- France

- /

- Specialty Stores

- /

- ENXTPA:ARAMI

November 2024's Top Stocks Estimated To Be Priced Below Intrinsic Value

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and broad-based gains across sectors, investors are keenly observing the ongoing economic indicators such as jobless claims and home sales that are contributing to positive market sentiment. Amidst this backdrop, identifying stocks priced below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies, especially when considering factors like strong fundamentals and growth potential in a fluctuating economic environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Truecaller (OM:TRUE B) | SEK47.98 | SEK95.84 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.25 | 49.9% |

| Kitron (OB:KIT) | NOK31.18 | NOK62.32 | 50% |

| CS Wind (KOSE:A112610) | ₩41600.00 | ₩83136.08 | 50% |

| PLAIDInc (TSE:4165) | ¥1604.00 | ¥3207.80 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Neosperience (BIT:NSP) | €0.57 | €1.14 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.38 | 50% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2905.00 | ¥5793.18 | 49.9% |

Let's dive into some prime choices out of the screener.

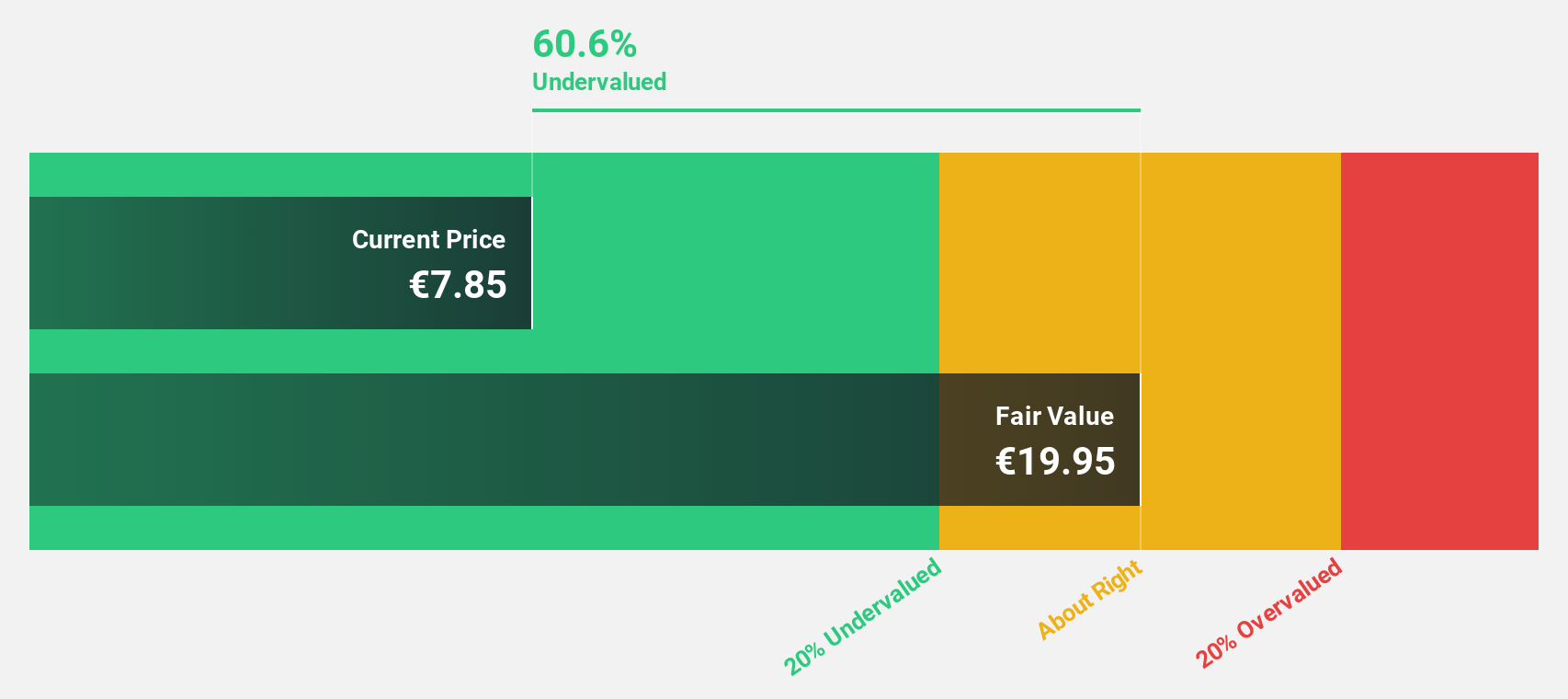

Aramis Group SAS (ENXTPA:ARAMI)

Overview: Aramis Group SAS operates in the online sale of used vehicles across several European countries including France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market cap of €580.43 million.

Operations: Aramis Group SAS generates revenue primarily through its online platform for selling pre-owned vehicles across multiple European markets, such as France, Belgium, the United Kingdom, Austria, Italy, and Spain.

Estimated Discount To Fair Value: 33.3%

Aramis Group SAS is trading at €7.02, significantly below its estimated fair value of €10.53, indicating it may be undervalued based on cash flows. The company recently reported sales of €2.24 billion and turned profitable with a net income of €5.01 million for the fiscal year ending September 2024, compared to a net loss previously. Its earnings are forecast to grow substantially at 78.5% annually, outpacing both revenue growth and the French market average.

- According our earnings growth report, there's an indication that Aramis Group SAS might be ready to expand.

- Unlock comprehensive insights into our analysis of Aramis Group SAS stock in this financial health report.

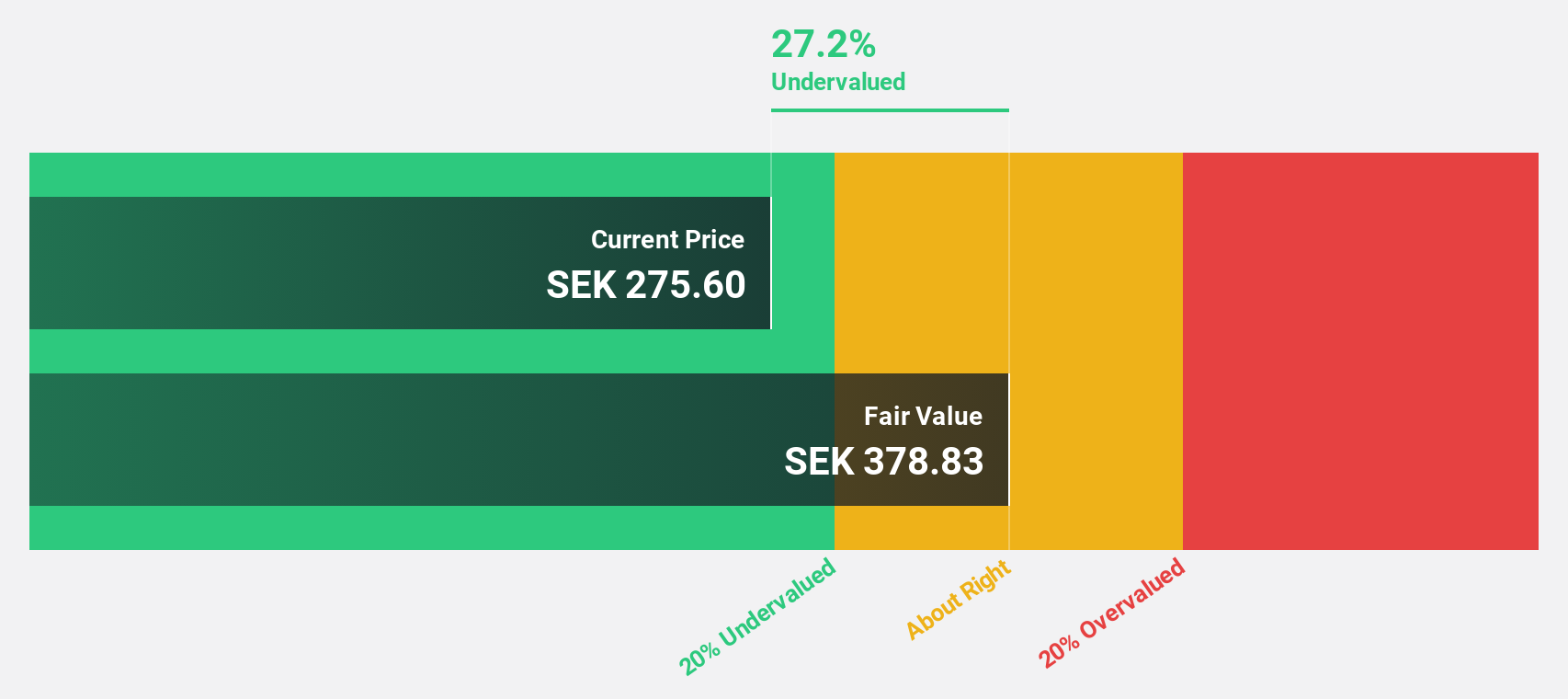

Thule Group (OM:THULE)

Overview: Thule Group AB (publ) is a sports and outdoor company operating in Sweden and internationally, with a market cap of SEK36.37 billion.

Operations: The company generates revenue from its Outdoor & Bags segment, which amounts to SEK9.43 billion.

Estimated Discount To Fair Value: 11%

Thule Group, priced at SEK344, is trading 11% below its estimated fair value of SEK386.64, suggesting potential undervaluation based on cash flows. Recent earnings reports show steady growth with Q3 sales increasing to SEK2.34 billion and net income rising to SEK300 million from the previous year. Earnings are projected to grow significantly by 20.1% annually, surpassing Swedish market averages and highlighting robust future profitability despite an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Thule Group's future results.

- Take a closer look at Thule Group's balance sheet health here in our report.

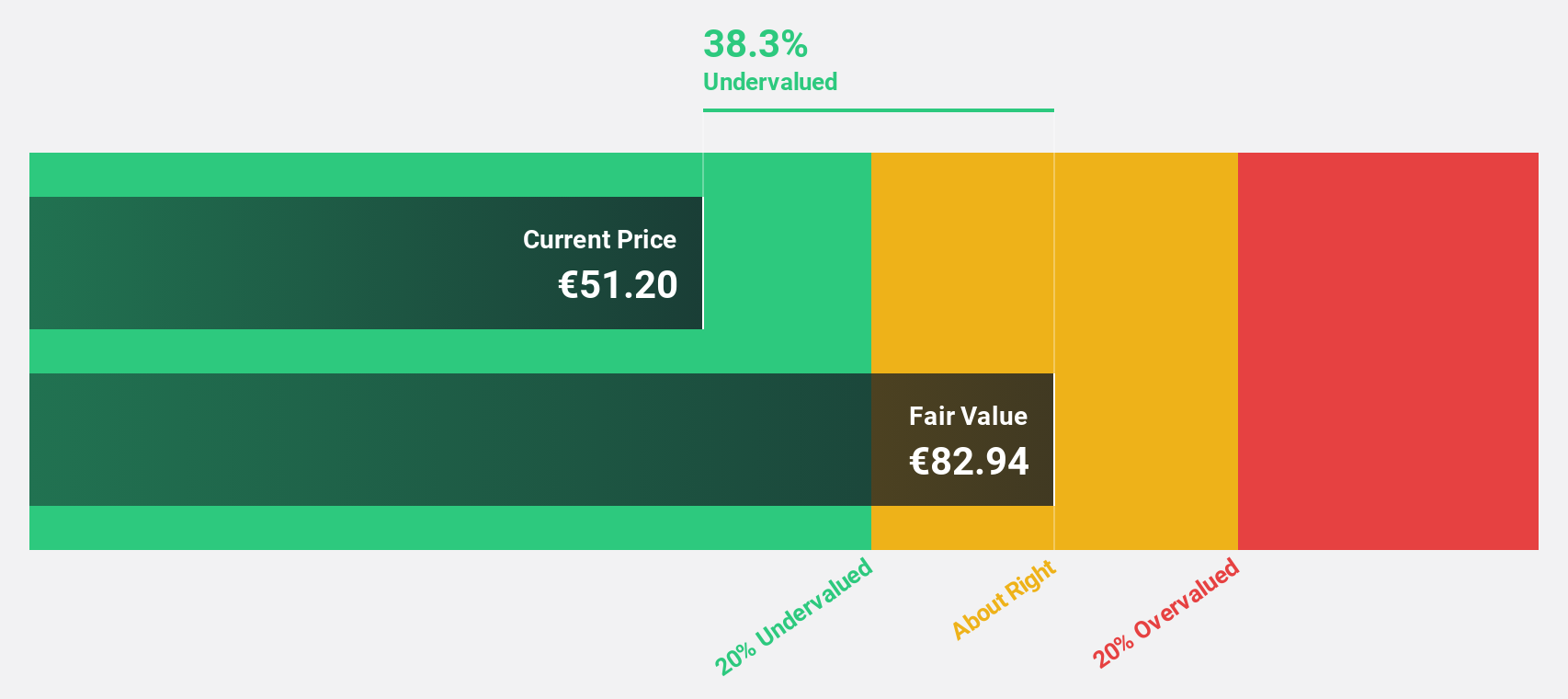

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA offers out-of-home media and online advertising solutions in Germany and internationally, with a market cap of €2.71 billion.

Operations: The company's revenue segments include Daas & E-Commerce (€352.26 million), Out-Of-Home Media (€941.99 million), and Digital & Dialog Media (€867.49 million).

Estimated Discount To Fair Value: 45.3%

Ströer SE KGaA, currently trading at €48.5, is valued 45.3% below its estimated fair value of €88.69, indicating potential undervaluation based on cash flows. The company reported Q3 sales of €495.9 million and net income of €34.75 million, showing year-over-year growth in both metrics. Earnings are forecast to grow significantly at 29.2% annually, outpacing the German market's average growth rate and suggesting strong future profitability despite high debt levels and unsustainable dividends.

- Our growth report here indicates Ströer SE KGaA may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Ströer SE KGaA.

Key Takeaways

- Delve into our full catalog of 914 Undervalued Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARAMI

Aramis Group SAS

Engages in the online sale of used vehicles in France, Belgium, the United Kingdom, Belgium, Austria, Italy, and Spain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives