The CEO of Avenir Telecom S.A. (EPA:AVT) is Jean-Daniel Beurnier, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Avenir Telecom

How Does Total Compensation For Jean-Daniel Beurnier Compare With Other Companies In The Industry?

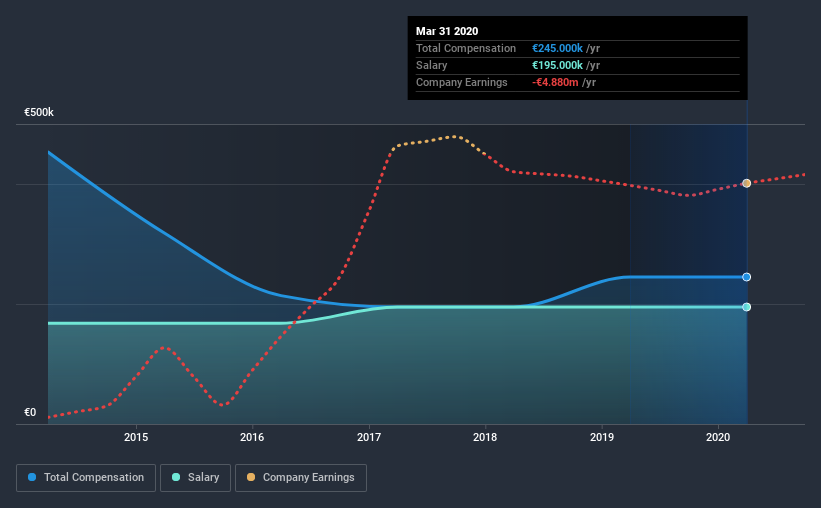

Our data indicates that Avenir Telecom S.A. has a market capitalization of €5.8m, and total annual CEO compensation was reported as €245k for the year to March 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of €195.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below €164m, reported a median total CEO compensation of €352k. That is to say, Jean-Daniel Beurnier is paid under the industry median. What's more, Jean-Daniel Beurnier holds €66k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €195k | €195k | 80% |

| Other | €50k | €50k | 20% |

| Total Compensation | €245k | €245k | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. Avenir Telecom pays out 80% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Avenir Telecom S.A.'s Growth

Over the last three years, Avenir Telecom S.A. has shrunk its earnings per share by 24% per year. It saw its revenue drop 3.8% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Avenir Telecom S.A. Been A Good Investment?

With a three year total loss of 97% for the shareholders, Avenir Telecom S.A. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we noted earlier, Avenir Telecom pays its CEO lower than the norm for similar-sized companies belonging to the same industry. EPS growth has failed to impress us, and the same can be said about shareholder returns. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Avenir Telecom (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Avenir Telecom or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:AVT

Avenir Telecom

Designs, manufactures and distributes mobile phones and mobility accessories in Europe, the Middle East, Africa, Asia, Oceania, and the Americas.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026