- France

- /

- Food and Staples Retail

- /

- ENXTPA:CA

Exploring Dividend Opportunities With Aubay Société Anonyme And Two Other Euronext Paris Stocks

Reviewed by Simply Wall St

As European markets navigate a challenging landscape with the CAC 40 Index experiencing a 2.46% decline amid broader regional tensions, investors are increasingly attentive to stable income opportunities. In this context, dividend stocks like Aubay Société Anonyme offer a potential avenue for steady returns amidst market volatility. A good dividend stock typically combines reliable payouts with strong business fundamentals, which can be particularly appealing in uncertain economic times as noted in current market conditions.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Rubis (ENXTPA:RUI) | 6.96% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

| SCOR (ENXTPA:SCR) | 8.73% | ★★★★★☆ |

| Carrefour (ENXTPA:CA) | 5.99% | ★★★★★☆ |

| Teleperformance (ENXTPA:TEP) | 3.72% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.18% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.03% | ★★★★★☆ |

| Sanofi (ENXTPA:SAN) | 4.02% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.38% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.47% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Aubay Société Anonyme (ENXTPA:AUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aubay Société Anonyme operates in providing application services across multiple European countries including Belgium, Luxembourg, Spain, Portugal, Italy, France, and the United Kingdom, with a market capitalization of approximately €485.13 million.

Operations: Aubay Société Anonyme generates its revenue from various segments, with notable contributions from Banking/Finance (€205.60 million), Insurance and Social Protection (€107.50 million), Telecoms, Media & Gaming (€77.70 million), Services/Utilities/Health (€70.10 million), Industry/Transportation (€29.60 million), Administration (€31.40 million), and Commerce & Distribution (€12.20 million).

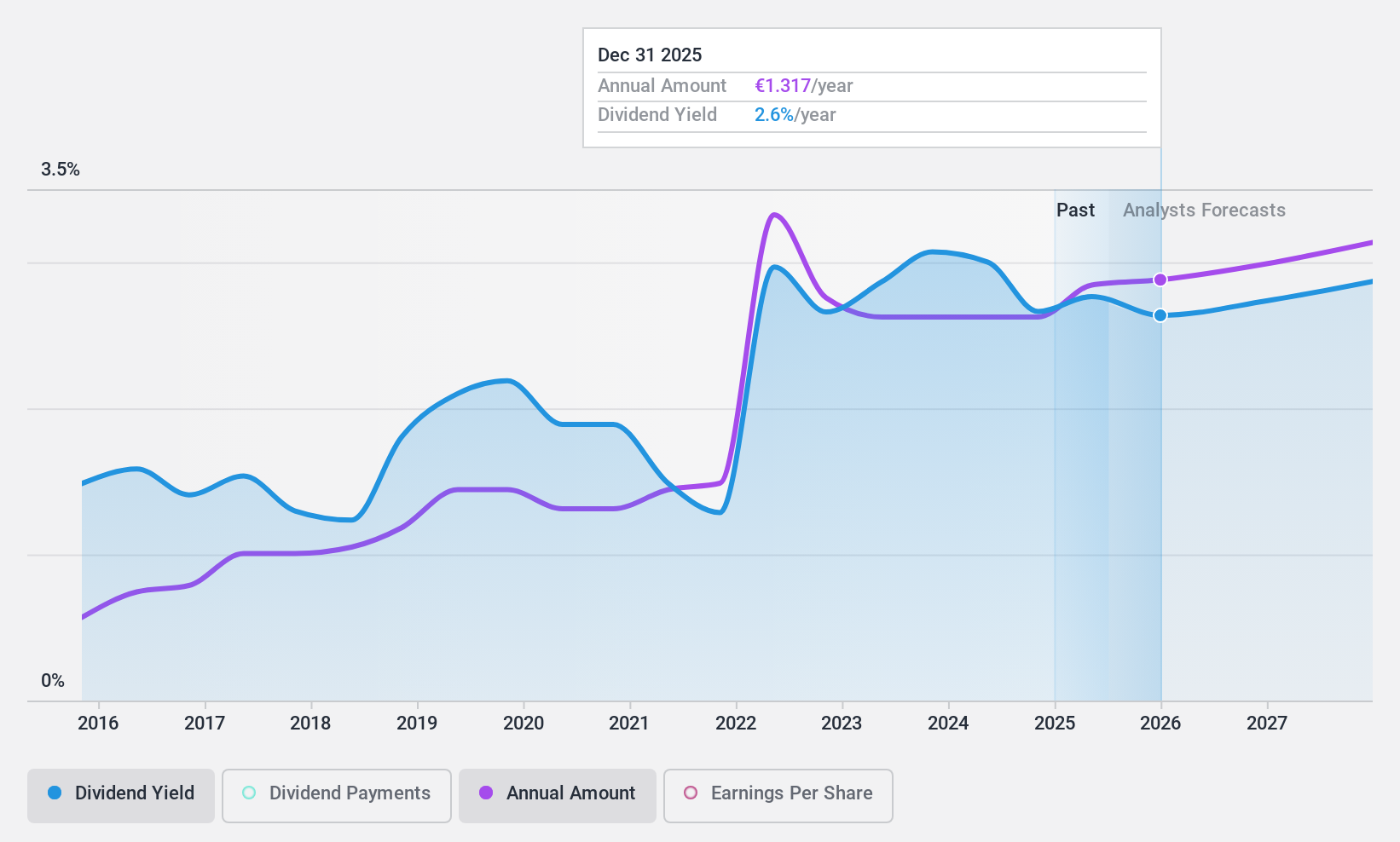

Dividend Yield: 3.2%

Aubay Société Anonyme's dividend yield at 3.23% is modest compared to other high-yield stocks in France, reflecting a cautious approach amidst its unstable dividend history over the last decade. Despite this, both earnings and cash flows substantiate its current payouts with payout ratios of 46.9% and 39.5%, respectively, ensuring dividends are well-supported financially. Recent strategic moves include a share repurchase program initiated on May 21, 2024, enhancing shareholder value by potentially reducing share supply and supporting per-share metrics.

- Unlock comprehensive insights into our analysis of Aubay Société Anonyme stock in this dividend report.

- The analysis detailed in our Aubay Société Anonyme valuation report hints at an deflated share price compared to its estimated value.

Carrefour (ENXTPA:CA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse range of food and non-food retail stores across multiple formats and channels in Europe, Latin America, the Middle East, Africa, and Asia, with a market capitalization of approximately €9.84 billion.

Operations: Carrefour SA generates €39.02 billion in revenue from France, €24.27 billion from Europe (excluding France), and €22.54 billion from Latin America.

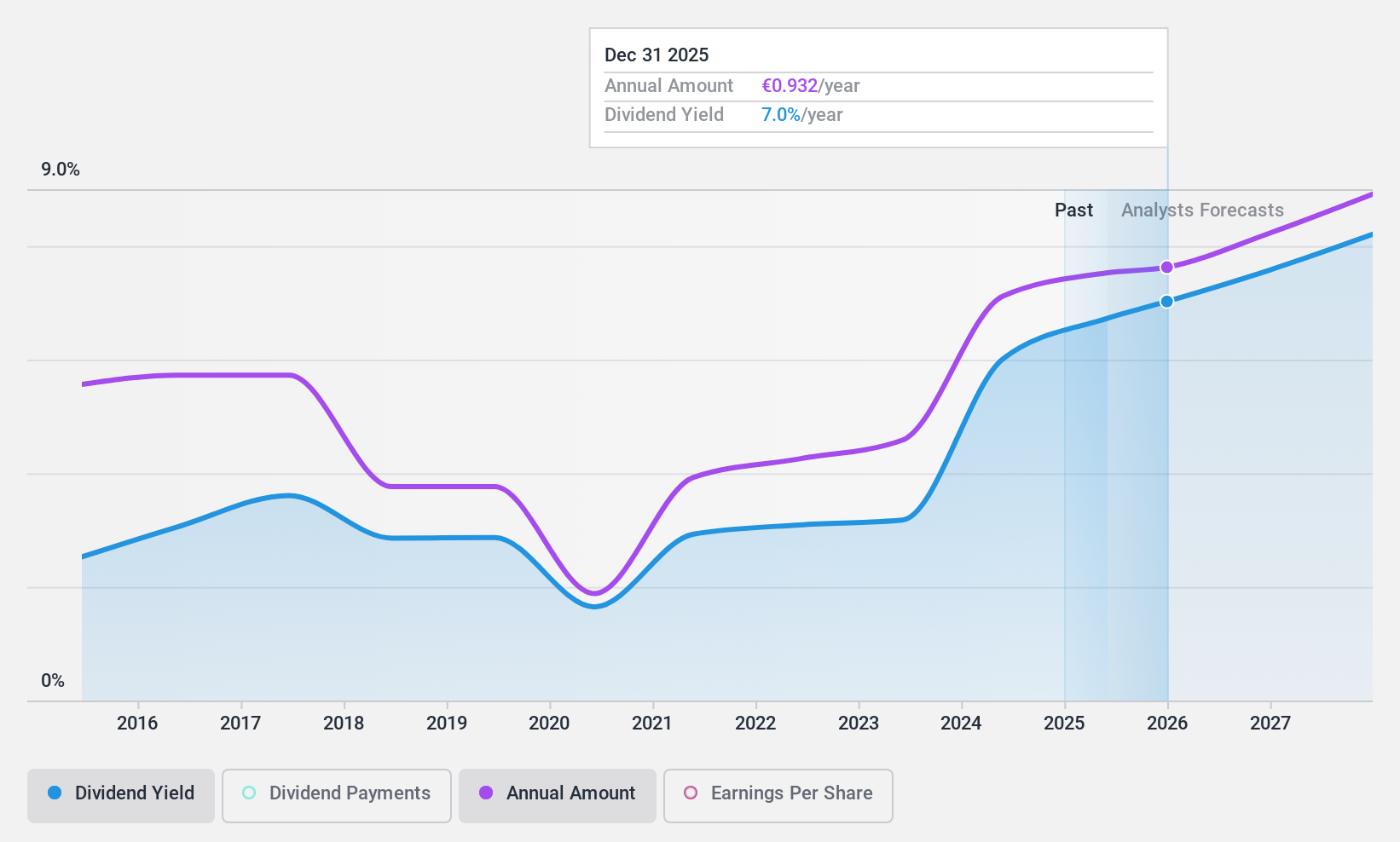

Dividend Yield: 6%

Carrefour SA's recent earnings show a significant increase in net income to €867 million from €25 million year-over-year, with sales slightly up at €40.74 billion. Despite this, the company's dividend track record remains unstable with volatile payments over the past decade. Dividends are covered by both earnings and cash flows, with payout ratios of 66.8% and 21.1% respectively, suggesting financial capability to sustain dividends despite past inconsistencies. However, profit margins have decreased from last year, indicating potential pressure on future profitability and dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Carrefour.

- Our valuation report unveils the possibility Carrefour's shares may be trading at a discount.

Colas (ENXTPA:RE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA is a global company specializing in the construction and maintenance of transport infrastructure, with a market capitalization of approximately €5.71 billion.

Operations: Colas SA generates revenue primarily through its diverse geographical operations, including €5.97 billion from Roads France-Overseas France/IO, €3.36 billion from Roads EMEA (Europe-Middle East-Africa), €2.38 billion from Canada Routes, €2.24 billion from Roads United States, and €1.38 billion from Railways and Other Activities.

Dividend Yield: 4.2%

Colas has experienced a 22.8% earnings growth over the past year, yet its dividend performance presents challenges. With a dividend yield of 4.2%, it falls below the top quartile of French dividend payers at 5.35%. Despite a high payout ratio of 81.3%, dividends are sufficiently covered by both earnings and cash flows, with respective payout ratios of 81.3% and 58.9%. However, dividends have been historically volatile and unreliable, reflecting an unstable track record over the past decade.

- Click to explore a detailed breakdown of our findings in Colas' dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Colas shares in the market.

Seize The Opportunity

- Dive into all 36 of the Top Euronext Paris Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CA

Carrefour

Engages in the operation of stores that offer food and non-food products in various formats and channels in France, Spain, Italy, Belgium, Poland, Romania, Brazil, and Argentina, as well as in the Middle East, Africa, and Asia.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives