- France

- /

- Retail REITs

- /

- ENXTPA:URW

Is There Still Upside in Unibail-Rodamco-Westfield After Asset Repositioning and 24% Price Gain?

Reviewed by Bailey Pemberton

Wondering whether to buy, sell, or just keep watching Unibail-Rodamco-Westfield? You are not alone. This stock has been catching plenty of attention lately, and for good reason. Over the past year, shares have climbed an impressive 23.6%, and if you look even further, the five-year return sits at a staggering 185.8%. Even in just the past month, the stock has notched a solid 4.0% gain. It is no surprise investors are stopping to take a closer look at what is driving those numbers and whether the momentum has room to run.

Much of the recent excitement around Unibail-Rodamco-Westfield can be traced to a mix of positive market sentiment and news that the company is actively repositioning some of its retail assets. These efforts have led investors to view the company as a potentially less risky bet than before, which has likely contributed to the steady lift in its share price. Short-term moves, like the 0.9% gain this week, might not seem dramatic on their own, but they are part of a longer trend suggesting that the market is recalibrating its expectations.

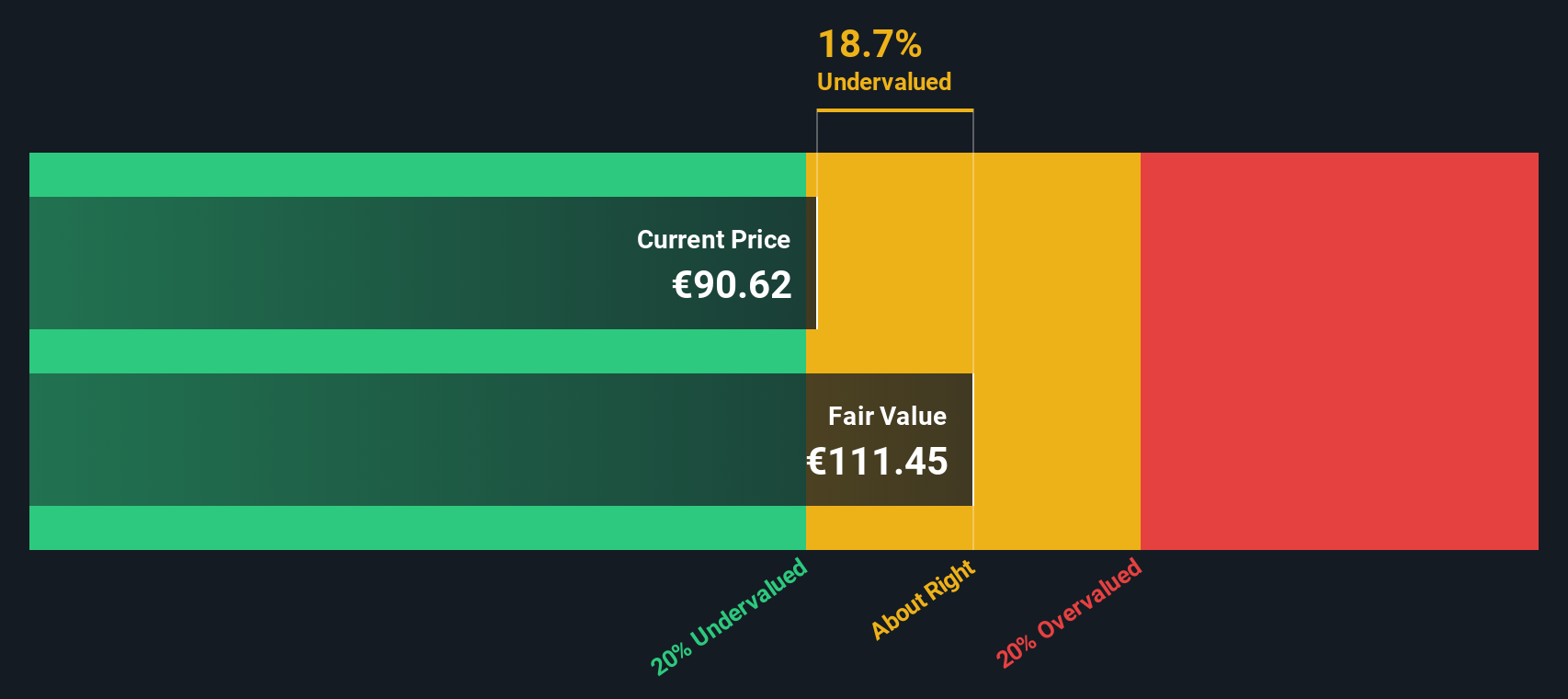

Of course, assessing whether the current price truly reflects the company’s value means digging deeper. According to our screening, Unibail-Rodamco-Westfield is undervalued in three out of six major valuation checks, giving it a value score of 3. But what does that really mean? In the next section, we will break down those valuation approaches and, at the end, share a perspective on valuation you will not want to miss.

Approach 1: Unibail-Rodamco-Westfield Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future funds from operations, then discounting those figures back to today using an appropriate rate. For Unibail-Rodamco-Westfield, this approach provides a robust framework to gauge whether the market price reflects the underlying business reality.

Currently, Unibail-Rodamco-Westfield reports Free Cash Flow of €2.21 billion. Analyst estimates forecast a gradual increase, with Free Cash Flow projected to reach around €1.42 billion by 2027 and approximately €1.64 billion by 2035. The first five years are based on consensus estimates from analysts, while projections beyond that are modeled using conservative growth assumptions from Simply Wall St.

Based on this analysis, the DCF model estimates an intrinsic fair value for the stock at €113.19 per share. When compared to the current market price, this represents a 19.5% discount, which suggests that the stock may be undervalued according to its long-term cash generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Unibail-Rodamco-Westfield is undervalued by 19.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Unibail-Rodamco-Westfield Price vs Earnings

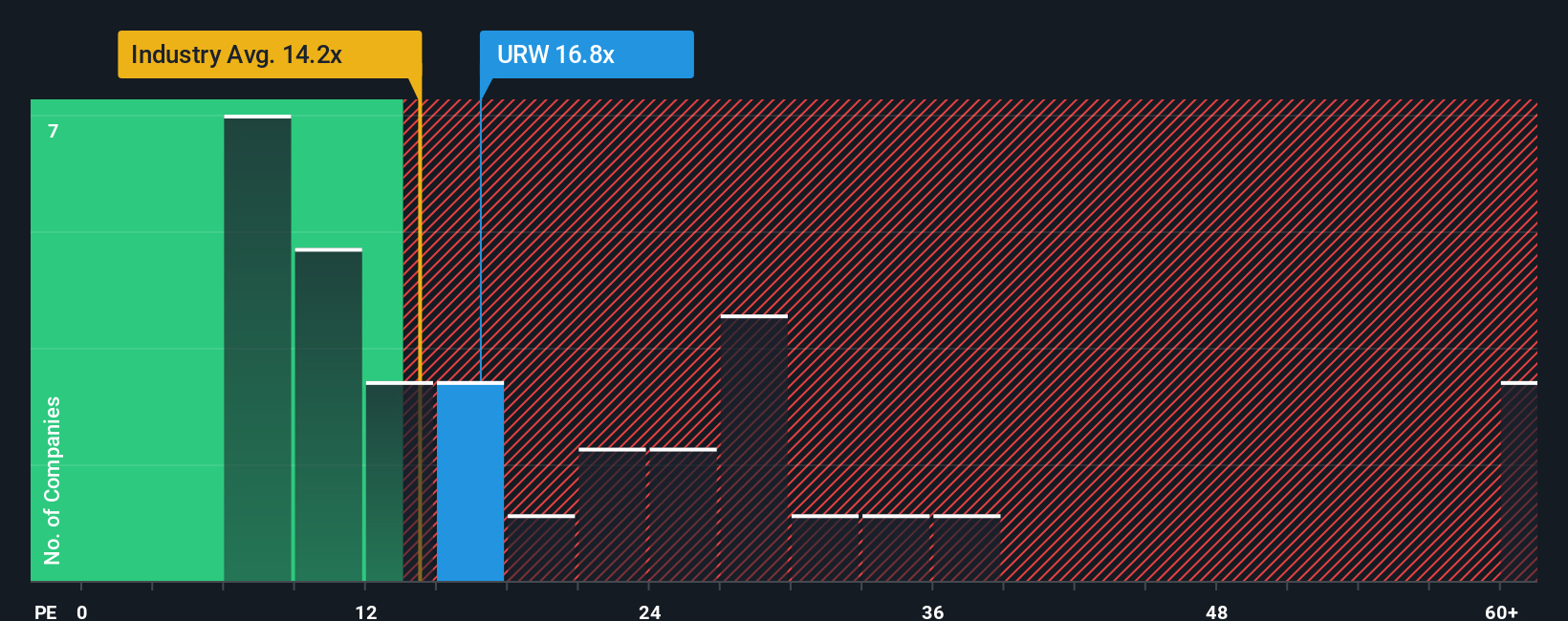

For companies that are profitable, the price-to-earnings (PE) ratio is often considered one of the most telling valuation tools. It allows investors to gauge how much the market is willing to pay for each euro of earnings and is especially insightful when companies generate consistent profits, as is the case with Unibail-Rodamco-Westfield.

The “right” PE ratio depends on a variety of factors, including the company’s growth prospects and perceived risk. Higher growth companies and lower risk firms tend to justify higher PE ratios, while lackluster growth or greater uncertainty may warrant lower multiples. Comparing a company’s PE to key benchmarks can put its valuation in context.

Unibail-Rodamco-Westfield is currently trading at a PE ratio of 16.9x. That is very close to the retail REITs industry average of 16.5x and significantly lower than the peer group average of 48.2x. To move beyond these traditional comparisons, Simply Wall St calculates a “Fair Ratio,” a proprietary figure reflecting not just industry factors but also company-specific elements like earnings growth, risk profile, profit margins, and market cap. For Unibail-Rodamco-Westfield, the Fair Ratio sits at 17.8x. Because this is nearly identical to the company’s current PE, the stock is trading right in line with what you would expect based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unibail-Rodamco-Westfield Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple but powerful idea: it is the story or viewpoint you have about a company, written out in plain language alongside your assumptions about its future revenue, earnings, and profit margins.

Narratives take the numbers one step further by tying your perspective to a financial forecast, and then translating that into a Fair Value for the stock. This means you can easily connect your reasoning (why you believe in the company’s strengths or see certain risks) with specific financial outcomes.

Best of all, Narratives are practical and accessible: you will find them on Simply Wall St’s Community page, where millions of investors share and debate their views. Narratives show you how your fair value stacks up against the current share price, giving you a clearer signal about whether it might be time to buy, hold, or sell.

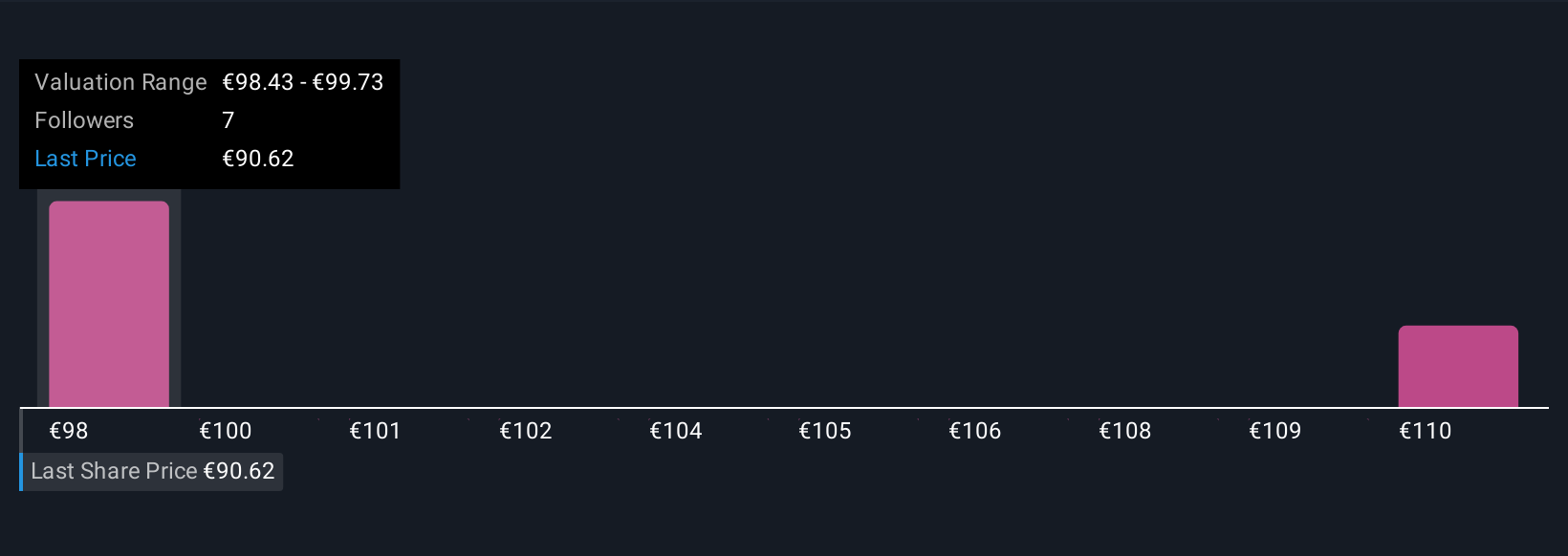

Because Narratives update dynamically when news or earnings come in, your outlook always reflects the latest information. For example, one Unibail-Rodamco-Westfield Narrative projects a fair value as high as €131.0, highlighting big upside based on growth and mixed-use opportunities. Meanwhile, another, more conservative Narrative values the shares at just €80.0, emphasizing debt and sector risks. This range shows how Narratives make your investment decisions truly your own.

Do you think there's more to the story for Unibail-Rodamco-Westfield? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:URW

Unibail-Rodamco-Westfield

Unibail-Rodamco-Westfield is an owner, developer and operator of sustainable, high-quality real estate assets in the most dynamic cities in Europe and the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives