- France

- /

- Specialty Stores

- /

- ENXTPA:CAFO

Here's Why Centrale d'Achat Française pour l'Outre-Mer Société Anonyme (EPA:CAFO) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Centrale d'Achat Française pour l'Outre-Mer Société Anonyme (EPA:CAFO) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Centrale d'Achat Française pour l'Outre-Mer Société Anonyme

What Is Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's Debt?

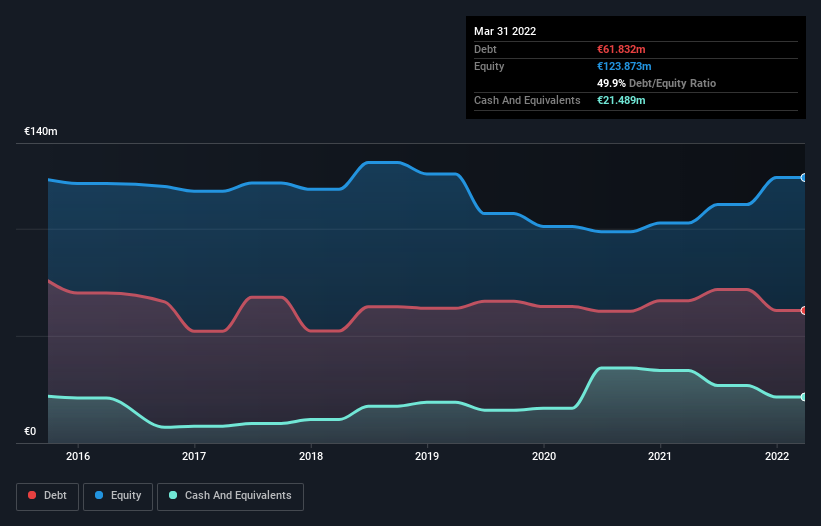

As you can see below, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme had €61.8m of debt at March 2022, down from €66.4m a year prior. However, it also had €21.5m in cash, and so its net debt is €40.3m.

How Strong Is Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's Balance Sheet?

The latest balance sheet data shows that Centrale d'Achat Française pour l'Outre-Mer Société Anonyme had liabilities of €125.9m due within a year, and liabilities of €163.9m falling due after that. Offsetting this, it had €21.5m in cash and €33.0m in receivables that were due within 12 months. So its liabilities total €235.4m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €81.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Centrale d'Achat Française pour l'Outre-Mer Société Anonyme has a low net debt to EBITDA ratio of only 1.5. And its EBIT easily covers its interest expense, being 10.3 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's EBIT dived 18%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Centrale d'Achat Française pour l'Outre-Mer Société Anonyme will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme produced sturdy free cash flow equating to 65% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

To be frank both Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Looking at the bigger picture, it seems clear to us that Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Centrale d'Achat Française pour l'Outre-Mer Société Anonyme you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Centrale d'Achat Française pour l'Outre-Mer Société Anonyme, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CAFO

Centrale d'Achat Française pour l'Outre-Mer Société Anonyme

Provides home furnishing products in South-East Asia, South America, Europe, and Middle East.

Flawless balance sheet and good value.