Atos (ENXTPA:ATO): Assessing Valuation Following Strategic Qevlar AI Cybersecurity Collaboration

Reviewed by Kshitija Bhandaru

Atos (ENXTPA:ATO) shares are drawing attention after the company announced a strategic partnership with Qevlar AI. This move brings new AI-driven automation to its cybersecurity operations, particularly for regulated clients.

See our latest analysis for Atos.

Atos’ collaboration with Qevlar AI comes on the heels of a period of dramatic share price swings. After a remarkable rebound, reflected in a 112.5% share price return year to date and a 92.5% gain in the past three months, momentum has recently faded as investors digested news and shifting market sentiment. Over the past year, however, total shareholder return still sits at just 6.9%, and multi-year returns remain sharply negative. This highlights lingering uncertainty despite short-term gains.

If this kind of bold strategic move got your attention, it could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock’s fundamentals still under pressure, but new AI initiatives gaining traction, investors have to ask if recent optimism and the share recovery are justified by untapped value or if the potential is already reflected in the price.

Most Popular Narrative: 43% Overvalued

Atos' widely followed narrative suggests a fair value of €37.15, well below the last close at €53.13. The disconnect highlights debate over whether the recent rally has outpaced what analysts believe is justified by fundamentals.

Ongoing restructuring, significant country exits, and pending divestitures are required to restore profitability but also create business disruption and uncertainty. This operational upheaval could impact customer retention, slow pipeline conversion, and further pressure short-to-medium term earnings.

Want to know what’s really driving this striking valuation gap? The narrative is built on bold changes in revenue stability, future margins, and share numbers, plus a forecast profit transformation that will surprise most investors. Find out what mix of future events and key assumptions the consensus says must happen for the numbers to add up.

Result: Fair Value of €37.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if customer confidence returns and restructuring progresses more quickly, these factors could challenge the bearish outlook, especially if they result in stronger earnings sooner than expected.

Find out about the key risks to this Atos narrative.

Another View: Are Multiples Telling a Different Story?

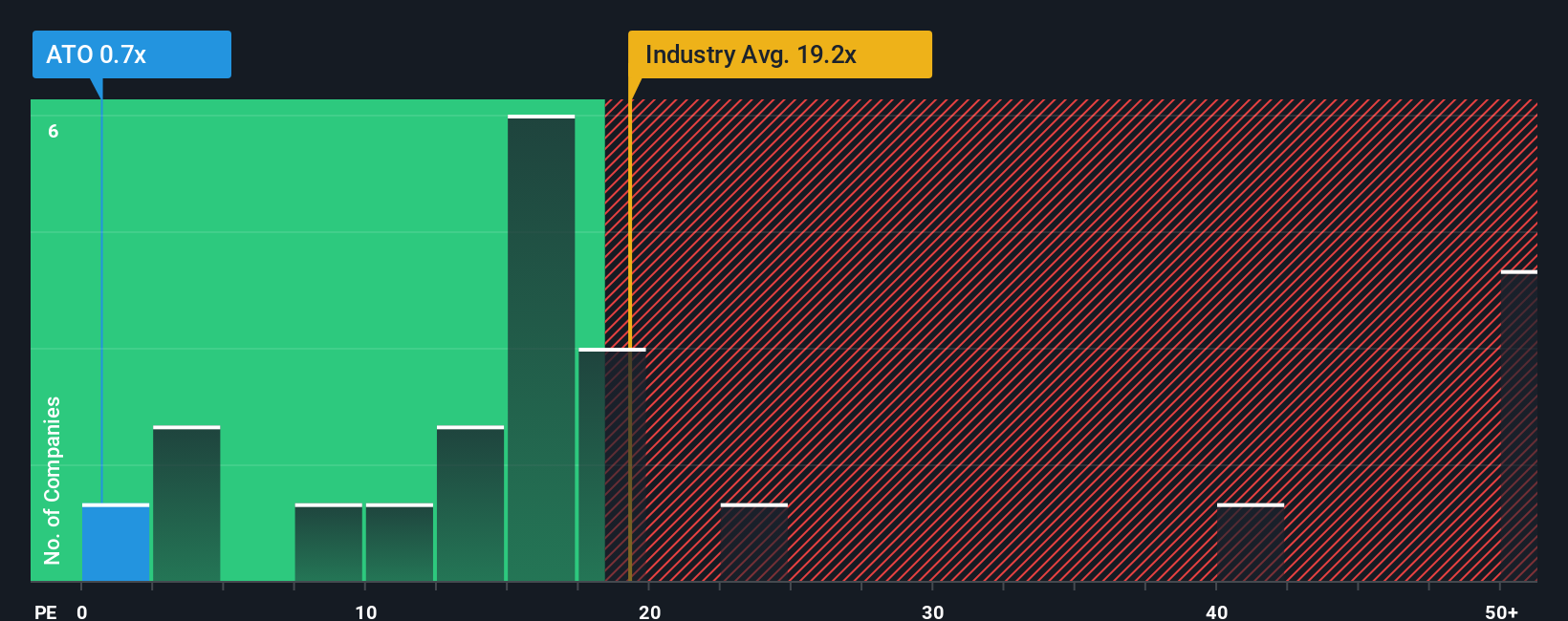

While the consensus narrative points to Atos' shares being overvalued, the market’s key valuation yardstick paints a different picture. Atos trades at a price-to-earnings ratio of just 0.7x, dramatically lower than both its peer group average of 16.9x and the broader European IT sector at 19.1x. Even compared with the fair ratio of 4.9x, Atos appears significantly discounted. This mismatch raises big questions. Does the market see risks others are missing, or is there untapped value that could surprise investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atos Narrative

If you have a different view or want to dig into the numbers on your own terms, you can easily shape your own Atos story in just a few minutes, so why not Do it your way

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your portfolio and seize fresh opportunities by tapping into these standout stock groups. Miss them and you might miss tomorrow’s top performers.

- Uncover undervalued opportunities others might overlook with these 888 undervalued stocks based on cash flows and position yourself ahead of the crowd.

- Target generous returns by checking out these 18 dividend stocks with yields > 3% featuring companies offering strong yields over 3%.

- Ride the innovation wave with these 25 AI penny stocks with businesses at the forefront of artificial intelligence growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives