Evaluating 74Software (ENXTPA:74SW): Is There More Value Left After a Strong Year-to-Date Rally?

Reviewed by Kshitija Bhandaru

See our latest analysis for 74Software.

74Software’s momentum is still in play, with a year-to-date share price return of 40%. This reflects renewed interest and optimism among investors. Longer-term total shareholder returns have also been solid. This suggests growth potential remains on the radar.

If you’re interested in discovering what else is gaining traction, now might be the perfect moment to explore fast growing stocks with high insider ownership.

That leaves investors with a key question: Is 74Software still trading below its true worth, or has the recent rally captured all the future growth potential, making now a time to wait rather than buy?

Most Popular Narrative: 24.8% Undervalued

74Software's widely followed narrative implies a fair value that is noticeably above the latest close. This suggests untapped upside if the story plays out. The fair value depends on optimistic projections for growth and profitability, with market catalysts currently aligned in the company's favor.

The ongoing shift by enterprises from on-premises to cloud-based solutions is expanding 74Software's recurring revenue base. This is evidenced by the increase in SaaS product adoption and recurring revenues rising from 71% to 75%. This transition is likely to further improve revenue predictability and gross margins as customers opt for managed services and subscriptions.

Want to know why the narrative is so bullish? It is built on ambitious growth, stronger margins, and a valuation multiple that is not typical for this sector. Which bold assumptions drive the gap between price and value? Check the full narrative for the story behind these numbers.

Result: Fair Value of €49.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on core products and potential delays in new offerings could disrupt the positive outlook and test the strength of 74Software's growth story.

Find out about the key risks to this 74Software narrative.

Another View: Is the Market Multiple Too High?

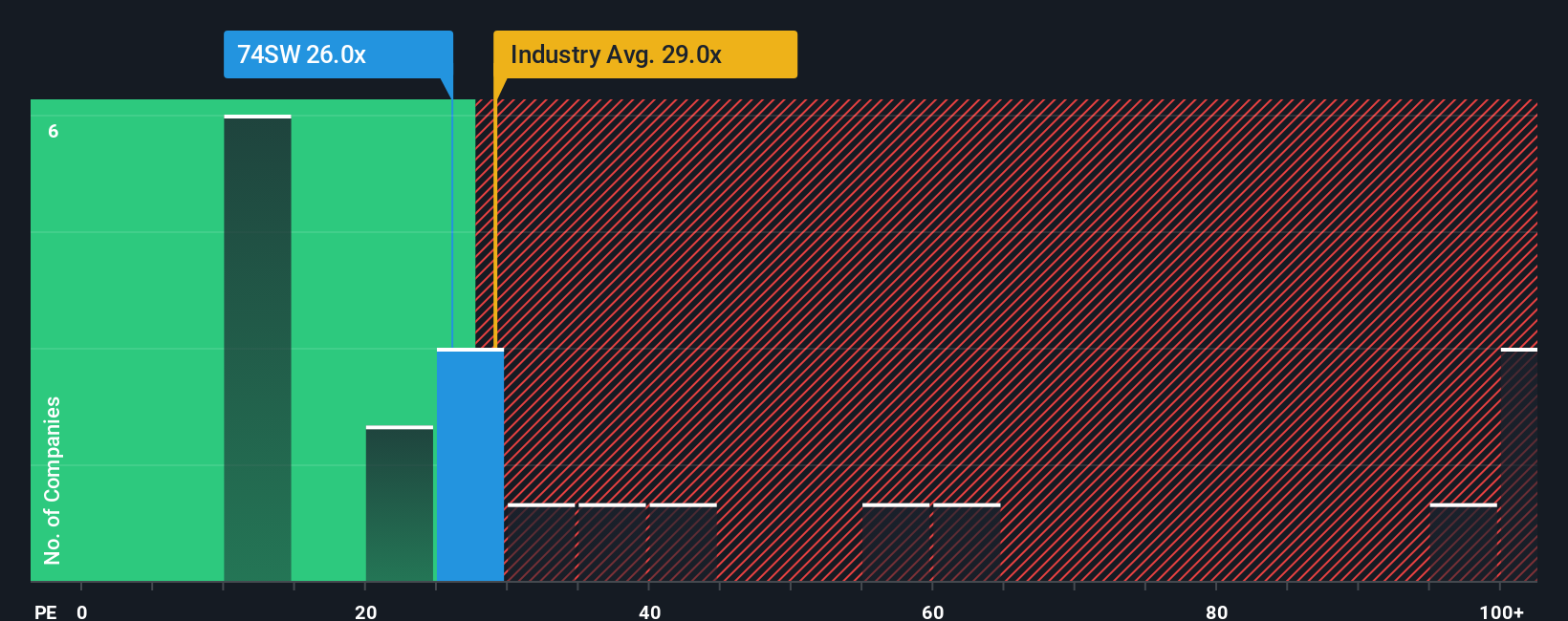

Looking at price-to-earnings for 74Software shows a different perspective. The current ratio stands at 25.8x, which is higher than its own “fair ratio” of 24.9x. However, it remains less expensive than the European Software industry average of 28.7x. Does this leave the stock exposed to valuation risk as market expectations change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 74Software Narrative

If you have your own take or want to dive deeper into the data yourself, you can easily build your own perspective in just a few minutes, too. Do it your way

A great starting point for your 74Software research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves start by broadening your watchlist. Get ahead of tomorrow’s trends and never settle for just one opportunity when there are so many to seize.

- Capture value by targeting hidden gems. Scan these 914 undervalued stocks based on cash flows and find stocks with exceptional potential based on strong cash flow metrics.

- Unlock passive income streams. Search for these 19 dividend stocks with yields > 3% offering attractive yields that can strengthen your portfolio.

- Position yourself at the cutting edge of health innovation. Browse these 31 healthcare AI stocks for companies revolutionizing patient care and medical technology with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:74SW

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion