- France

- /

- Semiconductors

- /

- ENXTPA:SOI

Soitec (ENXTPA:SOI) Faces Board and CEO Changes Will Leadership Transitions Shift Its Strategic Focus?

Reviewed by Sasha Jovanovic

- At its October 1, 2025 board meeting, Soitec announced that Julie Galland would immediately replace François Jacq as CEA Investissement's representative on both the Board of Directors and the Strategic Committee, while CEO Pierre Barnabé informed the board of his intention to step down at the end of March 2026 after a transition period.

- Galland's extensive background in technological research and policy, paired with upcoming CEO succession, could influence Soitec’s strategic direction and investor confidence during a period of sector-wide opportunity and challenge.

- We'll examine how this leadership transition and board appointment may reshape Soitec's investment narrative amid rising demand for advanced materials.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Soitec Investment Narrative Recap

To be a shareholder in Soitec, you need to believe in the growing global demand for advanced semiconductor materials, especially as AI, automotive, and 5G markets mature. The recent board changes and upcoming CEO transition do not materially affect the most immediate catalyst, which remains a sustained rebound in end-market demand, or the biggest risk: ongoing inventory corrections and pressure in key product lines that could weigh on near-term revenue growth.

Among recent announcements, Soitec’s confirmation of around 50% sequential revenue growth for Q2 2026 stands out. This is particularly relevant, as it shows management’s optimism despite a challenging backdrop and leadership changes, reinforcing that the fundamental drivers and near-term operating performance remain a focus as inventories and supply chains stabilize.

On the other hand, investors should be aware that persistent excess inventories could continue to restrain a full earnings recovery if demand normalization takes longer than expected...

Read the full narrative on Soitec (it's free!)

Soitec's narrative projects €928.3 million revenue and €95.2 million earnings by 2028. This requires 1.4% yearly revenue growth and a €4 million earnings increase from €91.2 million today.

Uncover how Soitec's forecasts yield a €48.47 fair value, a 7% upside to its current price.

Exploring Other Perspectives

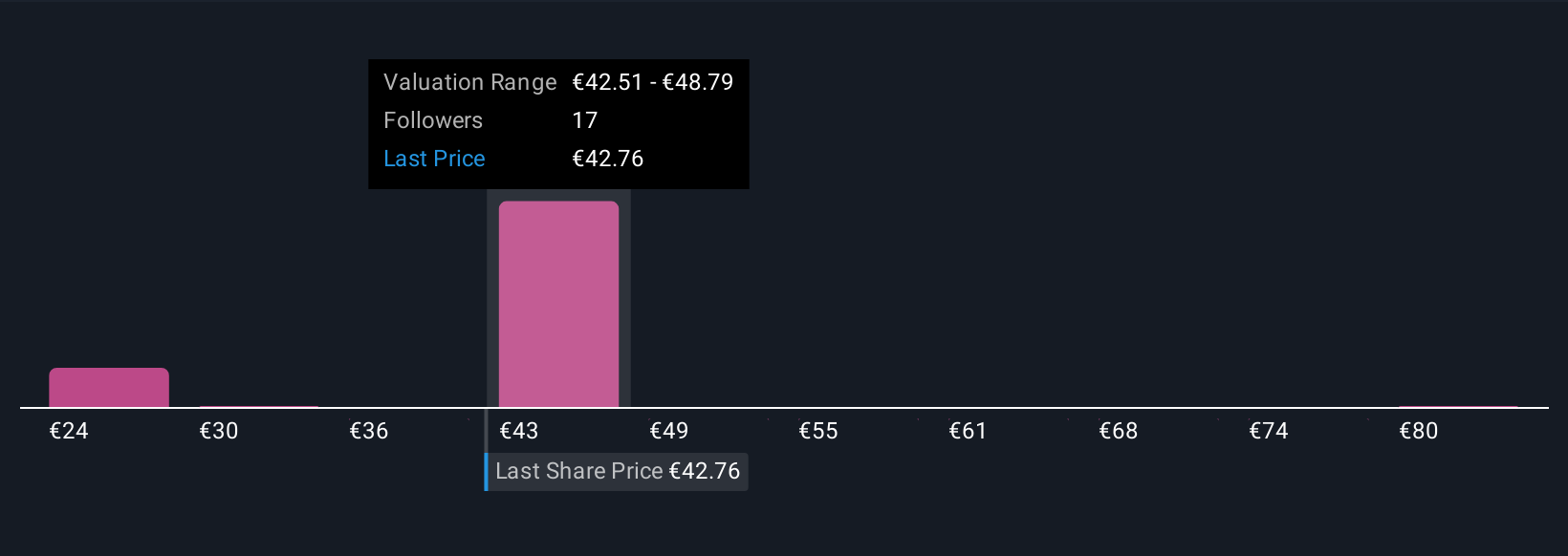

Four Simply Wall St Community valuations for Soitec range widely from €23.95 to €86.42 per share, reflecting diverging views on future growth. As inventory corrections remain a critical risk for near-term earnings, consider how these different perspectives might shape your understanding of Soitec’s performance.

Explore 4 other fair value estimates on Soitec - why the stock might be worth 47% less than the current price!

Build Your Own Soitec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Soitec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Soitec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Soitec's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SOI

Soitec

Develops and manufactures semiconductor materials in Asia, Europe, and the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives