- Japan

- /

- Real Estate

- /

- TSE:8876

November 2024's Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a wide dispersion in sector returns, with financials and energy shares gaining from deregulation hopes while healthcare faces volatility. Amid these shifts, finding stocks priced below their estimated value can present opportunities for investors seeking to capitalize on market inefficiencies. In such an environment, identifying undervalued stocks involves looking at companies with strong fundamentals that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.53 | CN¥30.97 | 49.9% |

| Oddity Tech (NasdaqGM:ODD) | US$43.12 | US$85.73 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$49.50 | HK$97.08 | 49% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.87 | 50% |

| S-Pool (TSE:2471) | ¥341.00 | ¥679.53 | 49.8% |

| Loihde Oyj (HLSE:LOIHDE) | €10.80 | €21.48 | 49.7% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.87 | 49.8% |

| Ai-Media Technologies (ASX:AIM) | A$0.705 | A$1.40 | 49.7% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.388 | €14.69 | 49.7% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥64.04 | CN¥127.37 | 49.7% |

Here's a peek at a few of the choices from the screener.

Soitec (ENXTPA:SOI)

Overview: Soitec SA designs and manufactures semiconductor materials globally, with a market cap of €2.43 billion.

Operations: Soitec generates its revenue from the design and manufacture of semiconductor materials on a global scale.

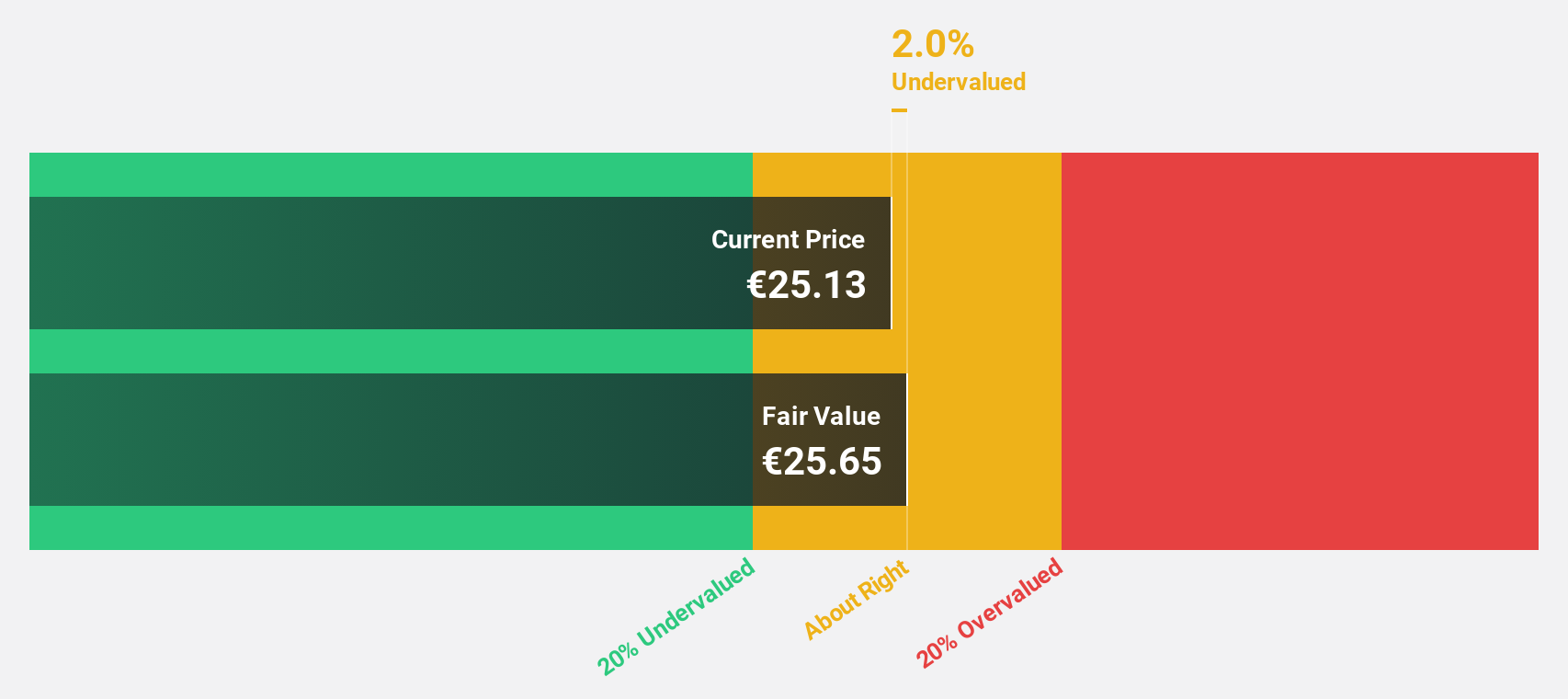

Estimated Discount To Fair Value: 31.4%

Soitec is trading 31.4% below its estimated fair value of €99.51, indicating potential undervaluation based on discounted cash flow analysis. Despite a drop in net income to €13.81 million for H1 2025, earnings are forecasted to grow significantly at 25.7% annually, outpacing the French market's growth rate of 12.4%. Recent board changes and stable revenue guidance suggest strategic positioning to leverage demand recovery in RF-SOI and other segments.

- According our earnings growth report, there's an indication that Soitec might be ready to expand.

- Click to explore a detailed breakdown of our findings in Soitec's balance sheet health report.

Easy Trip Planners (NSEI:EASEMYTRIP)

Overview: Easy Trip Planners Limited operates as an online travel agency across multiple countries including India, the Philippines, and the United States, with a market cap of ₹52.31 billion.

Operations: The company's revenue is primarily derived from Air Passage at ₹4.57 billion and Hotel Packages at ₹1.00 billion.

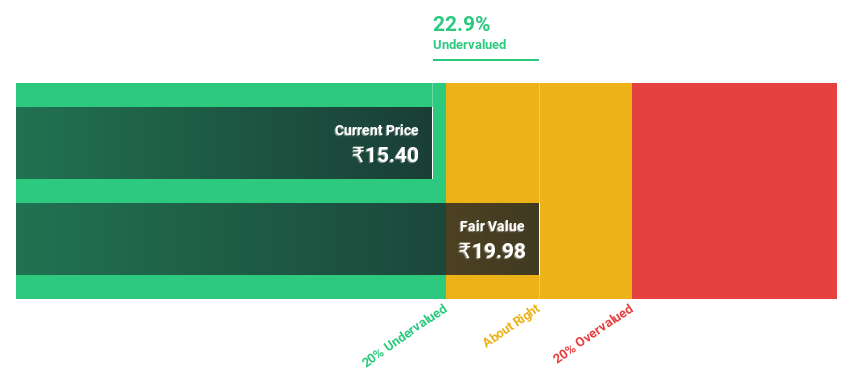

Estimated Discount To Fair Value: 20%

Easy Trip Planners is trading below its estimated fair value of ₹40.03, with a current price of ₹32.03, suggesting undervaluation based on cash flows. Earnings are forecast to grow significantly at 33.3% annually, surpassing the Indian market's growth rate of 18%. However, recent earnings showed a decline in net income from last year and profit margins decreased from 28.2% to 14.2%. The company is expanding its franchise network and enhancing card management capabilities through strategic partnerships.

- Our earnings growth report unveils the potential for significant increases in Easy Trip Planners' future results.

- Take a closer look at Easy Trip Planners' balance sheet health here in our report.

Relo Group (TSE:8876)

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥252.37 billion.

Operations: The company's revenue segments include ¥26.52 billion from the Welfare Program, ¥15.17 billion from the Tourism Business, and ¥97.34 billion from the Relocation Business.

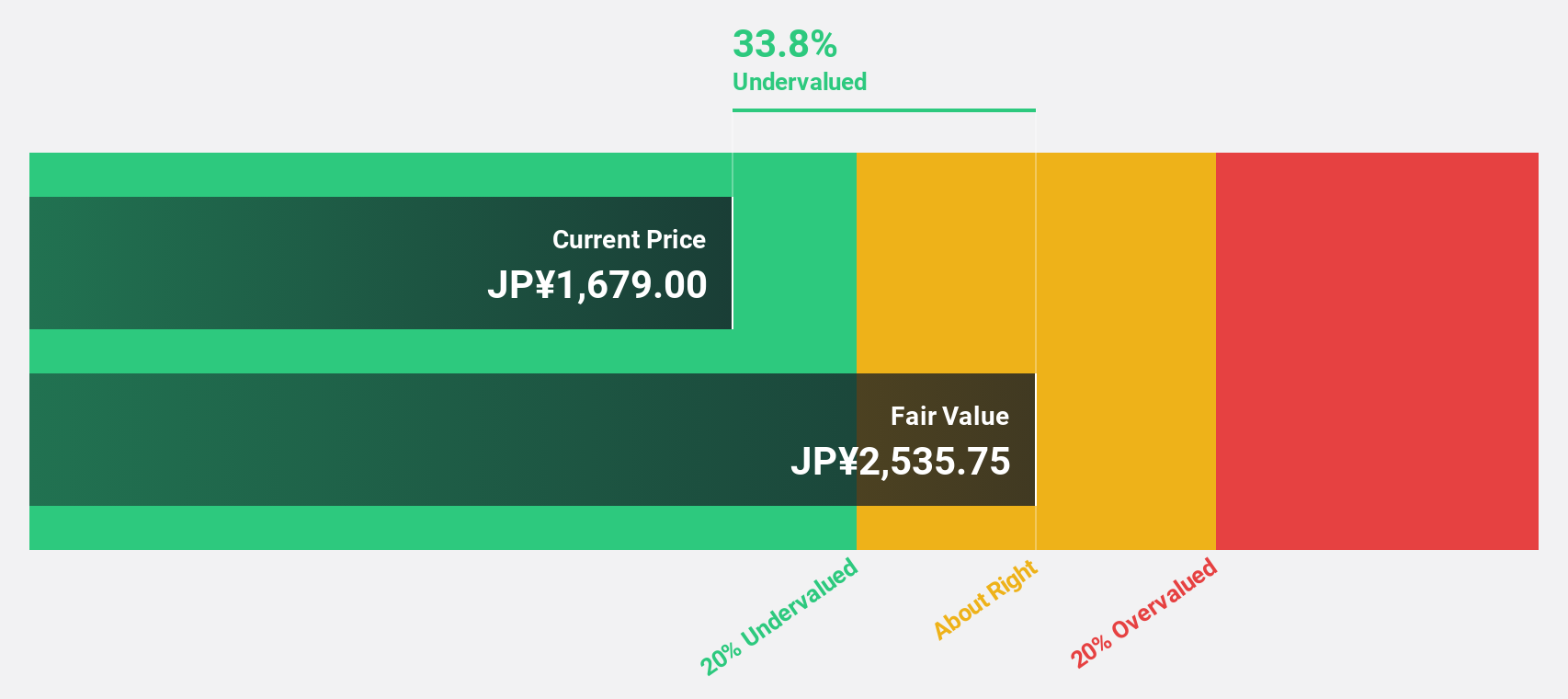

Estimated Discount To Fair Value: 28.7%

Relo Group is trading at ¥1,741, significantly below its estimated fair value of ¥2,440.75, highlighting potential undervaluation based on cash flows. The company has completed a share buyback program worth ¥5.50 billion for 3.11 million shares, enhancing shareholder value. Earnings are forecast to grow at 18.82% annually with revenue growth outpacing the Japanese market average at 6.1% per year; however, the current dividend yield of 2.18% isn't well covered by earnings.

- The analysis detailed in our Relo Group growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Relo Group.

Turning Ideas Into Actions

- Unlock our comprehensive list of 917 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8876

Relo Group

Engages in the provision of property management services in Japan.

High growth potential with excellent balance sheet.