3 European Stocks Estimated To Be Up To 48.3% Below Intrinsic Value

Reviewed by Simply Wall St

As the European stock market remains relatively flat, with mixed performances across major indices like Germany's DAX and France's CAC 40, investors are keenly observing trade discussions between the U.S. and Europe for any signs of progress. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Upsales Technology (OM:UPSALE) | SEK38.30 | SEK75.49 | 49.3% |

| Trøndelag Sparebank (OB:TRSB) | NOK113.70 | NOK222.13 | 48.8% |

| Talenom Oyj (HLSE:TNOM) | €3.525 | €6.97 | 49.4% |

| Sparebank 68° Nord (OB:SB68) | NOK180.02 | NOK352.00 | 48.9% |

| RVRC Holding (OM:RVRC) | SEK46.60 | SEK91.04 | 48.8% |

| Medhelp Care Aktiebolag (OM:MEDHLP) | SEK5.00 | SEK9.94 | 49.7% |

| Echo Investment (WSE:ECH) | PLN5.36 | PLN10.70 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.78 | 49.9% |

| Cambi (OB:CAMBI) | NOK21.90 | NOK42.97 | 49% |

| Aquila Part Prod Com (BVB:AQ) | RON1.45 | RON2.87 | 49.5% |

Let's review some notable picks from our screened stocks.

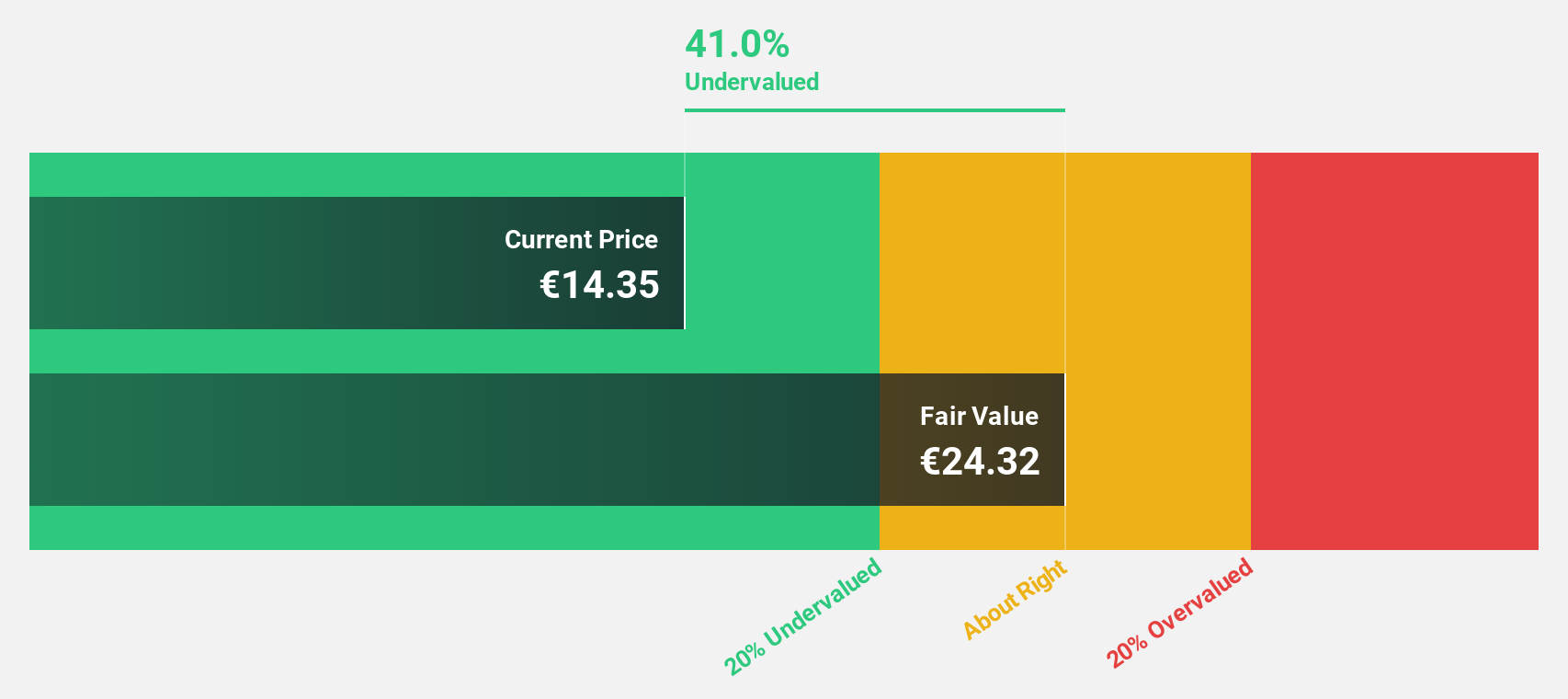

InPost (ENXTAM:INPST)

Overview: InPost S.A. operates as an out-of-home e-commerce enablement platform offering parcel locker services across Poland and other European countries, with a market cap of €6.49 billion.

Operations: InPost S.A. generates its revenue primarily from providing parcel locker services in Poland and various European countries.

Estimated Discount To Fair Value: 48.3%

InPost is trading at €13.05, significantly undervalued compared to its estimated fair value of €25.22, presenting a compelling case for investors focused on cash flow valuation. Despite high debt levels, InPost's earnings are forecasted to grow significantly over the next three years, outpacing the Dutch market. Recent equity offerings raised €231.88 million, potentially strengthening its financial position further as it anticipates substantial revenue growth driven by strategic expansions in Europe and the UK.

- Upon reviewing our latest growth report, InPost's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of InPost.

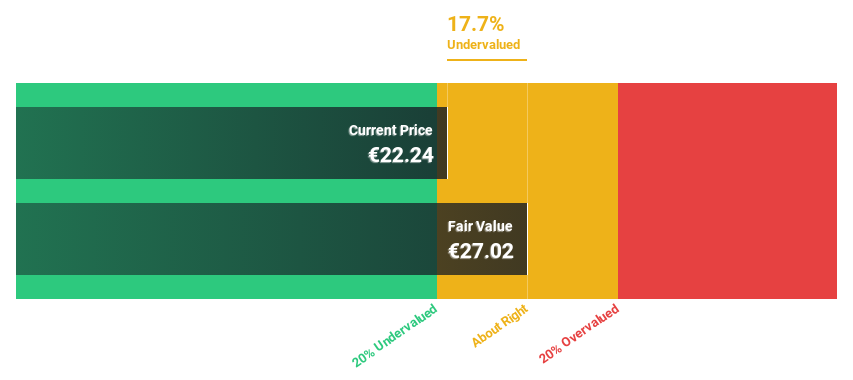

Icade (ENXTPA:ICAD)

Overview: Icade is a comprehensive real estate company in France, specializing in property investment with a portfolio valued at €6.40 billion and property development generating economic revenue of €1.20 billion, with a market capitalization of approximately €1.62 billion.

Operations: The company's revenue is primarily derived from its promotion segment, contributing €1.21 billion, and its land segment, adding €375.60 million.

Estimated Discount To Fair Value: 26.7%

Icade, trading at €21.34, is considerably undervalued against its estimated fair value of €29.13, making it attractive for cash flow-focused investors. Despite a recent net loss reduction to €91.7 million for H1 2025, Icade's earnings are projected to grow significantly over the next three years with profitability expected above market averages. However, its dividend yield of 20.2% remains unsustainable by current earnings, and revenue growth forecasts lag behind broader benchmarks but exceed the French market rate.

- The analysis detailed in our Icade growth report hints at robust future financial performance.

- Navigate through the intricacies of Icade with our comprehensive financial health report here.

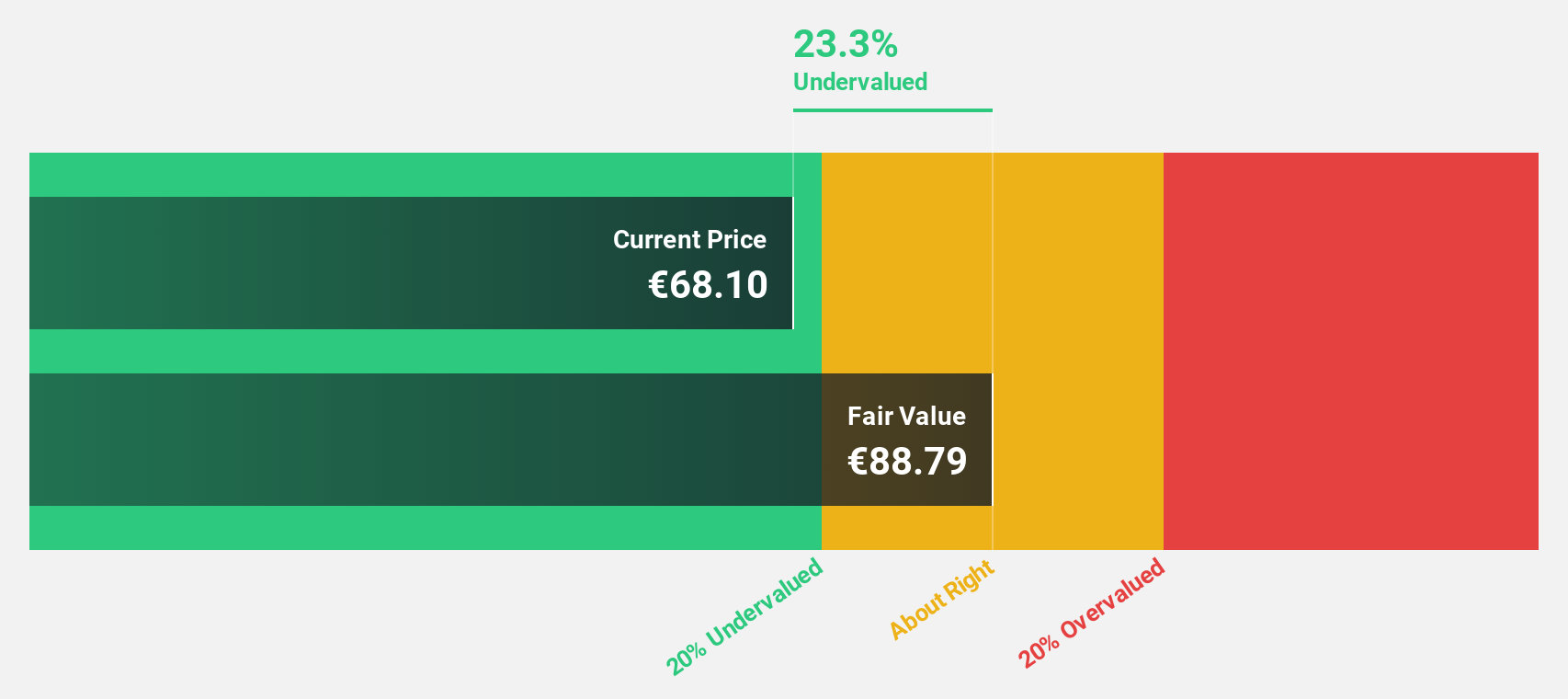

RENK Group (XTRA:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems globally and has a market cap of €7.16 billion.

Operations: RENK Group AG's revenue is primarily derived from its Vehicle Mobility Solutions segment at €736.77 million, followed by Marine & Industry at €324.40 million, and Slide Bearings contributing €126.77 million.

Estimated Discount To Fair Value: 19.7%

RENK Group, trading at €71.63, is undervalued compared to its estimated fair value of €89.15, appealing for those focused on cash flows. Recent earnings show a turnaround with net income of €0.681 million in Q1 2025 from a previous loss, and projected revenue growth outpaces the German market. Although debt levels are high and share price volatility is noted, forecasted earnings growth remains robust at 29.3% annually over the next three years.

- In light of our recent growth report, it seems possible that RENK Group's financial performance will exceed current levels.

- Take a closer look at RENK Group's balance sheet health here in our report.

Key Takeaways

- Navigate through the entire inventory of 178 Undervalued European Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives