- France

- /

- Office REITs

- /

- ENXTPA:FLY

Is Société Foncière Lyonnaise Fairly Priced After Latest Share Drop and Market Volatility in 2025?

Reviewed by Simply Wall St

Trying to decide if now is the right moment to buy, sell, or simply hold onto your Société Foncière Lyonnaise shares? You are not alone. With every market shakeup, investors are searching for signals, and this stock has certainly given us a few to watch. After a strong 11.1% return over the past year, recent weeks have brought a dip, with the shares falling 5.6% in the last seven days and dropping 4.6% over the past month. Despite these short-term bumps, its five-year performance is still up an impressive 44.5%, so the big picture remains intriguing.

Some of this volatility has mirrored broader market jitters, especially with shifting interest rates and renewed debate about the value and risk profile of European property sector stocks. For Société Foncière Lyonnaise, this has meant moments of both optimism about the long-term growth potential and renewed caution as investors reassess risk.

On the valuation front, things start to get interesting. The latest numbers give the company a value score of 3 out of 6, indicating it is undervalued according to half of the main financial checks analysts typically run. That suggests there may be an opportunity for savvy investors willing to look past near-term noise.

Let us dig into the key valuation approaches, examine what is behind that score, and see if there is more upside than meets the eye. In addition, we will wrap up by exploring a perspective that goes beyond the usual valuation checklist.

Société Foncière Lyonnaise delivered 11.1% returns over the last year. See how this stacks up to the rest of the Office REITs industry.Approach 1: Société Foncière Lyonnaise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company’s intrinsic value by projecting its funds from operations into the future and discounting those cash flows back to today’s value. For Société Foncière Lyonnaise, this involves evaluating its expected ability to generate free cash each year and determining what that is worth right now in euros.

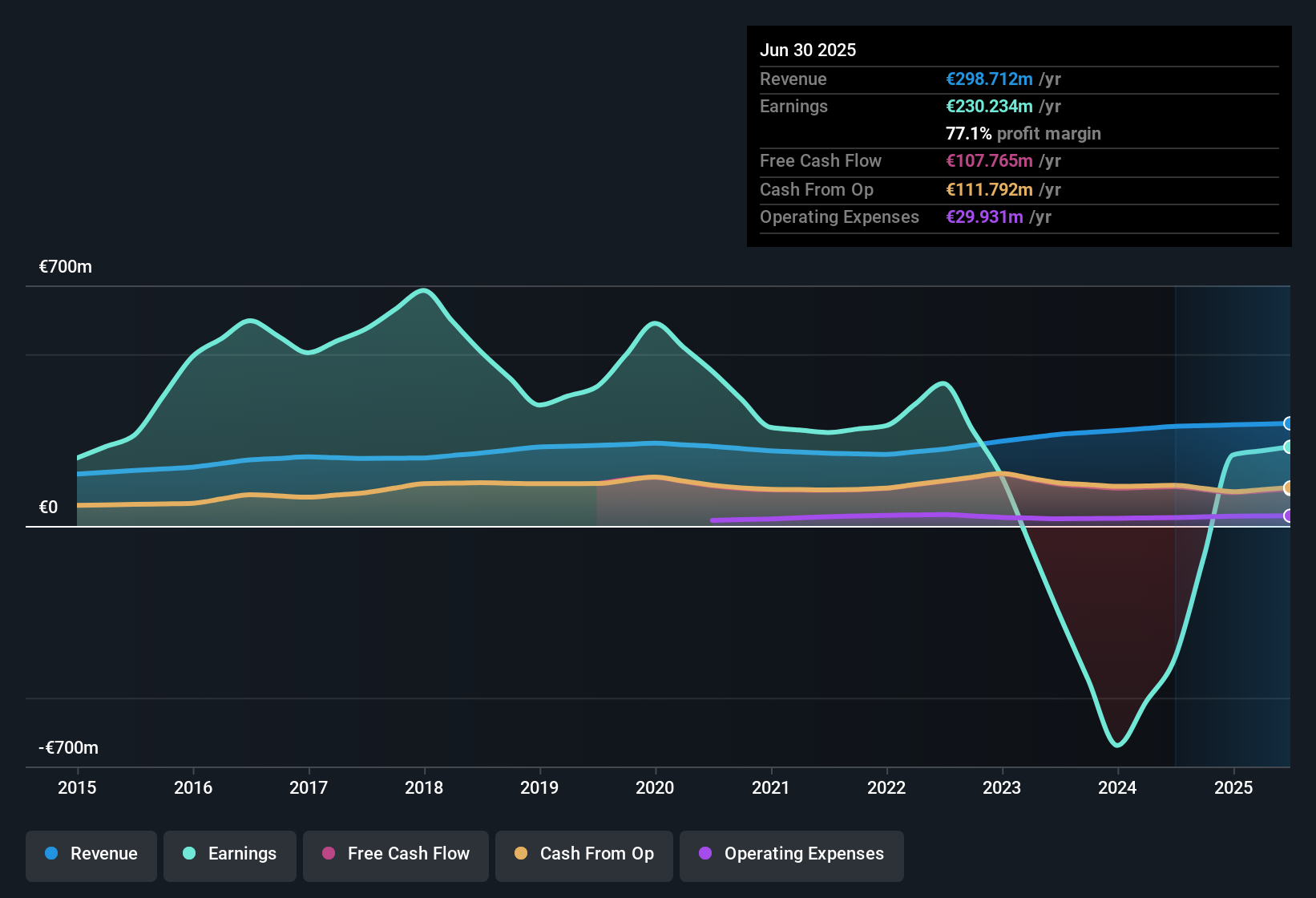

Currently, the company’s Free Cash Flow (FCF) stands at €111.79 million. Analysts provide forecasts for the next several years, but for a full 10-year view, Simply Wall St extrapolates using historical trends, projecting FCF to reach €143.76 million by 2035. The annual growth rate for FCF over this horizon is modest, and all values are reported in euros to match the listing currency.

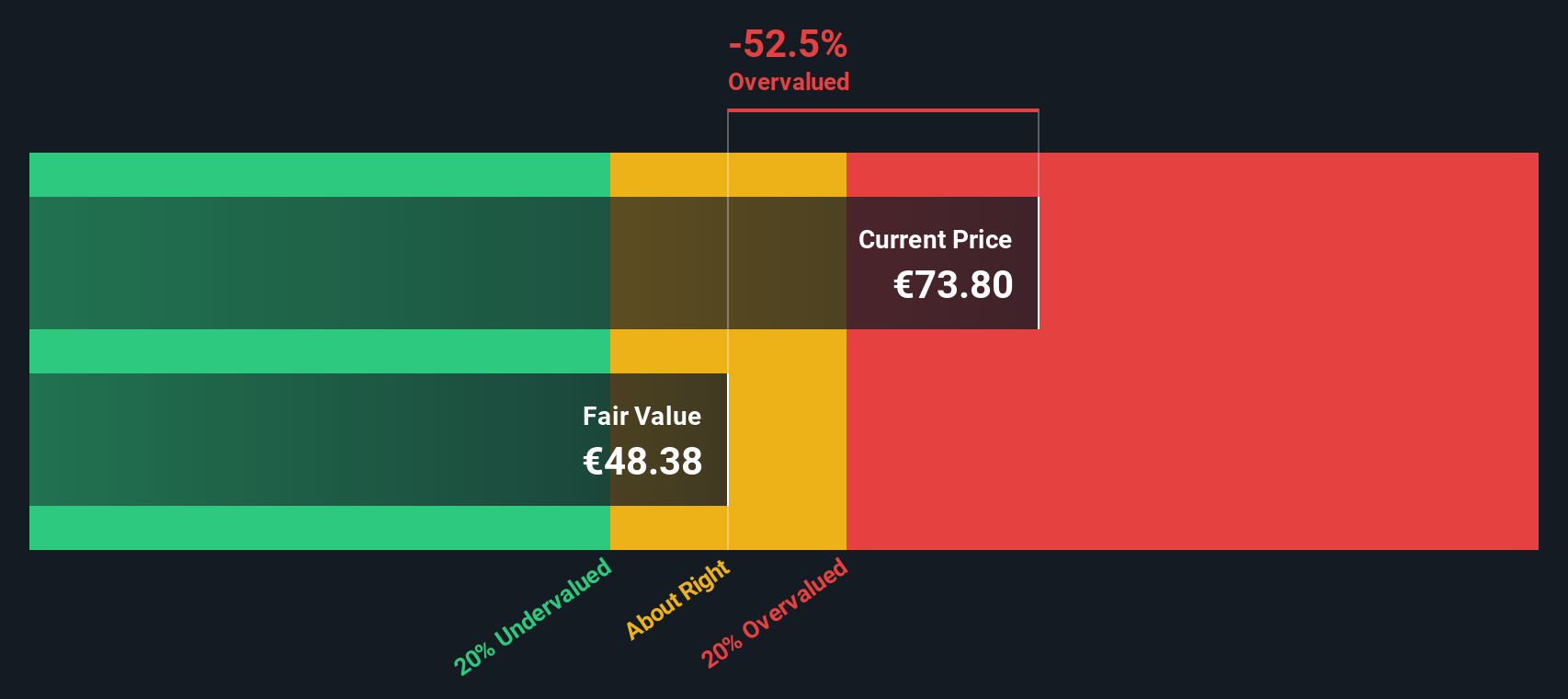

Based on the DCF model, the estimated intrinsic fair value for the stock is €46.98 per share. However, the model suggests the shares are trading at a 49.9% premium to this value, meaning they are significantly overvalued compared to these cash flow projections.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Société Foncière Lyonnaise.

Approach 2: Société Foncière Lyonnaise Price vs Earnings (PE)

The price-to-earnings (PE) ratio is often the go-to measure for valuing profitable companies like Société Foncière Lyonnaise because it connects the share price directly with the company’s actual earnings. Investors favor the PE ratio as it highlights how much they are paying for each euro of profit, making it an essential tool for comparing profitability across the sector.

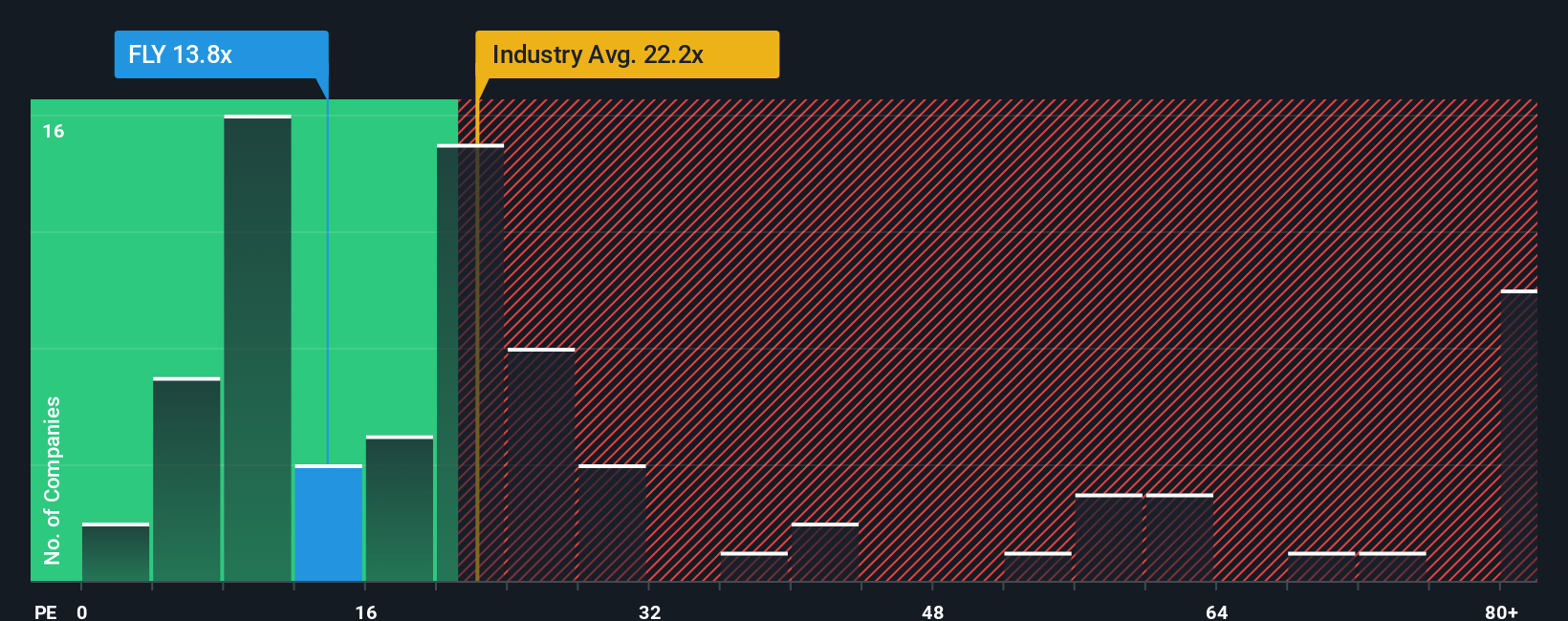

The ideal, or “fair,” PE ratio for any stock depends on several factors, especially growth expectations and risk. If a company can deliver earnings growth above the industry average or is perceived as less risky, investors are typically willing to accept a higher PE. Conversely, slower growth or higher risk means a lower PE is justified. Right now, Société Foncière Lyonnaise trades at 13.15x earnings. This is considerably lower than both the industry average for Office REITs at 23.37x and a peer average of 48.28x, indicating that at face value the stock is priced more conservatively than its direct competition.

However, simply comparing raw multiples does not always tell the whole story. Simply Wall St’s proprietary “Fair Ratio” aims to offer a more accurate benchmark by factoring in not just profit, but also growth profile, risks, profit margins, market capitalization, and the unique characteristics of both the company and its industry. For Société Foncière Lyonnaise, the Fair PE Ratio comes in at 16.43x. Because the stock’s actual PE is somewhat below this measure, it appears modestly undervalued according to this approach, once all the key variables are considered.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Société Foncière Lyonnaise Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple but powerful tool that lets you share your own story about a company, backing up your opinion with your personal estimates for fair value, future revenue, earnings, and margins. Narratives link a company’s journey and prospects to financial forecasts, turning numbers into a compelling story and a concrete valuation.

With Narratives, available to all users on the Simply Wall St Community page, millions of investors can easily create and compare different perspectives on a stock, whether they are bullish or cautious. As new information such as earnings releases or relevant news emerges, Narratives are updated dynamically, helping you keep your view accurate and timely. This makes it straightforward to decide if the share price is above or below what you believe it is worth, highlighting opportunities to buy or sell with confidence.

For example, one investor’s Narrative for Société Foncière Lyonnaise could point to a fair value of €37, while another’s might see the potential as high as €55, depending on their outlook and assumptions about the future. With Narratives, you can quickly find the approach that best matches your own thinking and act decisively.

Do you think there's more to the story for Société Foncière Lyonnaise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FLY

Société Foncière Lyonnaise

Société Foncière Lyonnaise Leader in the prime segment of the Parisian commercial real estate market, the firm stands out for the quality of its property portfolio, which is valued at 7.6 billion and is focused on the Central Business District of Paris (#cloud.paris, Edouard VII, Washington Plaza, etc.), and for the quality of its client portfolio, which is composed of prestigious companies.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives