- France

- /

- Semiconductors

- /

- ENXTPA:XFAB

Here's Why X-FAB Silicon Foundries (EPA:XFAB) Is Weighed Down By Its Debt Load

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that X-FAB Silicon Foundries SE (EPA:XFAB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is X-FAB Silicon Foundries's Net Debt?

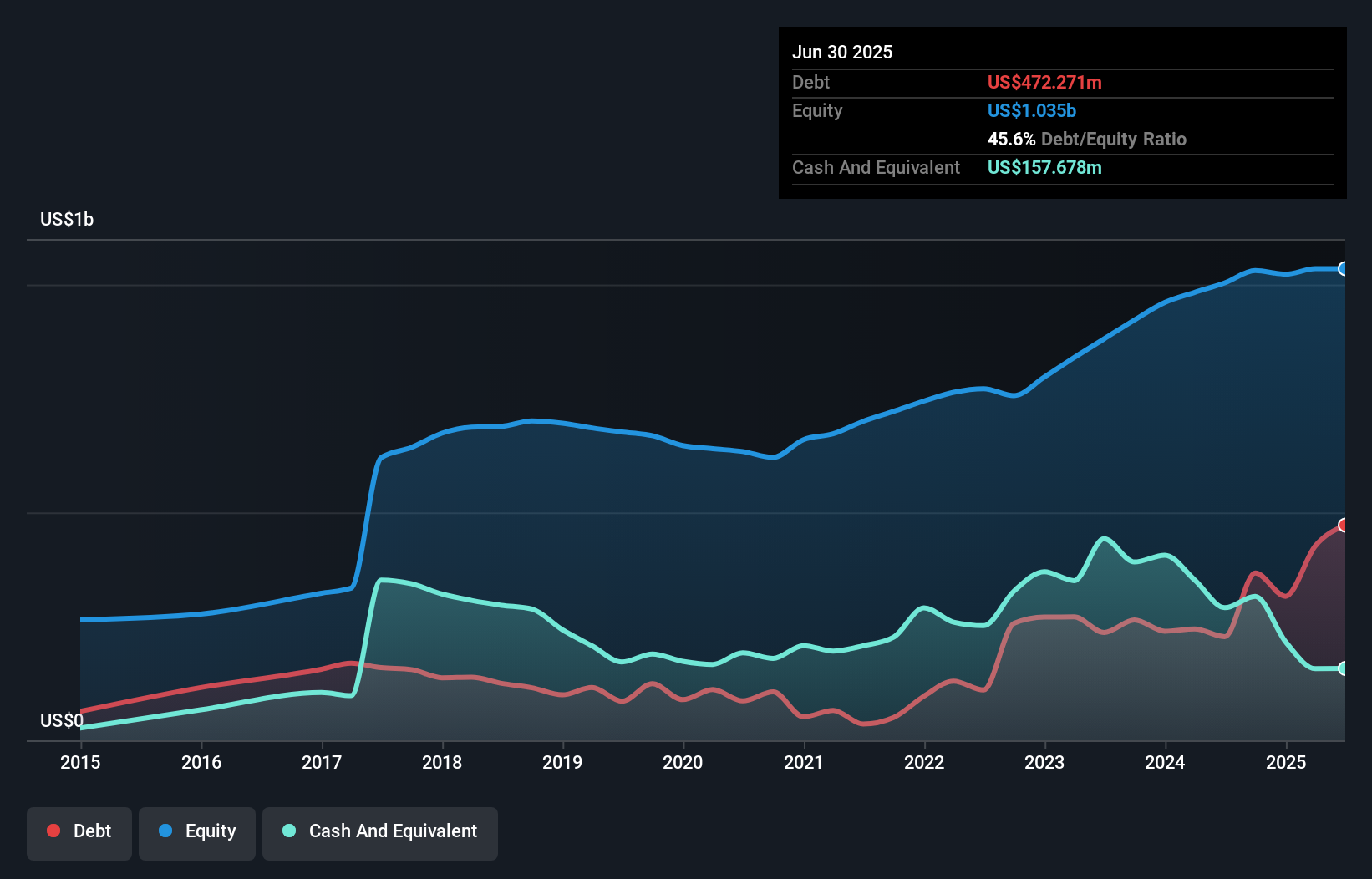

As you can see below, at the end of June 2025, X-FAB Silicon Foundries had US$472.3m of debt, up from US$227.3m a year ago. Click the image for more detail. On the flip side, it has US$157.7m in cash leading to net debt of about US$314.6m.

How Healthy Is X-FAB Silicon Foundries' Balance Sheet?

According to the last reported balance sheet, X-FAB Silicon Foundries had liabilities of US$493.9m due within 12 months, and liabilities of US$421.0m due beyond 12 months. Offsetting these obligations, it had cash of US$157.7m as well as receivables valued at US$128.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$628.7m.

This deficit isn't so bad because X-FAB Silicon Foundries is worth US$1.07b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

Check out our latest analysis for X-FAB Silicon Foundries

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

X-FAB Silicon Foundries's net debt is sitting at a very reasonable 1.7 times its EBITDA, while its EBIT covered its interest expense just 2.7 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Importantly, X-FAB Silicon Foundries's EBIT fell a jaw-dropping 42% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if X-FAB Silicon Foundries can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, X-FAB Silicon Foundries saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both X-FAB Silicon Foundries's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. We're quite clear that we consider X-FAB Silicon Foundries to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for X-FAB Silicon Foundries (1 can't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026