The Claranova (EPA:CLA) Share Price Is Up 632% And Shareholders Are Delighted

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held Claranova SE (EPA:CLA) shares for the last five years, while they gained 632%. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 10% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 13% in 90 days).

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Claranova

We don't think that Claranova's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Claranova can boast revenue growth at a rate of 30% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 49% per year in that time. It's never too late to start following a top notch stock like Claranova, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

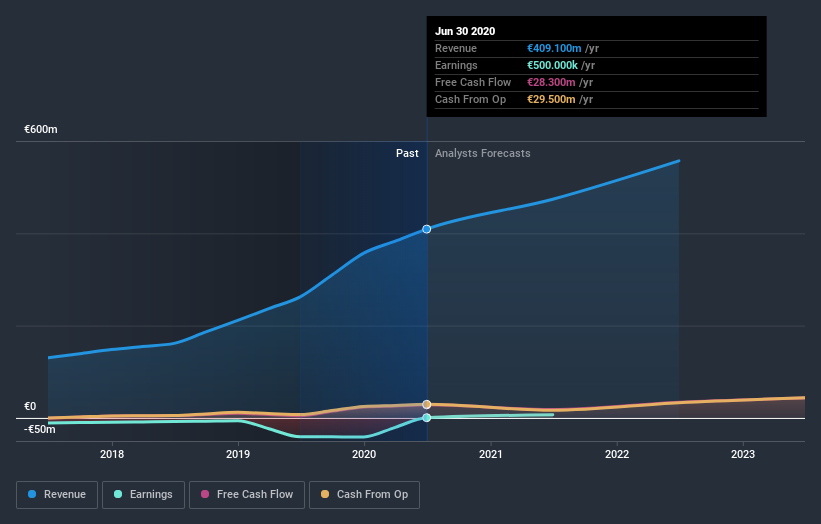

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Claranova has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Claranova in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 1.1% in the twelve months, Claranova shareholders did even worse, losing 12%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 49% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Claranova better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Claranova (of which 1 is potentially serious!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Claranova, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:CLA

Claranova

A technology company, engages in personalized e-commerce, software publishing, and Internet of Things (IoT) management in France, the United States, the United Kingdom, Germany, other European countries, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives