- France

- /

- Office REITs

- /

- ENXTPA:GFC

Gecina (ENXTPA:GFC): Assessing Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for Gecina.

After several months of choppy trading, Gecina’s recent 1% slip comes as momentum continues to cool. Its 30-day share price return sits at -4.5%, and the total shareholder return over the last year is down more than 18%. While the long-term total return over three years remains positive, the latest moves suggest investors are weighing up both risks and potential upside in the current climate.

If you’re looking to spot fresh opportunities beyond the big REIT names, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a noticeable discount to analyst price targets, investors may be wondering if Gecina is currently undervalued or if the recent drop reflects the market’s outlook for future growth. Is there a compelling entry point, or is everything already priced in?

Price-to-Earnings of 11.9x: Is it justified?

Gecina’s shares last closed at €82.15, pricing the company at a price-to-earnings (P/E) ratio of 11.9x. This stands out because Gecina trades at a significantly lower multiple than both its peers and the wider industry, suggesting it may be undervalued relative to earnings power.

The P/E ratio compares a company’s share price to its earnings per share, helping investors gauge market expectations for future profitability. For property companies like Gecina, which have recently returned to profitability and offer reliable dividends, this ratio is a key measure of value in the sector.

Gecina’s P/E of 11.9x is strikingly lower than the peer group average (72x) and the global office REITs industry average (22x). In addition, it sits below the estimated fair price-to-earnings ratio of 14.4x, highlighting how the market may be underestimating Gecina’s earnings outlook and future potential.

Explore the SWS fair ratio for Gecina

Result: Price-to-Earnings of 11.9x (UNDERVALUED)

However, ongoing revenue declines and moderate five-year returns could signal underlying challenges. This may leave investors cautious about the sustainability of an undervaluation thesis.

Find out about the key risks to this Gecina narrative.

Another View: Discounted Cash Flow Perspective

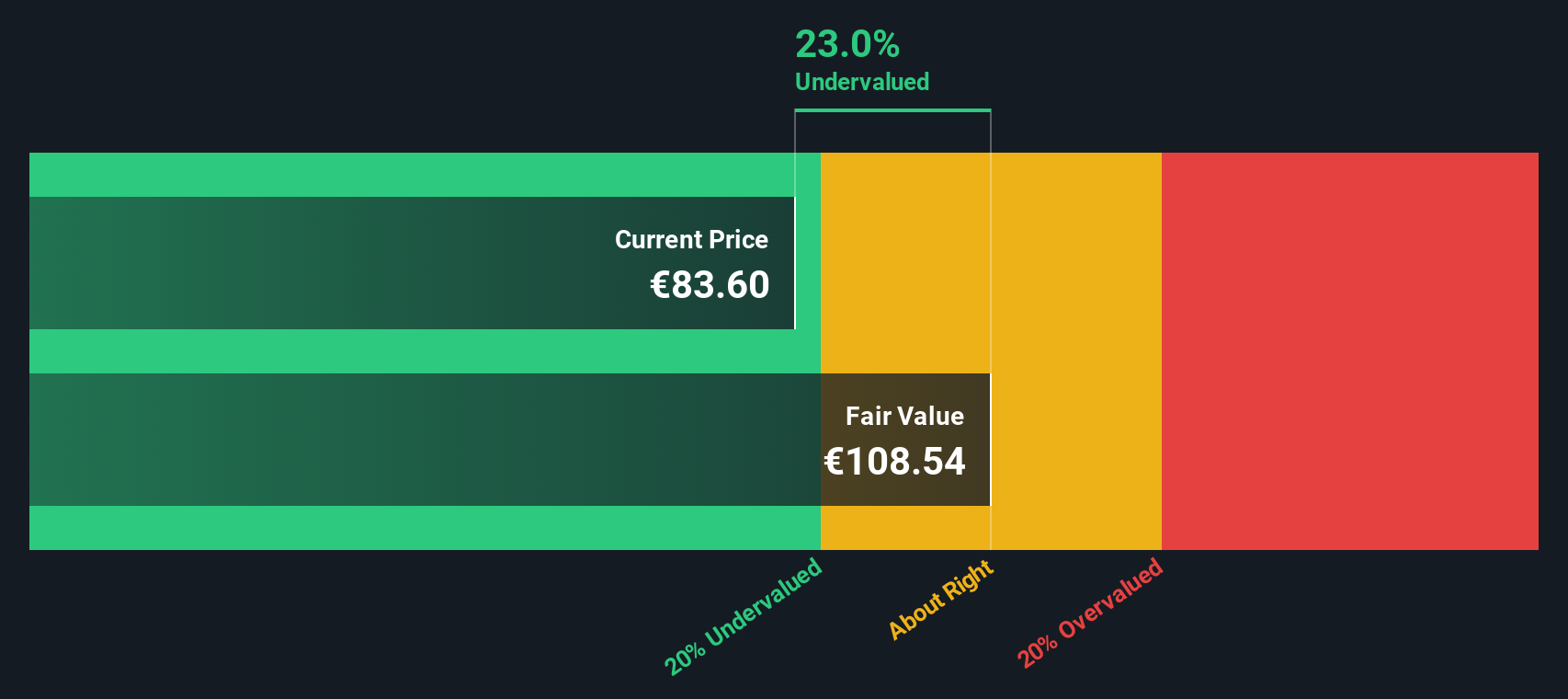

Switching gears, the SWS DCF model also suggests Gecina is undervalued, estimating the fair value at €110.31 compared to its current price of €82.15. While this supports the idea of a potential undervaluation, such models rely on future growth forecasts. It is possible that the market is considering risks that the numbers do not fully capture.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gecina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gecina Narrative

If these perspectives do not match your own, or you enjoy digging into the numbers independently, you can shape and visualize your own view of Gecina in just minutes, Do it your way

A great starting point for your Gecina research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd and seize tomorrow’s best investment opportunities today using the Simply Wall Street Screener. These handpicked ideas give you the power to act quickly and confidently.

- Capture steady income growth by tapping into these 18 dividend stocks with yields > 3% with strong yields and resilient track records in tough markets.

- Unlock technological disruption and propel your portfolio with these 24 AI penny stocks that are setting new standards in automation and smart intelligence.

- Position yourself for the next investing wave and leap ahead with these 26 quantum computing stocks transforming computation and innovation worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GFC

Gecina

A leading operator, that fully integrates all real estate expertise, owning, managing, and developing a unique prime portfolio valued at €17.0bn as at June 30, 2025.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives