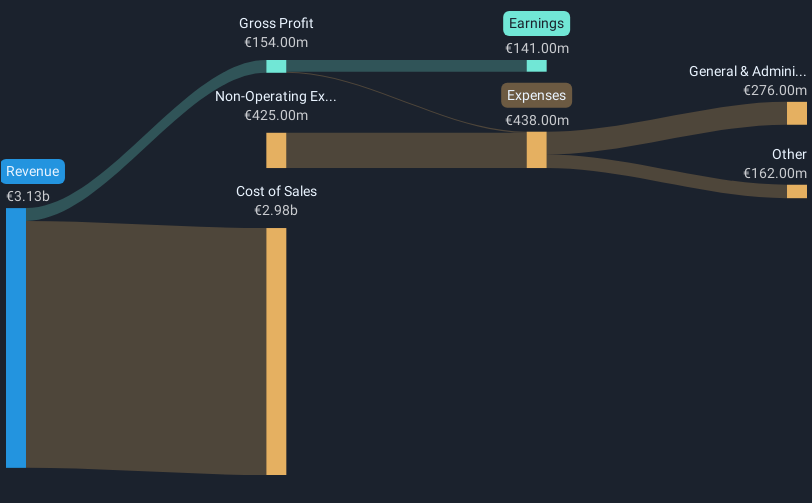

Operations: Bolloré SE generates significant revenue from its communications segment, contributing €14.86 billion, followed by Bolloré Energy at €2.75 billion and the industry segment at €353 million. The company operates across various regions, including Europe, the Americas, Asia, Oceania, and Africa.

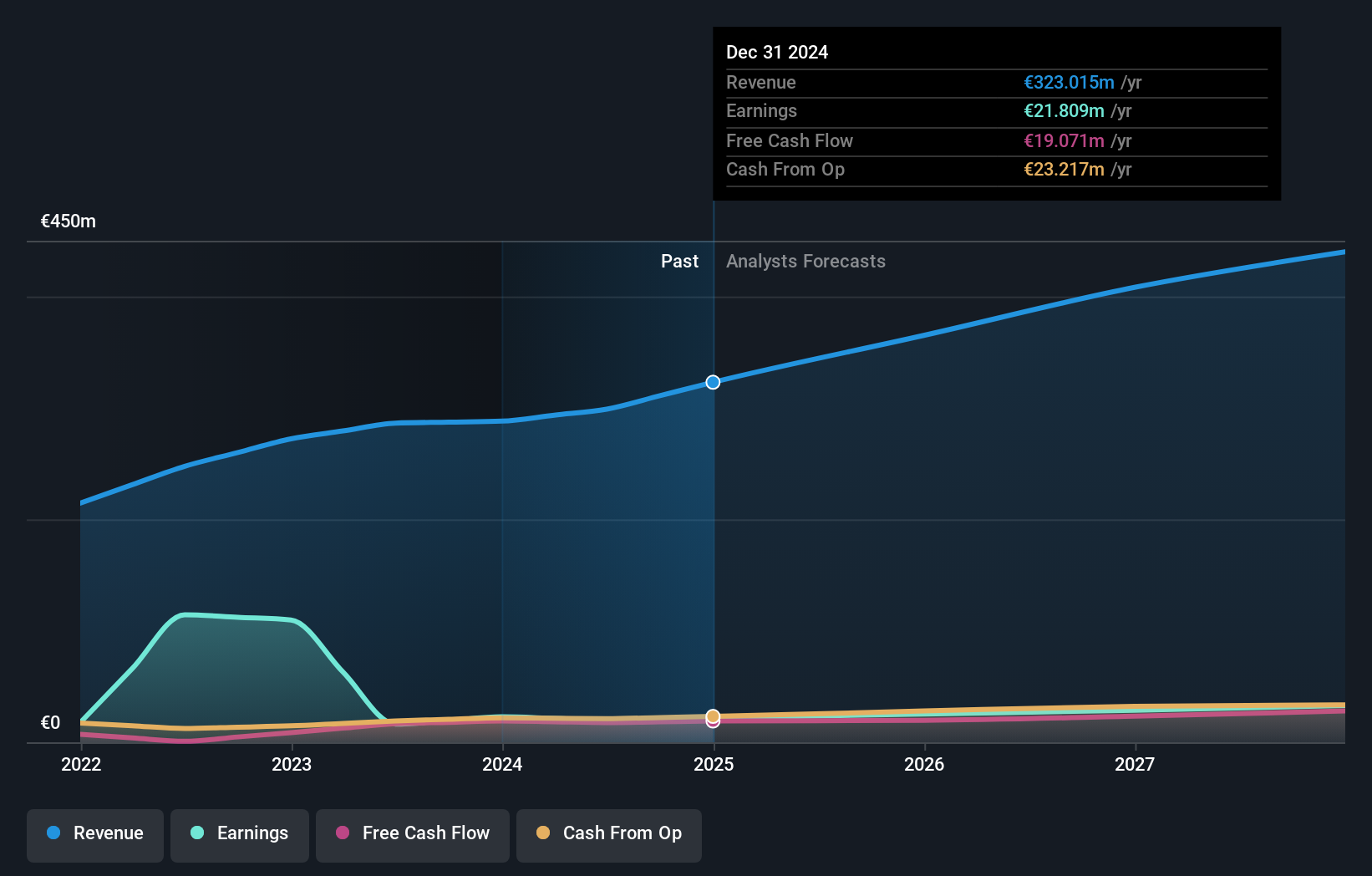

Bolloré SE, a diversified conglomerate with a growing presence in high-tech sectors, shows promising financial dynamics. With an annual revenue growth rate of 8.1%, Bolloré outpaces the French market average of 6%. This growth is complemented by an impressive forecast for earnings, expected to surge by 32.7% annually. Recently, the firm initiated a share repurchase program on January 6, 2025, highlighting confidence in its financial health and commitment to shareholder value. This strategic move aligns with its robust free cash flow generation and high-quality earnings profile, positioning Bolloré favorably within Europe's competitive tech landscape.

- Get an in-depth perspective on Bolloré's performance by reading our health report here.

Gain insights into Bolloré's past trends and performance with our Past report.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. offers IT and software solutions on a global scale, with a market capitalization of €312.43 million.

Operations: Sword Group S.E. generates revenue through its IT and software services across regions, with notable contributions from Switzerland (€105.75 million), Belux (€104.26 million), and the United Kingdom (€88.88 million).

Amidst the dynamic landscape of European tech, Sword Group stands out with its robust performance metrics. The company's revenue has surged by 13.5% annually, surpassing the French market's growth rate of 6%. Notably, Sword Group's earnings have also seen a significant uptick, growing at an annual rate of 17.3%. This financial vigor is further underscored by its strategic focus on R&D, allocating substantial resources that promise to drive future innovations and maintain competitive edge in rapidly evolving sectors like AI and software development. With these solid growth figures and a commitment to reinvesting in technological advancements, Sword Group is well-positioned to capitalize on emerging opportunities within the high-tech industry.

- Delve into the full analysis health report here for a deeper understanding of Sword Group.

Evaluate Sword Group's historical performance by accessing our past performance report.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stemmer Imaging AG specializes in providing machine vision technology for both industrial and non-industrial applications globally, with a market capitalization of €352.30 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, amounting to €113.27 million.

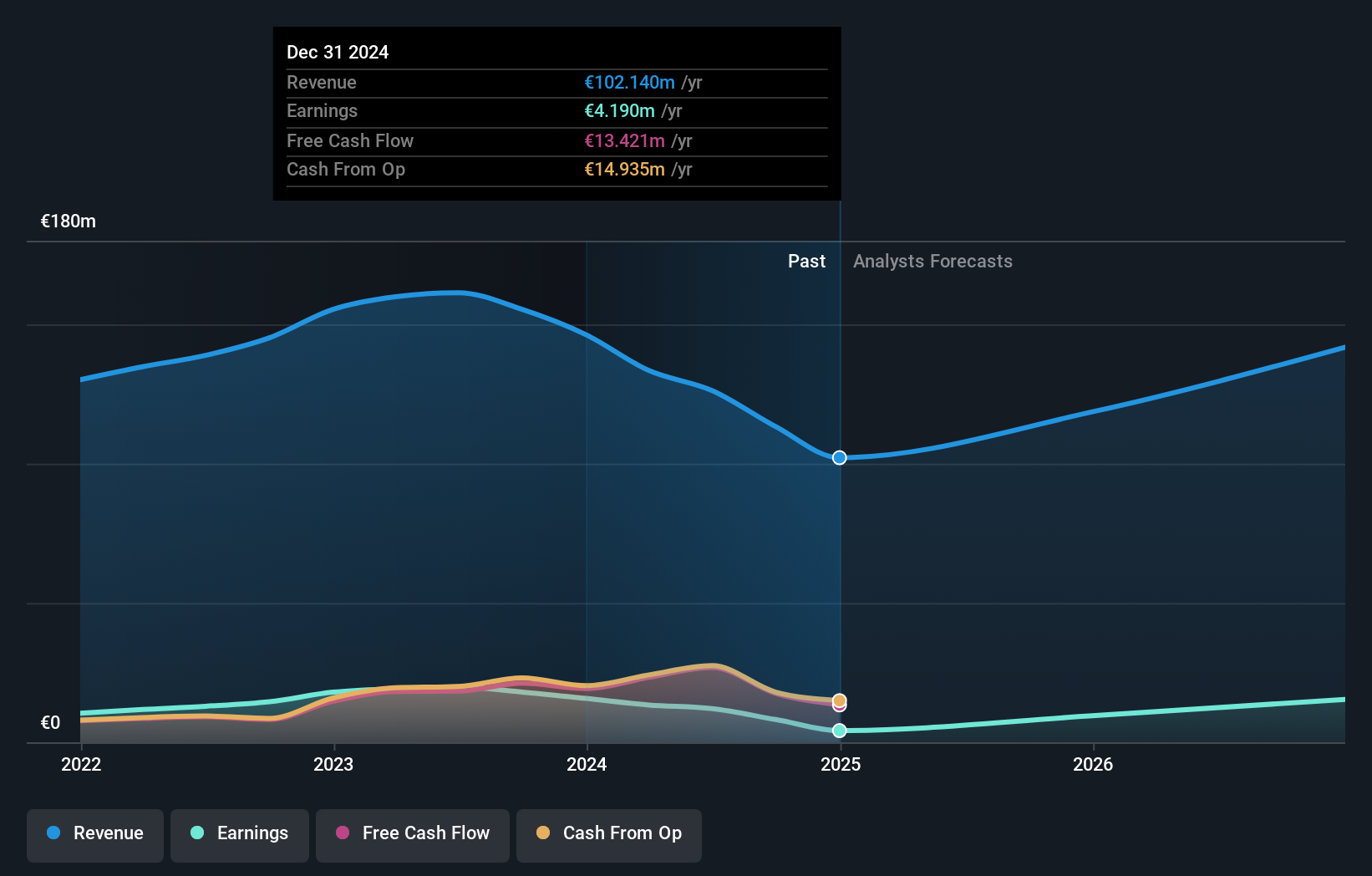

Stemmer Imaging, a notable entity in the European tech arena, is demonstrating promising growth with an 11.2% annual increase in revenue, though slightly trailing the high-growth benchmark of 20%. The company's earnings are on a robust upward trajectory, projected to expand by 41% annually. This performance is underpinned by a strategic emphasis on R&D investments which have been pivotal in maintaining its competitive edge and fueling innovations. Despite facing challenges like a dip in profit margins from 11.6% to 7.2%, Stemmer Imaging's commitment to technological advancement and its substantial client base position it well for future opportunities within the high-tech sector.

- Take a closer look at Stemmer Imaging's potential here in our health report.

Explore historical data to track Stemmer Imaging's performance over time in our Past section.

Where To Now?

- Unlock our comprehensive list of 245 European High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, Asia, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives