Evaluating Atos (ENXTPA:ATO): Is the Recent Share Price Move Justified by Fundamentals?

Reviewed by Simply Wall St

If you’ve been watching Atos (ENXTPA:ATO) lately, you might have noticed the recent uptick in its share price over the past month. While there hasn’t been a single major event making headlines for Atos, the recent movement could raise eyebrows among investors who wonder whether this shift signals new momentum or just noise. Sometimes, when a stock starts to stir without a clear catalyst, it’s a cue to pause and look closer at underlying drivers.

Looking at the bigger picture, Atos has been on a roller coaster. The stock has bounced back 32% in the past month, with a run up of 24% over the past 3 months, but when you zoom out to the past year, it’s still down 6%. And over the longer haul, multi-year returns remain deeply negative. So, while recent gains suggest shifting market sentiment, it comes against headwinds that have weighed on Atos for some time.

With these swings in mind, is Atos trading at a compelling value after its recent run, or is the market already anticipating a turnaround that is yet to materialize?

Most Popular Narrative: 51.7% Overvalued

According to the most widely followed narrative, Atos is trading well above what its future fundamentals might justify. The current price reflects a significant premium to the estimated fair value.

Ongoing restructuring, significant country exits, and pending divestitures are required to restore profitability. However, these changes also create business disruption and uncertainty. This operational upheaval could impact customer retention, slow pipeline conversion, and further pressure short-to-medium term earnings.

Are these warning signs hiding a deeper story about Atos’s financial future? The market’s bold bet on a turnaround comes with ambitious projections driving this valuation. Which assumptions lie at the heart of such a high price target? Only a closer look at the numbers will reveal whether the optimism is justified or if investors are reaching too far.

Result: Fair Value of €30.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Atos’s recent order wins are sustained and its restructuring continues ahead of schedule, earnings could stabilize sooner than bearish forecasts suggest.

Find out about the key risks to this Atos narrative.Another View: Discounted Cash Flow Model Points in a Different Direction

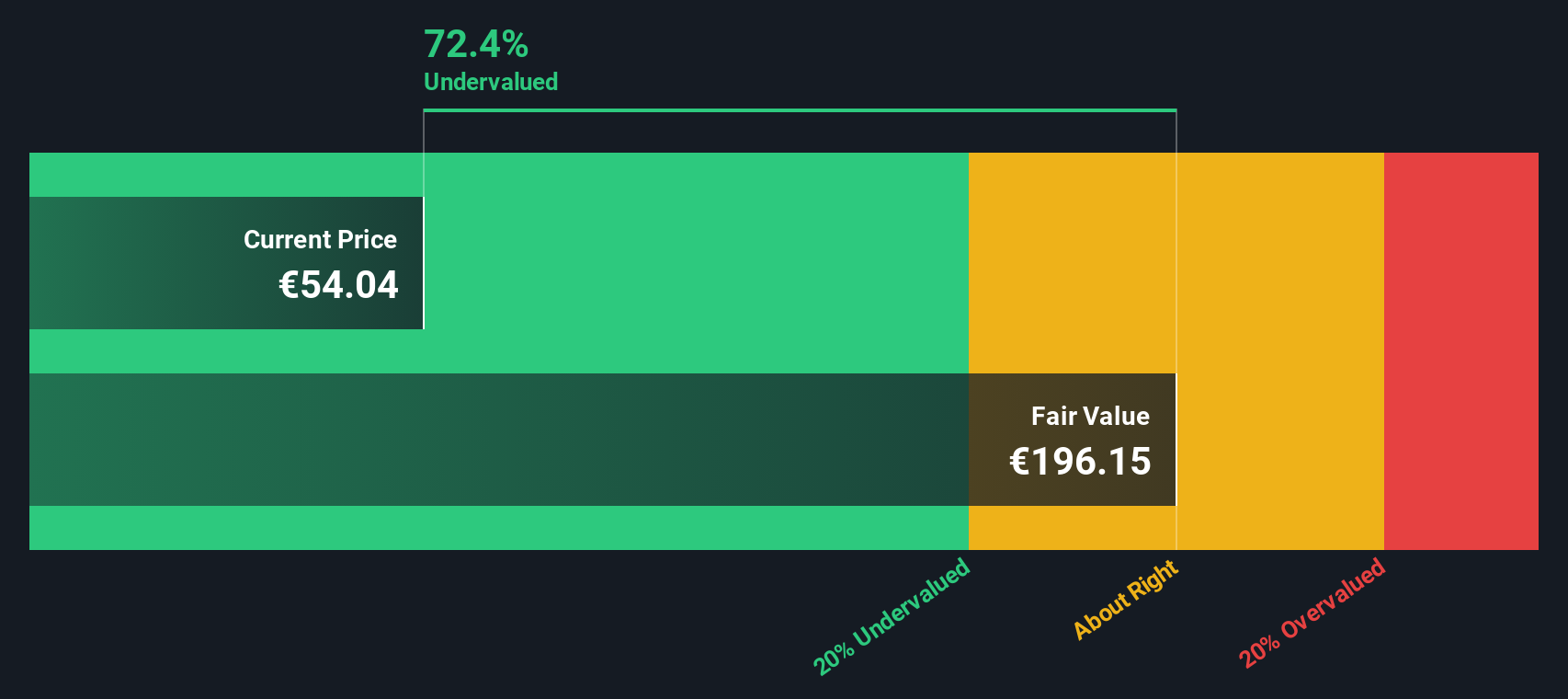

While analyst targets appear pessimistic, our SWS DCF model tells a strikingly different story. This analysis suggests Atos could be deeply undervalued. Can two respected valuation methods arrive at such opposite conclusions, or is the truth somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atos Narrative

If you see things differently or would rather follow your own research trail, you can easily build your personal narrative in just a few minutes with Do it your way.

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investment horizons and stay ahead of the crowd by checking out stocks fitting these powerful trends. There is opportunity waiting for you if you know where to look.

- Spot high-potential bargains by scanning undervalued stocks based on cash flows poised to benefit from market mispricings and future growth catalysts.

- Capitalize on market shifts in healthcare innovation by exploring healthcare AI stocks making waves in AI-driven patient care and next-generation treatments.

- Catch the next wave of digital disruption with cryptocurrency and blockchain stocks, connecting you to pioneers in blockchain technology and the future of finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives