Atos (ENXTPA:ATO) Sees 34% Stock Price Increase Over Last Quarter

Reviewed by Simply Wall St

Atos (ENXTPA:ATO) recently appointed Olivier Jacmart as Head of Technology Services for the BNN region, a move that may underscore its efforts in digital transformation and cybersecurity, contributing to a substantial 34% stock price increase over the last quarter. This sharp rise contrasts with the broader market's 5% increase over the past week. Other events, such as the appointment of Pierre-Yves Jolivet and advancements in AI and strategic partnerships, likely supported Atos's robust performance, indicating a comprehensive corporate approach to innovation and leadership realignment amid recovering financials.

We've spotted 5 weaknesses for Atos you should be aware of, and 4 of them are significant.

Atos's recent leadership appointments, particularly Olivier Jacmart as Head of Technology Services, signal a renewed focus on digital transformation and cybersecurity, potentially impacting its narrative of financial instability amid operational challenges. While the stock has surged 34% over the last quarter, it is essential to recognize that Atos experienced a total return, including share price and dividends, of 76.59% decline over the past year. This longer-term decline reflects underlying challenges despite recent positive developments.

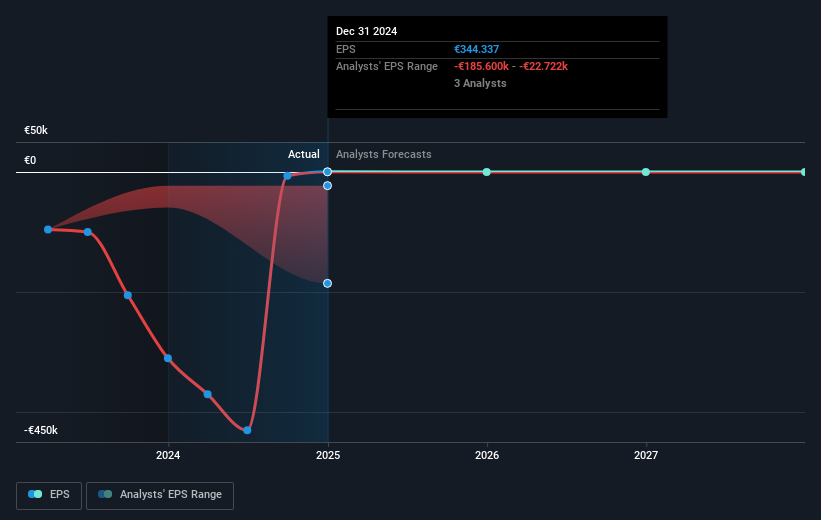

Over the past year, Atos underperformed against its peers, trailing the broader French market that saw a modest 5% decline over the same period. While the new leadership could provide a catalyst for change, analysts forecast continued revenue and earnings pressures. They expect revenue to shrink around 3.4% annually over the next three years while projecting ongoing unprofitability. The recent stock rally brings it closer to the analyst consensus price target of €27.0, though still below the current trading price by approximately 25.6%.

Review our growth performance report to gain insights into Atos' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives