Euronext Paris Growth Leaders With High Insider Stakes May 2024

Reviewed by Simply Wall St

As of May 2024, the French market, like many global counterparts, has shown mixed performance with the CAC 40 Index experiencing a modest decline amidst broader European economic uncertainties and fluctuating interest rate expectations. In such a landscape, growth companies with high insider ownership in France may offer unique investment appeal due to aligned interests between company executives and shareholders, potentially fostering resilience and long-term value creation in turbulent times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 24.4% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.6% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

| Munic (ENXTPA:ALMUN) | 29.2% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 68.8% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.2% | 65% |

Let's review some notable picks from our screened stocks.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific, with a market capitalization of approximately €1.47 billion.

Operations: The company generates revenue primarily through two segments: Premium Solutions, which brought in €825.12 million, and Automated Solutions, contributing €55.19 million.

Insider Ownership: 10.9%

Revenue Growth Forecast: 14.0% p.a.

Believe S.A. is navigating a pivotal phase with significant insider interest and acquisition bids, reflecting its potential despite current financial challenges. Recently rejecting Warner Music's €1.79 billion bid, Believe shows a preference for strategic alignment over pure financial gain, aligning with insider-led offers around €1.52 billion. Financially, Believe is on a recovery path with reduced losses and promising revenue growth forecasts of 14% annually, outpacing the French market's 5.7%. However, its forecasted return on equity remains modest at 10.7%.

- Unlock comprehensive insights into our analysis of Believe stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Believe shares in the market.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture industries with a market capitalization of approximately €1.24 billion.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, totaling €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Revenue Growth Forecast: 11.3% p.a.

Lectra SA, a French growth company with high insider ownership, is poised for robust expansion with earnings expected to increase by 28.6% annually, outpacing the French market's 10.9%. Despite a slight dip in net income and EPS as reported in Q1 2024, revenue growth remains strong at 11.3% yearly. However, its projected return on equity of 13.3% suggests moderate future profitability. The stock is currently valued at 20.3% below its estimated fair value, indicating potential undervaluation.

- Click here and access our complete growth analysis report to understand the dynamics of Lectra.

- Our comprehensive valuation report raises the possibility that Lectra is priced lower than what may be justified by its financials.

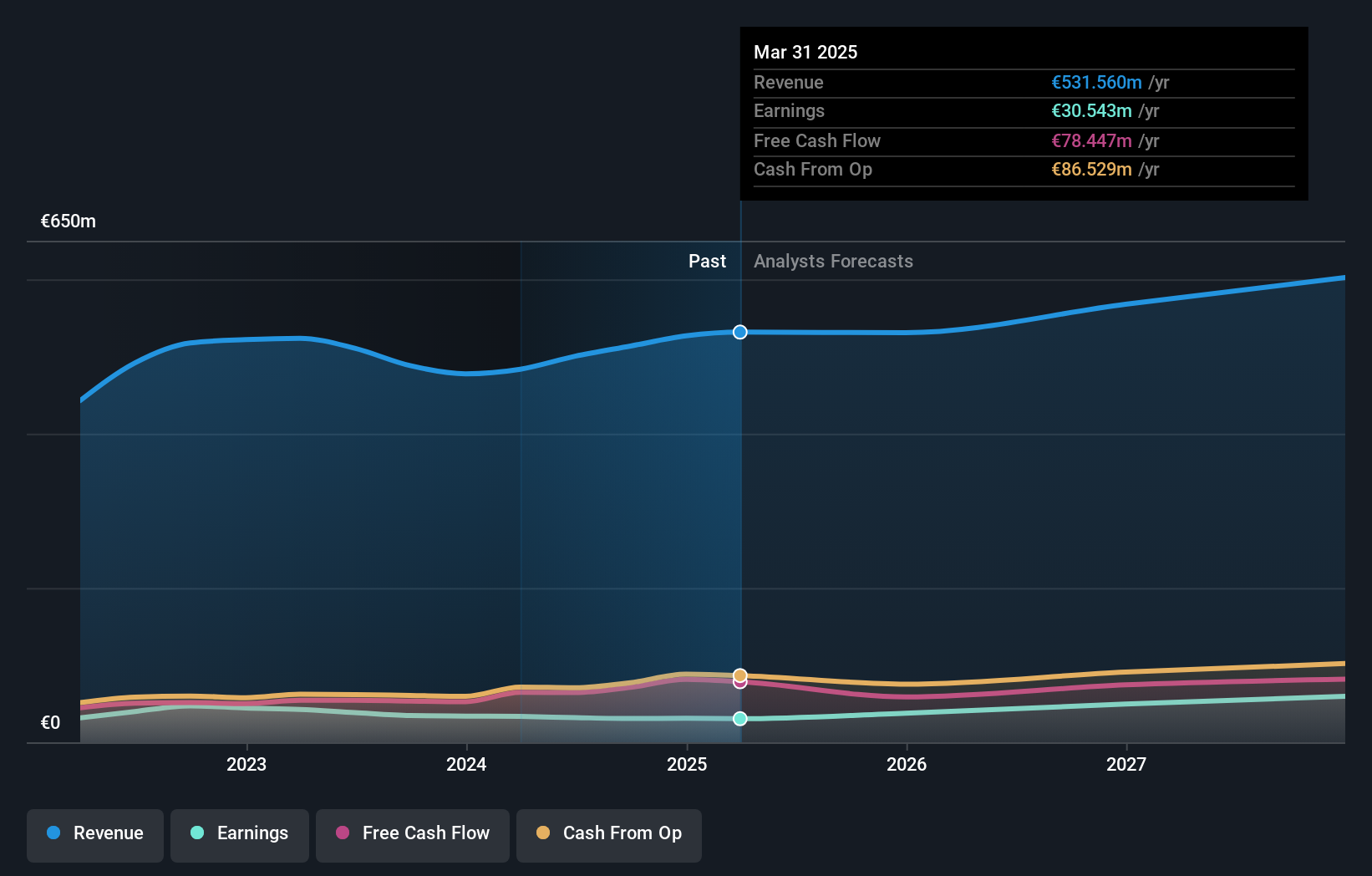

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €442.22 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €14.13 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 40.1% p.a.

MedinCell, a French biotech firm, demonstrates potential in growth with high insider ownership but faces challenges. Recent trials for F14 (mdc-CWM) showed mixed results, failing its primary endpoint but revealing improvements in secondary measures such as knee range of motion and swelling reduction. Collaborations with Teva and AbbVie highlight its innovative BEPO® technology's application across various therapies. Despite recent successes like UZEDY's market launch, MedinCell's stock remains volatile and currently trades below its estimated fair value.

- Click to explore a detailed breakdown of our findings in MedinCell's earnings growth report.

- Our valuation report here indicates MedinCell may be overvalued.

Make It Happen

- Reveal the 21 hidden gems among our Fast Growing Euronext Paris Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade MedinCell, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives