With the business potentially at an important milestone, we thought we'd take a closer look at Largo SA's (EPA:ALLGO) future prospects. Largo SA engages in the sale of refurbished digital equipment primarily smartphones, tablets, and laptops in France. The €8.3m market-cap company’s loss lessened since it announced a €5.0m loss in the full financial year, compared to the latest trailing-twelve-month loss of €3.8m, as it approaches breakeven. The most pressing concern for investors is Largo's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

Check out our latest analysis for Largo

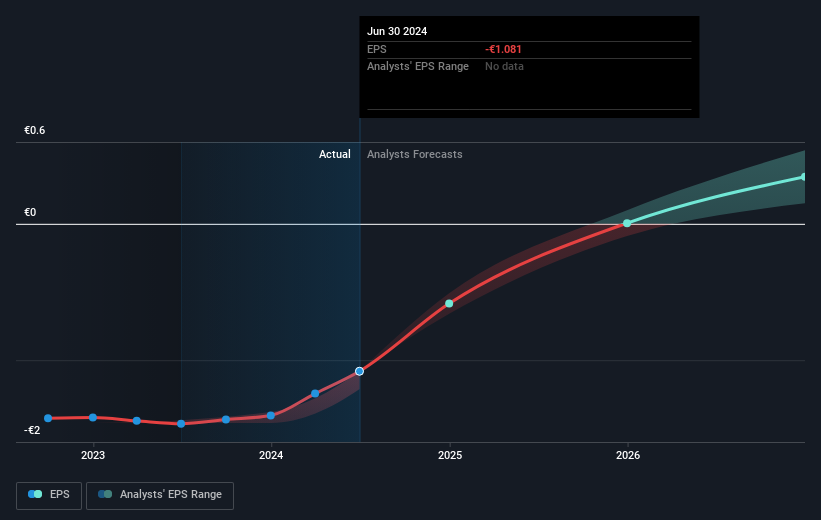

Largo is bordering on breakeven, according to the 2 French Specialty Retail analysts. They anticipate the company to incur a final loss in 2024, before generating positive profits of €50k in 2025. The company is therefore projected to breakeven around a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2025? Working backwards from analyst estimates, it turns out that they expect the company to grow 110% year-on-year, on average, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for Largo given that this is a high-level summary, though, take into account that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we would like to bring into light with Largo is its debt-to-equity ratio of over 2x. Generally, the rule of thumb is debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. Note that a higher debt obligation increases the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Largo to cover in one brief article, but the key fundamentals for the company can all be found in one place – Largo's company page on Simply Wall St. We've also put together a list of relevant factors you should look at:

- Valuation: What is Largo worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Largo is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Largo’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALLGO

Largo

Engages in the sale of refurbished digital equipment primarily smartphones, tablets, and laptops in France.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)