Is Capgemini Set for Recovery After 1.2% Weekly Jump in 2025?

Reviewed by Bailey Pemberton

If you are looking at Capgemini’s recent stock performance and wondering whether to buy, sell, or hold, you are definitely not alone. The company's shares have seen their fair share of ups and downs lately, with a notable 1.2% rise over the last week after a long period of lagging behind the broader market. Over the past year, the stock is down by 30.3%, and it has posted a -20.2% return year-to-date, which may leave some investors feeling cautious. Yet, when you look at the five-year view, Capgemini stock is still up by a respectable 21.8%.

With this backdrop, it is natural to want more clarity about whether the stock is a bargain or a trap, especially given shifting market sentiment and ongoing changes in the broader tech and consulting landscape. Interestingly, when Capgemini is run through a set of six key valuation checks, it scores a strong 5 out of 6, suggesting the market may be overlooking the company’s underlying value. This high value score suggests that risks might already be priced in, or that the business is trading below what its fundamentals truly deserve.

It is worth digging deeper into what this valuation score really means by walking through each major method analysts use to assess whether a stock like Capgemini is undervalued. For an even clearer picture, consider the discussion at the end about a better, more comprehensive way to think about valuation in fast-moving markets.

Why Capgemini is lagging behind its peers

Approach 1: Capgemini Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to today’s value. This method is widely used because it focuses on underlying business performance rather than short-term market swings.

For Capgemini, the latest reported Free Cash Flow (FCF) is €2.16 billion. Analyst consensus covers FCF projections for the next five years, with expectations of steady growth. By 2029, the company’s FCF is estimated to reach €2.39 billion. Projections beyond that, supplied by Simply Wall St, show further increases based on moderate growth rates, keeping the results grounded in realistic expectations.

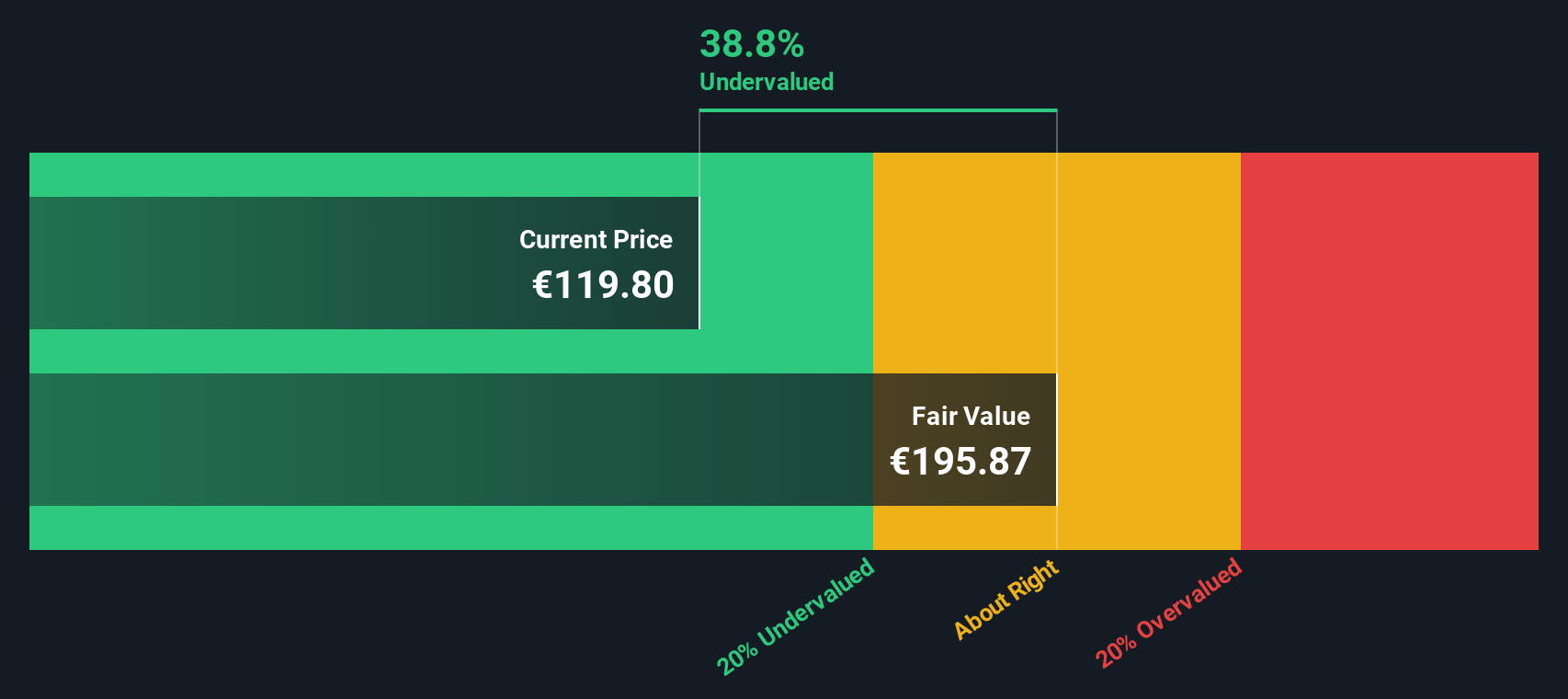

Running these cash flows through a 2 Stage Free Cash Flow to Equity DCF model, Capgemini’s intrinsic value emerges at €188.11 per share. This valuation is 33.5% higher than the current market price, implying the shares are significantly undervalued according to cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Capgemini is undervalued by 33.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Capgemini Price vs Earnings

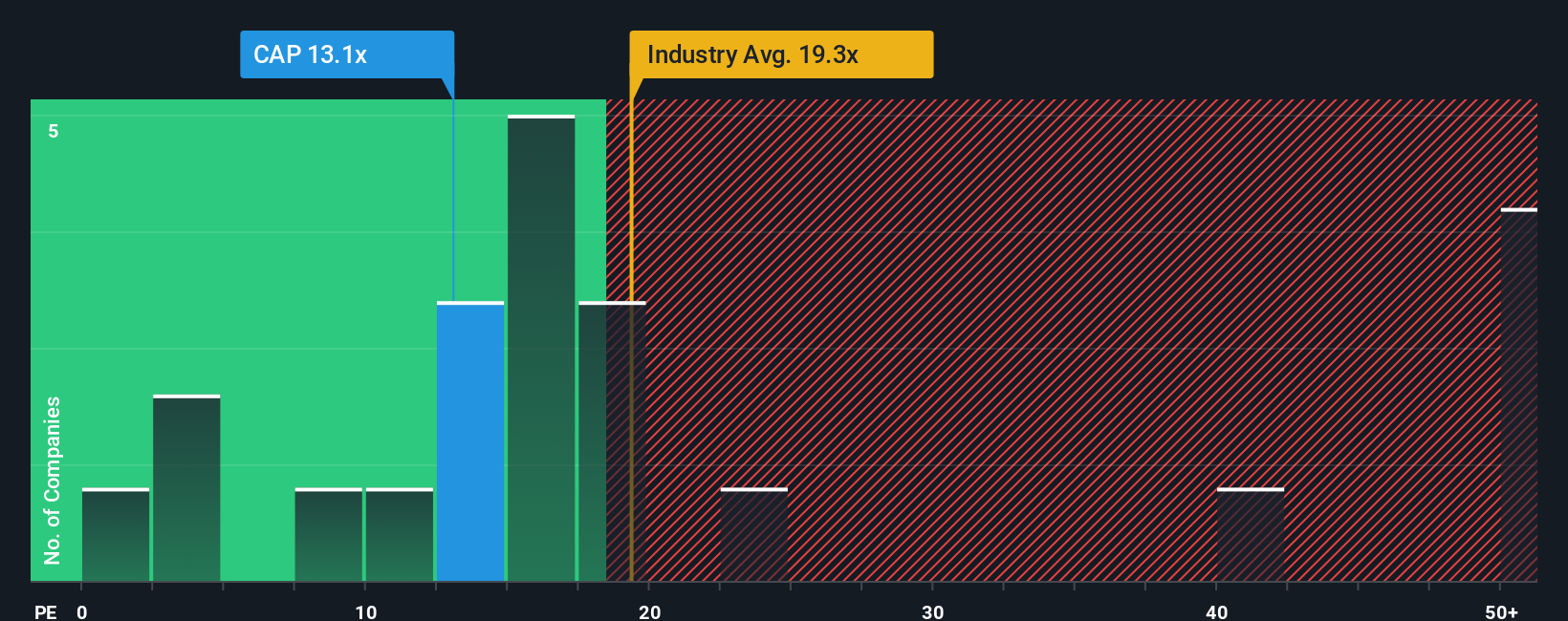

The Price-to-Earnings (PE) ratio is the preferred multiple for valuing profitable companies like Capgemini because it directly relates the market price of the stock to its earnings. This makes it especially useful for established businesses with consistent profit streams, providing a straightforward way to gauge how much investors are willing to pay for each euro of earnings.

Of course, what counts as a “normal” or “fair” PE ratio depends on a company’s future growth expectations and risk profile. Typically, faster-growing or lower-risk companies can justify higher PE ratios, while slow-growing or riskier firms warrant lower ones. Context is key, so comparing a company’s PE ratio on its own only tells part of the story.

Currently, Capgemini trades at a PE ratio of 13.6x. This is noticeably lower than the IT industry average of 21.8x and also below the peer group average of 11.4x. However, Simply Wall St introduces a more nuanced measure called the “Fair Ratio”, which considers not just earnings and industry averages but also growth prospects, profitability, market cap, and company-specific risks. For Capgemini, the Fair Ratio is 25.9x. This is well above the company’s current multiple and suggests that the market is not fully recognizing Capgemini's potential based on these broader factors.

Compared to both the industry and its Fair Ratio, Capgemini appears substantially undervalued by the market right now. Using the Fair Ratio gives a more complete perspective than peer or industry averages alone, since it factors in everything that affects the company’s valuation outlook, not just raw multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capgemini Narrative

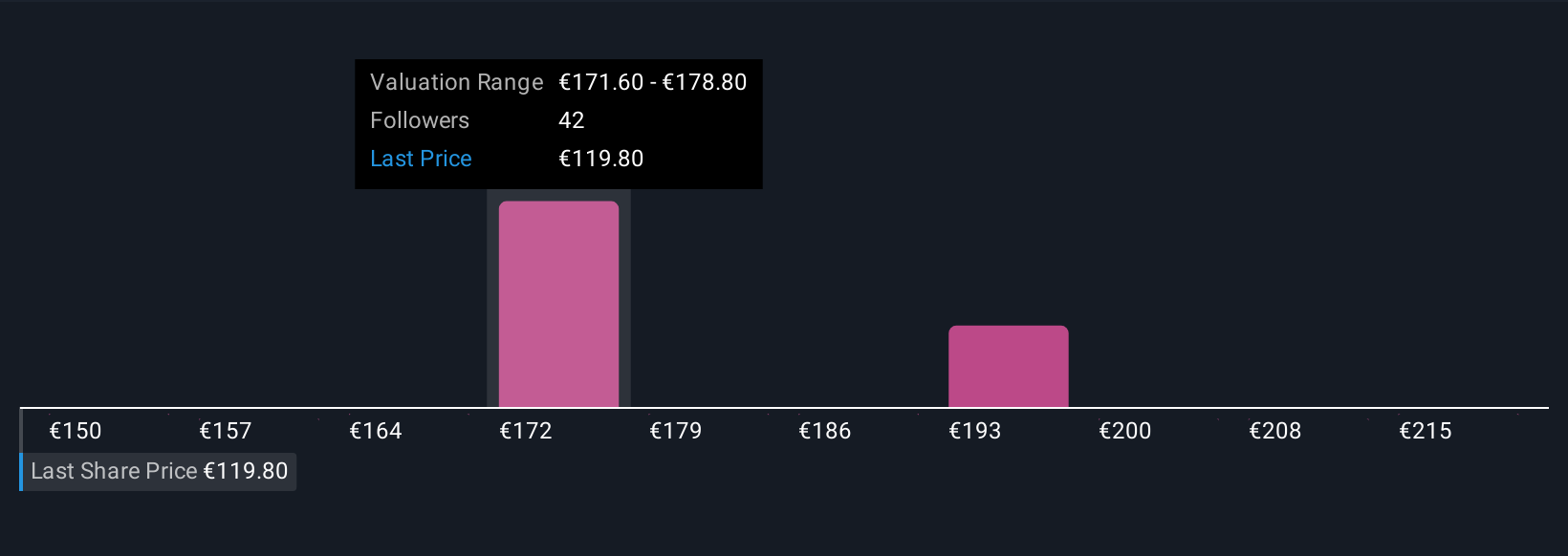

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal investment story. It includes the ideas and assumptions you believe about a company’s future, including the numbers you expect for revenue, earnings, and margins, as well as what you think its shares should be worth.

With Narratives, you connect your view of Capgemini’s business outlook to a concrete financial forecast and see how that translates into a fair value. This makes your investment rationale clear and actionable. Narratives are available on Simply Wall St’s Community page, where millions of investors build and share perspectives easily. No expertise is required.

Narratives give you instant visual feedback on whether Capgemini’s current price is above or below your estimated fair value, helping you decide when to buy, hold, or sell. Because these stories are dynamic, if important news drops or earnings surprise, your Narrative and its fair value will update automatically to reflect the latest information.

For example, some investors see Capgemini’s leadership in AI, cloud, and digital transformation driving strong future growth and set price targets as high as €214.0 per share. Others worry about competition and macro risks, with more cautious targets down at €134.0. Your Narrative helps you choose which perspective fits you best.

Do you think there's more to the story for Capgemini? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives