3 Euronext Paris Growth Stocks With Up To 15% Insider Ownership

Reviewed by Simply Wall St

As the French CAC 40 Index recently climbed by nearly 3.89%, buoyed by hopes for interest rate cuts and China's economic stimulus measures, investors are increasingly attentive to growth opportunities within the Euronext Paris. In this context, companies with high insider ownership often attract interest due to their potential alignment with shareholder interests and commitment to long-term value creation, making them noteworthy candidates in today's market landscape.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 20.6% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.7% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 35.2% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| Adocia (ENXTPA:ADOC) | 11.9% | 64% |

| Munic (ENXTPA:ALMUN) | 27.1% | 150% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Here we highlight a subset of our preferred stocks from the screener.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

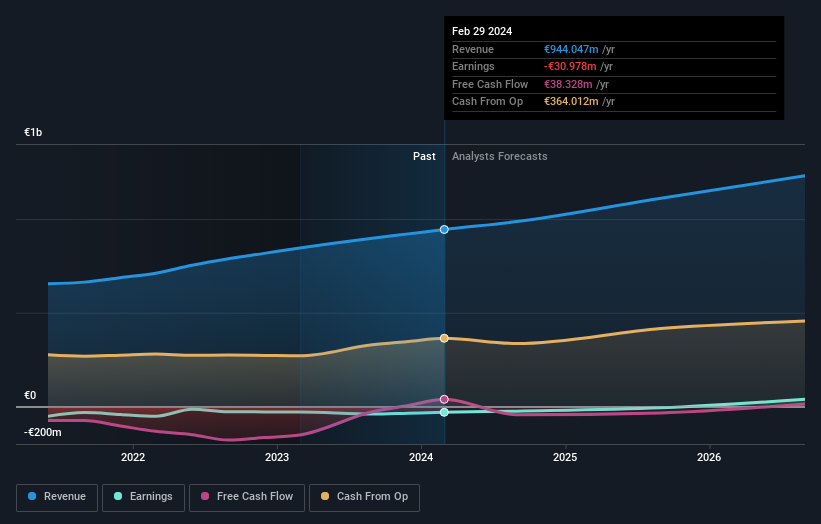

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue is segmented into €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

Insider Ownership: 13.1%

Exclusive Networks, a French cybersecurity firm, is experiencing significant growth with earnings forecasted to rise 33.5% annually, outpacing the French market. Despite a decline in profit margins from 5.5% to 2.7%, the company trades at a value below its estimated fair price. Insider ownership remains strong with Permira and founder Olivier Breittmayer holding 66.7%. A proposed acquisition by CD&R and Permira values Exclusive Networks at €2.2 billion, offering shareholders a substantial premium per share.

- Click here to discover the nuances of Exclusive Networks with our detailed analytical future growth report.

- Our valuation report here indicates Exclusive Networks may be overvalued.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France that specializes in developing long-acting injectables across various therapeutic areas, with a market cap of €440.97 million.

Operations: MedinCell generates revenue primarily from its pharmaceuticals segment, amounting to €11.95 million.

Insider Ownership: 15.8%

MedinCell, a French pharmaceutical company, is poised for significant growth with earnings expected to increase by 93.95% annually and revenue projected to grow at 46.2% per year, surpassing market averages. The company trades significantly below its estimated fair value and has secured a strategic collaboration with AbbVie worth up to $1.9 billion in potential milestones. Recent governance changes include the appointment of Christophe Douat as CEO and Philippe Guy as Chairman of the Board.

- Navigate through the intricacies of MedinCell with our comprehensive analyst estimates report here.

- The analysis detailed in our MedinCell valuation report hints at an deflated share price compared to its estimated value.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

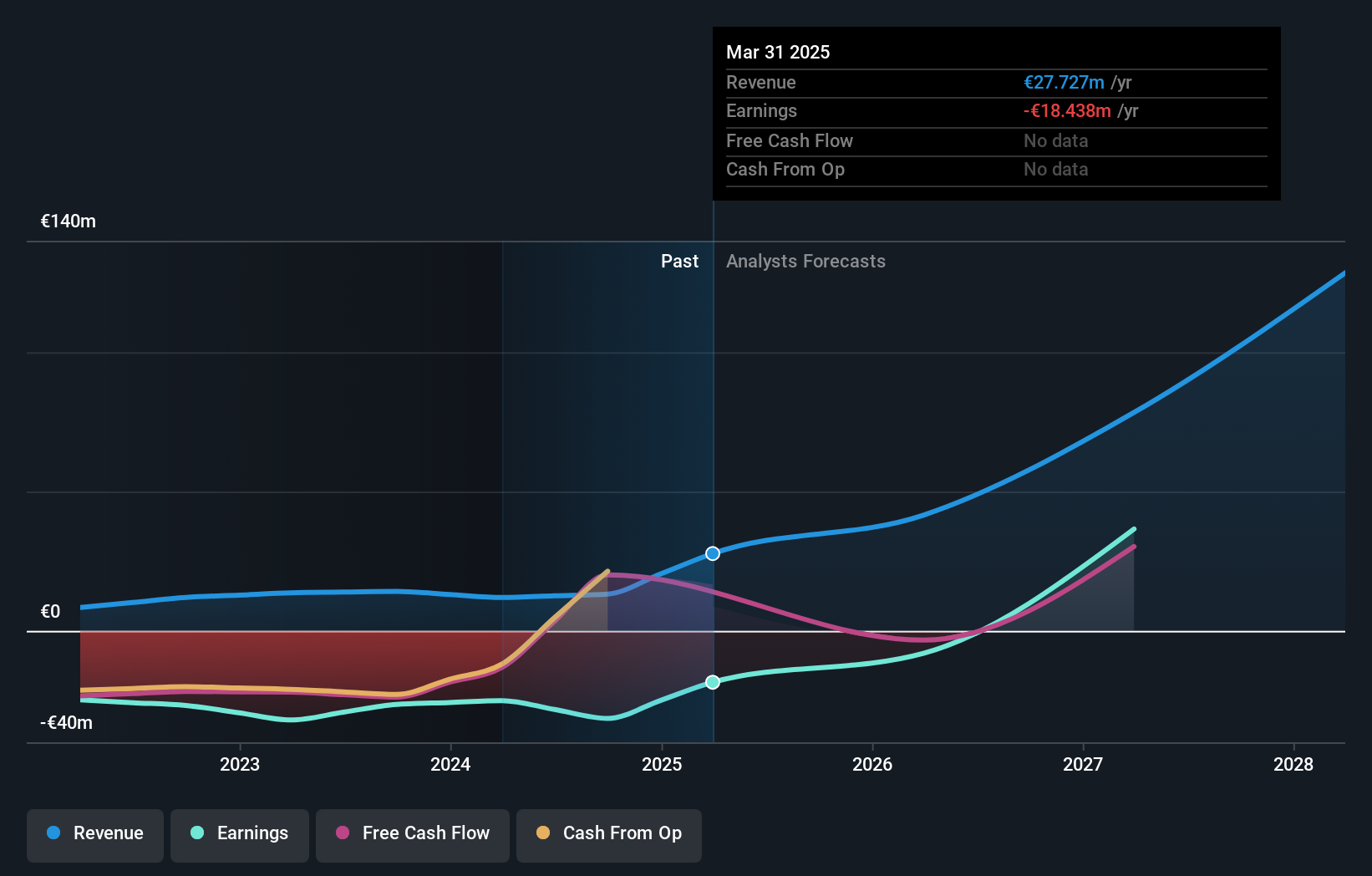

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market cap of approximately €1.25 billion.

Operations: The company's revenue segments include Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million).

Insider Ownership: 10.5%

OVH Groupe, a French cloud services provider, is positioned for growth with earnings expected to rise by 101.12% annually and revenue forecasted to grow at 9.7% per year, outpacing the French market average. The stock trades at a significant discount to its estimated fair value, although it has experienced high share price volatility recently. While profitability is anticipated in three years, the projected Return on Equity remains low at 1.7%.

- Click here and access our complete growth analysis report to understand the dynamics of OVH Groupe.

- Our valuation report here indicates OVH Groupe may be undervalued.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 18 Fast Growing Euronext Paris Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.