3 European Penny Stocks With Market Caps Under €60M To Consider

Reviewed by Simply Wall St

As the European markets experience mixed returns, with some indices showing modest gains amid hopes for interest rate cuts, investors are increasingly exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, remain a relevant and intriguing area for those seeking growth potential at lower price points. By focusing on firms with strong financials and clear growth prospects, investors can uncover promising opportunities in this often overlooked segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.74 | €84.18M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.04 | €15.45M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €223.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €63.63M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.305 | €380.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.929 | €74.97M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.23 | €308.23M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.822 | €27.53M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Netgem (ENXTPA:ALNTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netgem SA develops, operates, and distributes the NetgemTV digital video entertainment platform in France and Europe with a market cap of €27.53 million.

Operations: The company generates revenue from its Internet Telephone segment, which amounts to €32.45 million.

Market Cap: €27.53M

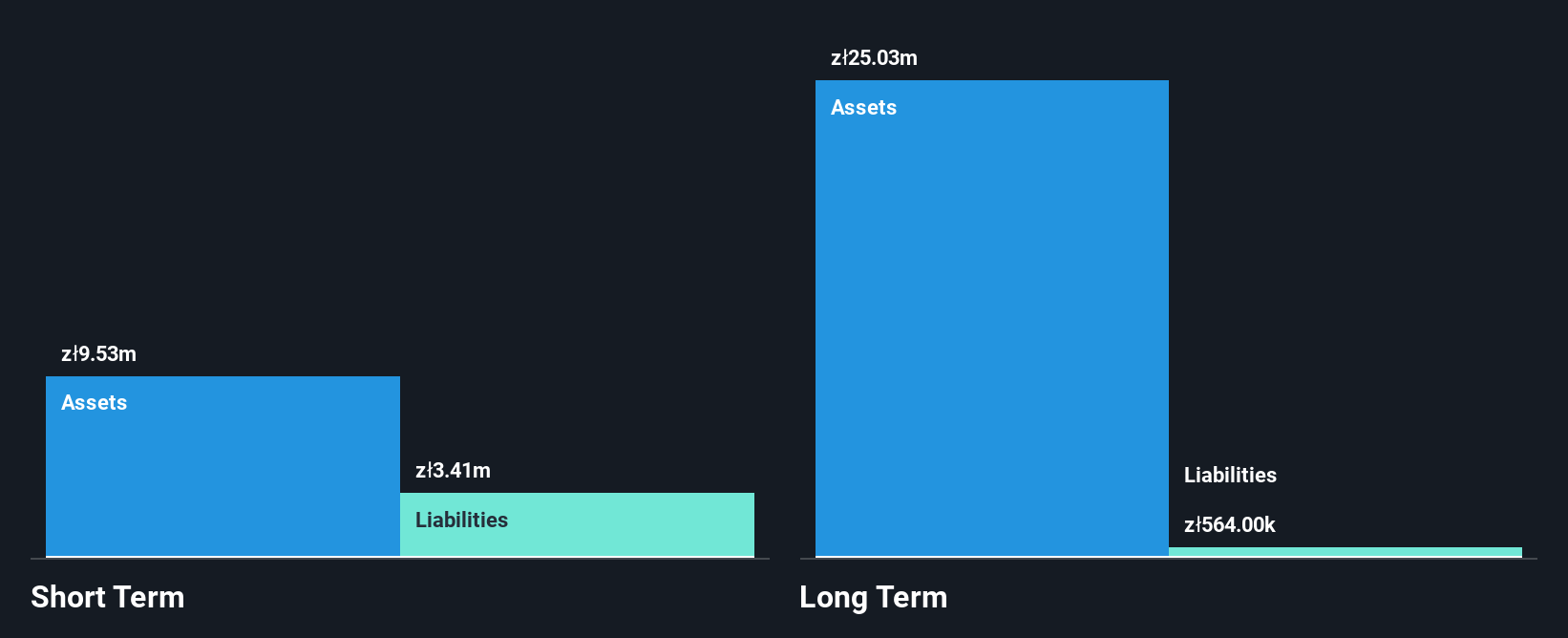

Netgem, with a market cap of €27.53 million, generates significant revenue from its Internet Telephone segment (€32.45 million). Despite experiencing negative earnings growth over the past year and a 14.9% annual decline over five years, the company maintains high-quality earnings and improved profit margins. Its short-term assets exceed both short- and long-term liabilities, indicating solid financial health. Trading significantly below estimated fair value suggests potential undervaluation for investors seeking penny stocks in Europe. However, the dividend is not well-covered by earnings, and the board's average tenure of 2.9 years indicates limited experience compared to industry norms.

- Take a closer look at Netgem's potential here in our financial health report.

- Learn about Netgem's future growth trajectory here.

Biohit Oyj (HLSE:BIOBV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Biohit Oyj is a biotechnology company that manufactures and sells products for acetaldehyde binding and diagnostic analysis, serving research institutions, healthcare, and industry globally, with a market cap of €55.93 million.

Operations: The company generates revenue primarily through its Diagnostic Kits and Equipment segment, which reported €14.28 million.

Market Cap: €55.93M

Biohit Oyj, with a market cap of €55.93 million, primarily generates revenue through its Diagnostic Kits and Equipment segment (€14.28 million). The company is debt-free, eliminating concerns over interest payments or debt coverage by cash flow. Its management team and board are experienced, with average tenures of 3.3 and 6.7 years respectively. Although the stock has been highly volatile recently, earnings have grown by 37.4% over the past year—a rate surpassing industry averages—and profit margins have improved to 15.9%. Despite high non-cash earnings, its Return on Equity remains low at 17.3%.

- Navigate through the intricacies of Biohit Oyj with our comprehensive balance sheet health report here.

- Examine Biohit Oyj's earnings growth report to understand how analysts expect it to perform.

Energoinstal (WSE:ENI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Energoinstal S.A. manufactures and sells power boilers both in Poland and internationally, with a market cap of PLN48.24 million.

Operations: The company's revenue primarily comes from its operations in Poland, amounting to PLN16.39 million.

Market Cap: PLN48.24M

Energoinstal S.A., with a market cap of PLN48.24 million, primarily generates revenue from its domestic operations totaling PLN16.39 million. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a positive cash flow that supports a cash runway exceeding three years. The company is debt-free, which alleviates concerns about financial leverage or interest obligations. While its short-term assets comfortably cover both short and long-term liabilities, the stock's high volatility poses risks for investors seeking stability in their portfolios. Recent earnings reports show modest net income improvements but remain below previous levels.

- Dive into the specifics of Energoinstal here with our thorough balance sheet health report.

- Learn about Energoinstal's historical performance here.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 276 European Penny Stocks now.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netgem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALNTG

Netgem

Develops, operates, and distributes the NetgemTV digital video entertainment platform in France and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026