- Italy

- /

- Capital Markets

- /

- BIT:BGN

European Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of recent trade agreements with the U.S. and a steady yet stagnant economic environment, investors are keenly observing potential opportunities in dividend stocks. In such a climate, selecting stocks that offer reliable dividend yields can provide a measure of stability and income amidst broader market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.38% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.32% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.55% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.08% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.17% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.72% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Banca Generali (BIT:BGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Generali S.p.A. is an Italian company that offers financial products and services to high net worth, affluent, and private customers through financial advisors, with a market cap of €5.64 billion.

Operations: Banca Generali S.p.A. generates revenue by distributing a range of financial products and services to high net worth, affluent, and private clients in Italy through its network of financial advisors.

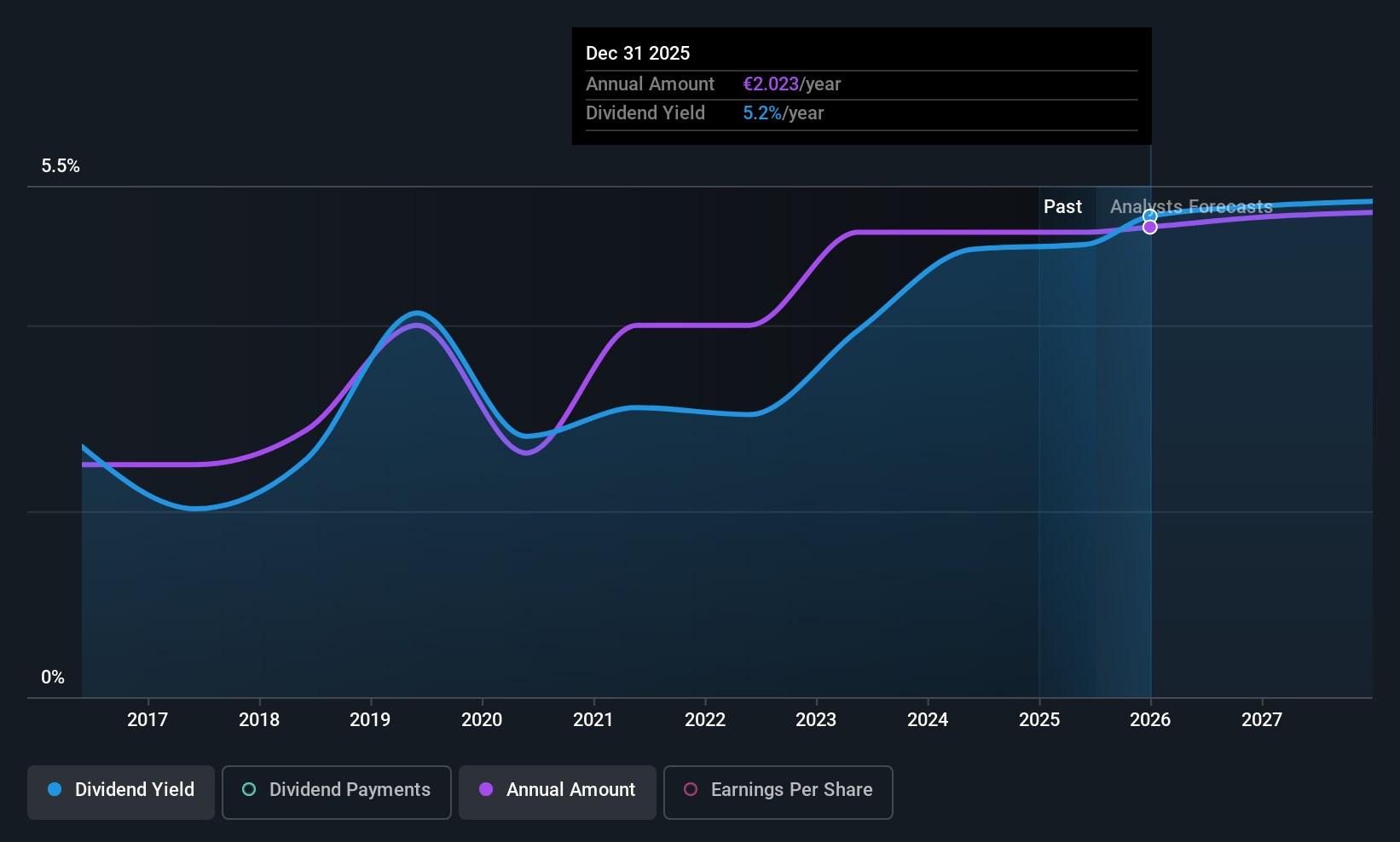

Dividend Yield: 5.7%

Banca Generali's dividend yield of 5.66% is among the top 25% in Italy, supported by a payout ratio of 76.1%, indicating current earnings coverage. Despite past volatility in dividend payments, dividends have grown over the last decade. Recent earnings show a decline, with net income at €89.9 million for Q2 2025 compared to €117.6 million a year ago, suggesting caution for future payouts despite good relative value with a P/E ratio of 14.4x below market average.

- Take a closer look at Banca Generali's potential here in our dividend report.

- Our valuation report here indicates Banca Generali may be undervalued.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA designs, develops, markets, and maintains software solutions focused on security, performance, and management across France, the rest of Europe, and the United States with a market cap of €290.19 million.

Operations: Infotel SA generates its revenue primarily from Services (€281.49 million) and Software (€13.33 million).

Dividend Yield: 4.8%

Infotel's dividend yield of 4.81% falls short of the top quartile in France, and its dividends have been unstable over the past decade. However, with a payout ratio of 74.9%, dividends are covered by earnings, and a cash payout ratio of 44.3% indicates strong cash flow support. The company's recent share buyback program aims to enhance market liquidity and potentially bolster shareholder value amidst trading at a discount to estimated fair value.

- Dive into the specifics of Infotel here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Infotel shares in the market.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG offers car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €543.32 million.

Operations: WashTec AG's revenue is generated from its operations in North America, contributing €82.50 million, and Europe and Other regions, contributing €405.44 million.

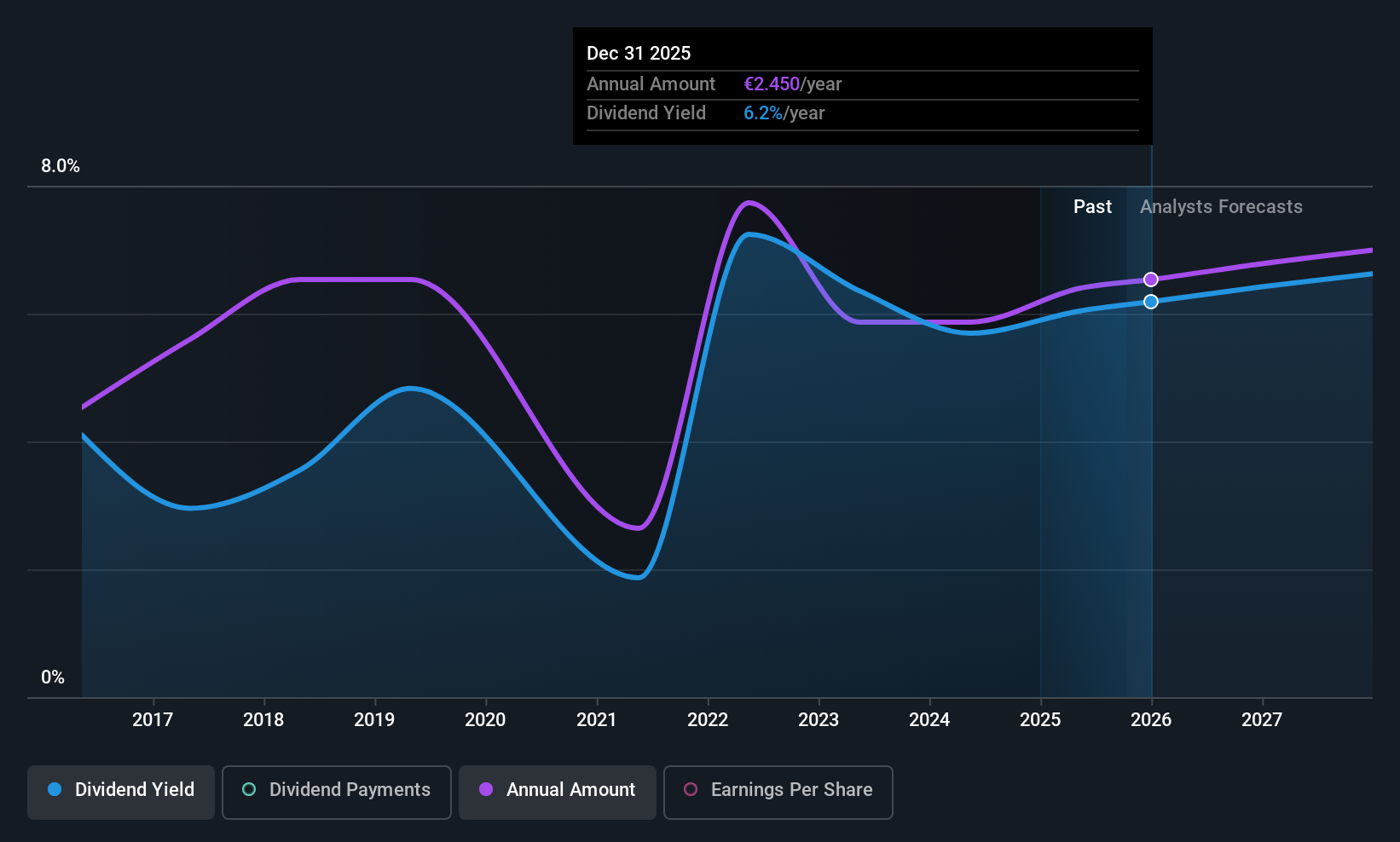

Dividend Yield: 5.9%

WashTec's dividend yield of 5.91% ranks in the top quartile of German dividend payers, yet its dividends have been volatile and not well covered by earnings, with a high payout ratio of 104.1%. The cash payout ratio stands at a more sustainable 66.8%, suggesting adequate cash flow support. Recent developments include a €2.40 per share dividend approval and strategic transformations discussed during an Analyst/Investor Day to improve mid-term outlooks amidst trading below estimated fair value.

- Click here to discover the nuances of WashTec with our detailed analytical dividend report.

- According our valuation report, there's an indication that WashTec's share price might be on the cheaper side.

Summing It All Up

- Click through to start exploring the rest of the 217 Top European Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banca Generali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BGN

Banca Generali

Distributes financial products and services for high net worth, affluent, and private customers through financial advisors in Italy.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives