- France

- /

- Semiconductors

- /

- ENXTPA:SOI

Does Soitec’s Recent 35% Rally Signal Real Value After Industry Forecast Upgrade?

Reviewed by Bailey Pemberton

If you have been watching Soitec stock lately, you are probably feeling a mix of curiosity and caution. After a brutal period that saw the share price fall nearly 48% so far this year, Soitec surprised everyone with a sharp recovery, jumping 9.3% in just the past week and 35.7% over the last month. Despite this bounce, the longer-term picture still looks rocky, with shares down more than 47% since a year ago, and off over 66% in the past five years. It is no wonder investors are wondering if this is a turnaround or just a brief rally within a much larger downward trend.

Much of the recent excitement has been driven by optimism around developments in semiconductor markets, as chatter about global supply chains and new customer wins have brought renewed attention to companies like Soitec. Investors seem to be shifting their risk perceptions, and some are betting that the worst might be behind the company. But whenever you see swings like this, the big question looms: what is Soitec’s stock actually worth today? Is there genuine value here, or is this just another case of hope outpacing reality?

To answer that, we turn to a more grounded approach: valuation. Based on our value scorecard, Soitec gets a 3 out of 6, signaling that it is undervalued in three key areas. But how does each method of assessing valuation paint a picture for this stock? And is there a smarter, holistic way to cut through the noise? Let’s dig deeper into the different valuation lenses. Stick around, because we will end with a fresh perspective on finding true value.

Why Soitec is lagging behind its peers

Approach 1: Soitec Discounted Cash Flow (DCF) Analysis

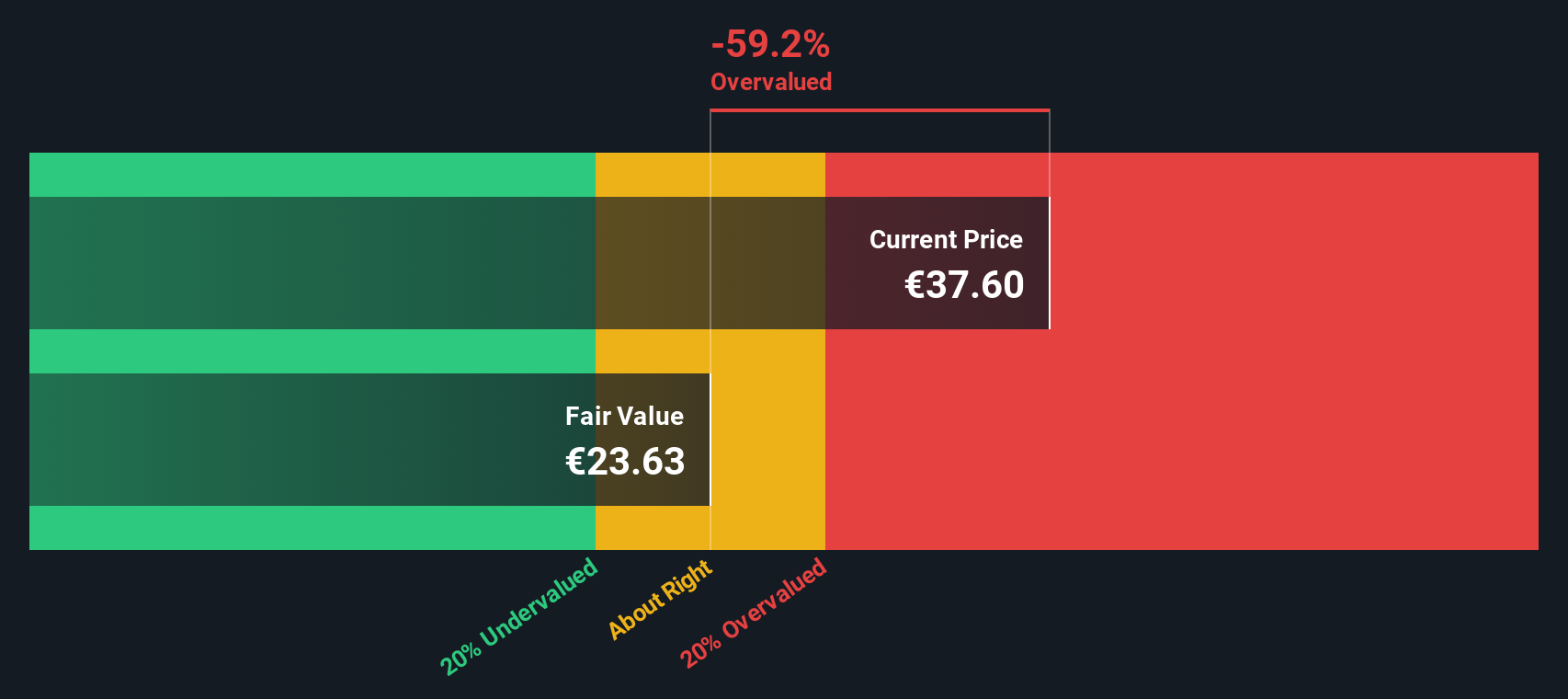

The Discounted Cash Flow (DCF) model starts by projecting Soitec’s future cash flows and then discounts them back to today to estimate what the company is worth right now. This approach helps gauge whether the current share price reflects the business’s actual earning power.

Currently, Soitec’s Free Cash Flow stands at approximately €5 million. Analyst consensus and projections estimate this growing steadily, reaching just over €105 million by 2030. The model used here takes firm analyst estimates for the next five years and then extends these further into the future based on reasonable growth assumptions.

- 2026 projected Free Cash Flow: approximately €47 million

- 2027 projected Free Cash Flow: approximately €92 million

- 2030 projected Free Cash Flow: approximately €106 million

The resulting intrinsic value per share from this DCF analysis comes out to €23.80. However, when compared to the current share price, this suggests Soitec is 86.1% overvalued. This means the market is pricing the stock far above what its discounted future earnings would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Soitec may be overvalued by 86.1%. Find undervalued stocks or create your own screener to find better value opportunities.

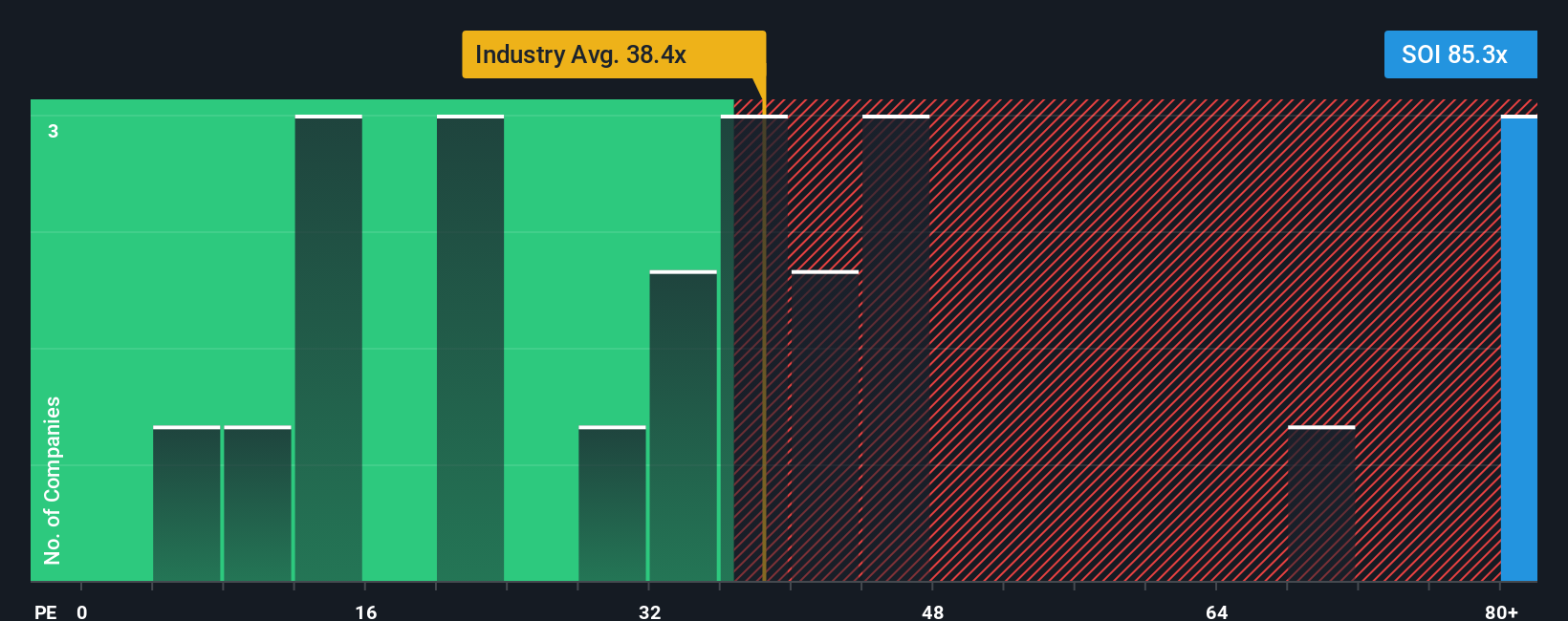

Approach 2: Soitec Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly relates a company’s market value to its actual earnings. For companies generating positive profits like Soitec, the PE ratio helps investors determine whether the market is paying a reasonable price for those earnings, given the company’s outlook and risk profile.

What counts as a “normal” or fair PE ratio often depends on future growth prospects and perceived risks. High-growth companies or those facing low risk often justify higher PE ratios. Conversely, slower growth or elevated risks tend to push the fair multiple lower.

Soitec is currently trading at a PE ratio of 17.3x. This is notably lower than the semiconductor industry average of 38.1x, and also well below the 42.2x average among its sector peers. At first glance, this might suggest the stock is attractively valued. However, Simply Wall St’s proprietary “Fair Ratio” digs deeper. It calculates what a truly fair PE would be for Soitec, considering not only industry factors but also the company’s earnings growth potential, risk, profit margin, and market cap. For Soitec, the Fair Ratio stands at 23.2x, higher than its current multiple but still far below group averages. This tailored benchmark offers a more precise reference point than generic peer comparisons.

Given that Soitec’s current PE is below its Fair Ratio, the stock could be considered undervalued based on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Soitec Narrative

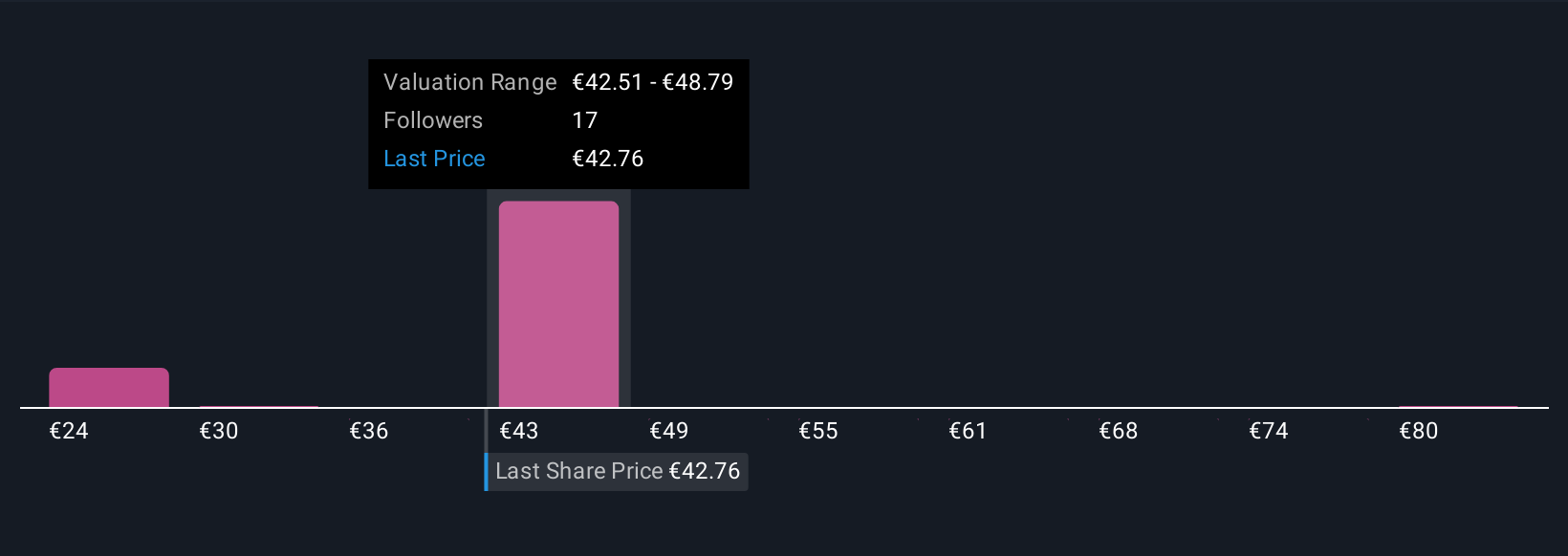

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story, your perspective, that connects what you believe about Soitec’s business, the market’s trends, and the company’s future to a set of financial forecasts. Narratives let you go beyond the numbers by combining your outlook for revenue, earnings, and margins into a projected fair value. This approach shows how your conviction leads straight to a buy or sell decision.

Narratives are the easiest entry point for smarter, more dynamic analysis and are available within Simply Wall St’s Community page, where millions of investors share and update their views. As soon as news breaks or earnings are released, Narratives automatically update your forecast and instantly reflect new risks or opportunities. This means you are always equipped with the latest, most relevant fair value, rather than relying on outdated financials.

For example, one Soitec Narrative might be bullish, reflecting a fair value close to €99 based on optimistic earnings forecasts. A bearish Narrative could see fair value at just €32, with each story built from different assumptions about industry growth and competitive risks. Narratives help you compare the current price directly to what matters most: your own view of fair value, informed by real-world data and crowd insights.

Do you think there's more to the story for Soitec? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SOI

Soitec

Develops and manufactures semiconductor materials in Asia, Europe, and the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)