As European markets experience a positive shift with major indices like the STOXX Europe 600 Index rising by 2.10% following a de-escalation in U.S.-China trade tensions, investors are increasingly exploring diverse opportunities. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can offer unique growth potential when backed by solid financials. In this article, we explore three European penny stocks that stand out for their financial strength and potential to uncover hidden value for investors seeking promising opportunities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.29 | SEK2.19B | ✅ 5 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.68 | SEK455.54M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.23 | SEK217.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.07 | PLN137.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.69 | €56.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.155 | €297.53M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 451 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MotorK (ENXTAM:MTRK)

Simply Wall St Financial Health Rating: ★★★★☆☆

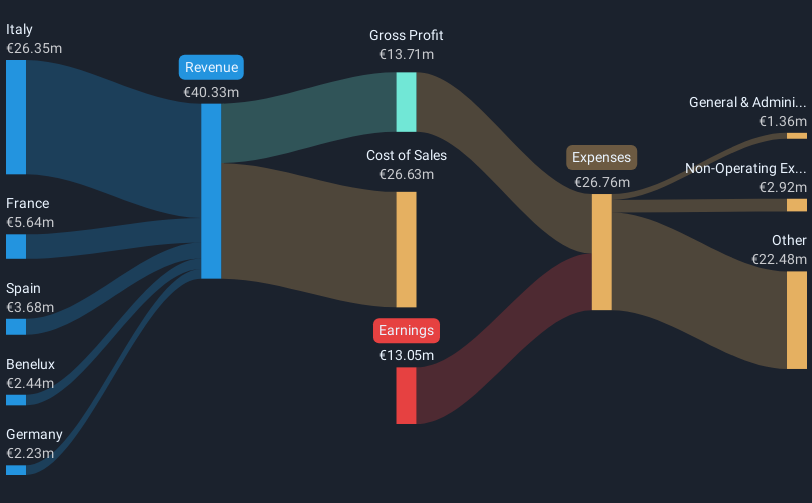

Overview: MotorK plc, with a market cap of €200.43 million, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company generates €40.33 million in revenue from its software and programming segment.

Market Cap: €200.43M

MotorK plc, with a market cap of €200.43 million, has been navigating the challenges typical of penny stocks. Despite generating €40.33 million in revenue from its software segment, the company remains unprofitable with a net loss of €12.92 million for 2024. Its high net debt to equity ratio of 59.1% and short-term liabilities exceeding short-term assets highlight financial pressures; however, it has reduced its debt significantly over five years and raised capital through recent private placements totaling approximately €5.36 million to bolster its cash runway amid volatile share price movements and an experienced management team averaging 2.9 years tenure.

- Unlock comprehensive insights into our analysis of MotorK stock in this financial health report.

- Examine MotorK's earnings growth report to understand how analysts expect it to perform.

FIPP (ENXTPA:FIPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

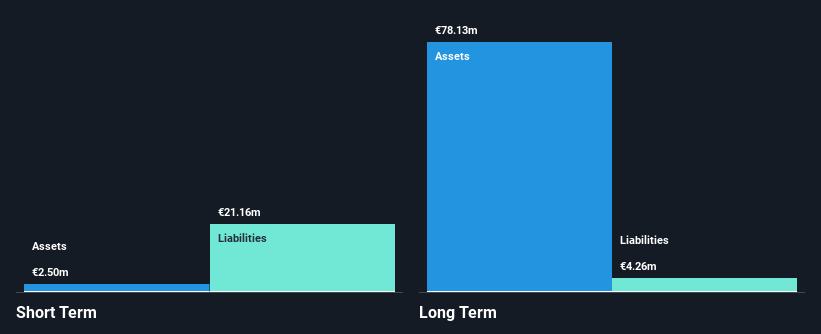

Overview: FIPP S.A. operates in the real estate sector both in Paris and internationally, with a market capitalization of €15.80 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: €15.8M

FIPP S.A., with a market cap of €15.80 million, operates in the real estate sector and remains unprofitable despite reporting €2.25 million in sales for 2024, up from €1.83 million the previous year. The company is debt-free and has a stable cash runway exceeding three years due to positive free cash flow growth of 2.6% annually, though short-term assets (€2.7M) fall short of covering both its long-term (€4.1M) and short-term liabilities (€22.2M). Despite trading significantly below estimated fair value, FIPP's high volatility persists alongside an experienced board averaging 9.4 years tenure.

- Click to explore a detailed breakdown of our findings in FIPP's financial health report.

- Review our historical performance report to gain insights into FIPP's track record.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

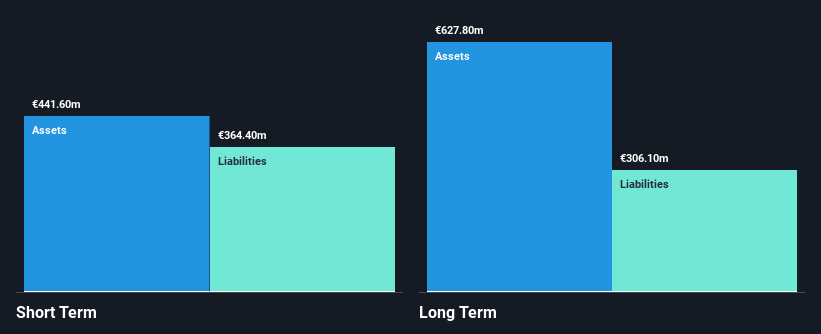

Overview: Anora Group Oyj is involved in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €218.87 million.

Operations: Anora Group Oyj generates revenue through three main segments: Wine (€321.4 million), Spirits (€224.9 million), and Industrial (€229.4 million).

Market Cap: €218.87M

Anora Group Oyj, with a market cap of €218.87 million, has shown stability in its weekly volatility while maintaining a satisfactory net debt to equity ratio of 21.9%. Despite becoming profitable recently, the company's earnings have declined by 42.3% annually over the past five years and its Return on Equity remains low at 2.5%. Anora's short-term assets exceed both its short-term and long-term liabilities, yet interest payments are not well covered by EBIT. The dividend yield of 6.79% is not supported by earnings or cash flows, although analysts suggest potential stock price appreciation of 21.4%.

- Dive into the specifics of Anora Group Oyj here with our thorough balance sheet health report.

- Gain insights into Anora Group Oyj's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Click this link to deep-dive into the 451 companies within our European Penny Stocks screener.

- Curious About Other Options? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Anora Group Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ANORA

Anora Group Oyj

Produces, imports, markets, distributes, and sells alcoholic beverages in the Finland, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives