A Fresh Look at Atos (ENXTPA:ATO) Valuation After Its Major EU Cybersecurity Win

Reviewed by Kshitija Bhandaru

Atos (ENXTPA:ATO) has been awarded a major cybersecurity contract by the European Commission, which tasks the company with delivering essential protection services to EU institutions. This move underscores Atos’s leadership in European cybersecurity.

See our latest analysis for Atos.

Atos has seen a modest but steady climb in its share price lately. This growth has been driven by momentum from high-profile wins like the European Commission contract and its recent addition to the S&P Global BMI Index. Over the past year, its total shareholder return has hovered just above breakeven. This suggests the market is waiting to see whether these developments translate into longer-term value and growth.

If recent headline deals spark your curiosity, it could be worthwhile to broaden your outlook and discover fast growing stocks with high insider ownership

With shares making a tentative rebound and a major contract in hand, the question now is whether Atos is trading at a discount given its prospects or if recent successes are fully reflected in the current price.

Most Popular Narrative: 102% Overvalued

The most widely followed narrative sees Atos’s fair value at less than half its current market price, reflecting tough headwinds despite recent momentum. This perspective centers on the transformative impact of technology shifts and internal restructuring.

Despite management's optimism, Atos continues to face significant headwinds from increasing automation and adoption of AI, which is structurally reducing demand for its traditional IT outsourcing and managed services. This ongoing shift is likely to pressure both revenues and margins as clients transition toward more modern, self-service, and cloud-native solutions.

Curious which future assumptions drive this sharp discount? There's a bold forecast behind these numbers. Hint: think declining profits, slow sales, and a valuation multiple rarely seen in IT. Ready to see the full financial vision shaping Atos’s fair value? Unlock all the numbers and logic inside the complete narrative.

Result: Fair Value of €30.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if revenue stabilizes and restructuring accelerates, margin improvements and renewed customer confidence could quickly challenge this bearish outlook.

Find out about the key risks to this Atos narrative.

Another View: Multiples Suggest Value

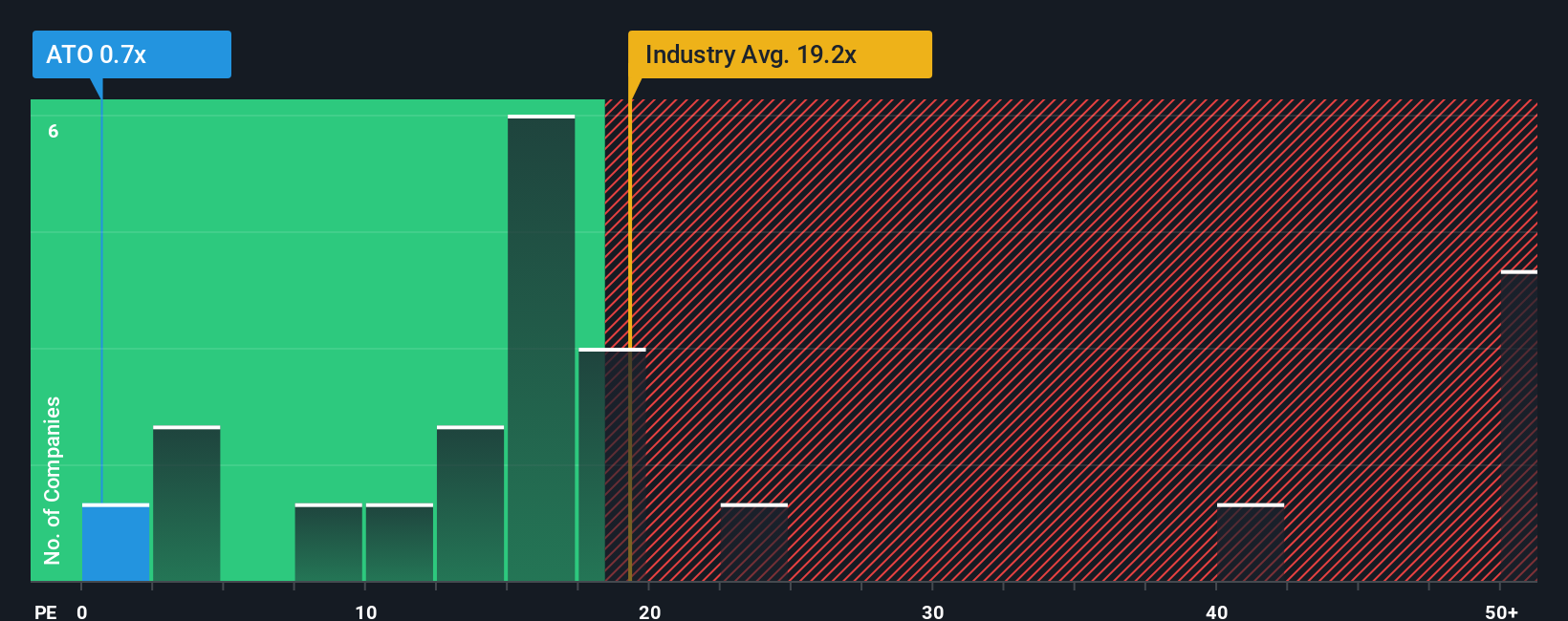

Looking at traditional price-to-earnings ratios paints a very different picture. Atos trades at just 0.8x earnings, well below the European IT industry average of 19.1x, its peer average of 17.3x, and even our estimated fair ratio of 5.1x. Such a big gap might flag an overlooked opportunity or hint at deeper risks beneath the surface. Which side of the coin will flip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atos Narrative

If you have your own take on Atos or believe the numbers tell a different story, try building your own view using the same data, and see how your outlook stacks up. Do it your way

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment playbook and don’t let high-potential opportunities slip away. Use the Simply Wall Street Screener to spot stocks the crowd might be missing.

- Capture higher yields and steady income by searching through these 19 dividend stocks with yields > 3% with robust payouts that consistently beat the market’s average.

- Spot tomorrow’s biggest disruptors by browsing these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs across industries.

- Harness the growth potential of blockchain innovation by reviewing these 78 cryptocurrency and blockchain stocks leading advances in digital finance, secure payments, and next-generation record keeping.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives