Investors in Claranova (EPA:CLA) from five years ago are still down 81%, even after 11% gain this past week

Claranova SE (EPA:CLA) shareholders should be happy to see the share price up 13% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 81%. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Claranova

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

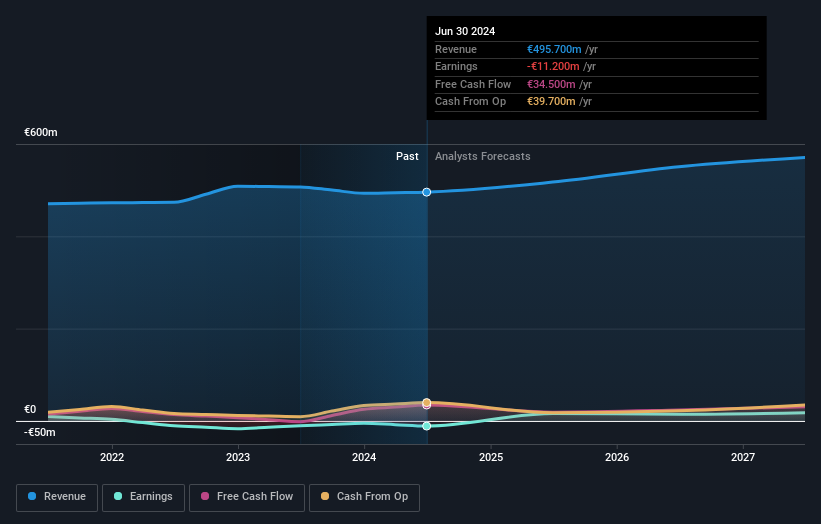

Claranova has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 8.3% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Claranova's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 6.6% in the last year, Claranova shareholders lost 38%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Claranova better, we need to consider many other factors. For example, we've discovered 2 warning signs for Claranova (1 can't be ignored!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CLA

Claranova

A technology company, engages in personalized e-commerce, software publishing, and internet of things (IoT) management in France, the United States, the United Kingdom, Germany, other European countries, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives