These 4 Measures Indicate That Capgemini (EPA:CAP) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Capgemini SE (EPA:CAP) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Capgemini

What Is Capgemini's Net Debt?

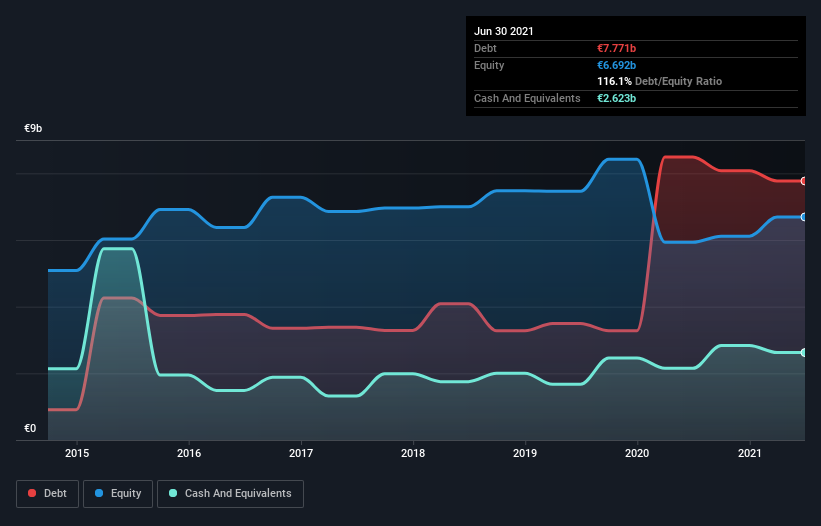

You can click the graphic below for the historical numbers, but it shows that Capgemini had €7.77b of debt in June 2021, down from €8.49b, one year before. On the flip side, it has €2.62b in cash leading to net debt of about €5.15b.

How Strong Is Capgemini's Balance Sheet?

The latest balance sheet data shows that Capgemini had liabilities of €6.51b due within a year, and liabilities of €9.06b falling due after that. Offsetting this, it had €2.62b in cash and €4.37b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €8.58b.

This deficit isn't so bad because Capgemini is worth a massive €31.9b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

We'd say that Capgemini's moderate net debt to EBITDA ratio ( being 2.3), indicates prudence when it comes to debt. And its strong interest cover of 13.6 times, makes us even more comfortable. If Capgemini can keep growing EBIT at last year's rate of 17% over the last year, then it will find its debt load easier to manage. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Capgemini can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Capgemini recorded free cash flow worth a fulsome 100% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Capgemini's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think Capgemini's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Capgemini you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Capgemini or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion