Why We Think Virbac SA's (EPA:VIRP) CEO Compensation Is Not Excessive At All

Key Insights

- Virbac's Annual General Meeting to take place on 21st of June

- Salary of €379.0k is part of CEO Sebastien Huron's total remuneration

- The total compensation is 34% less than the average for the industry

- Virbac's total shareholder return over the past three years was 23% while its EPS was down 3.5% over the past three years

Shareholders may be wondering what CEO Sebastien Huron plans to do to improve the less than great performance at Virbac SA (EPA:VIRP) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 21st of June. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Virbac

Comparing Virbac SA's CEO Compensation With The Industry

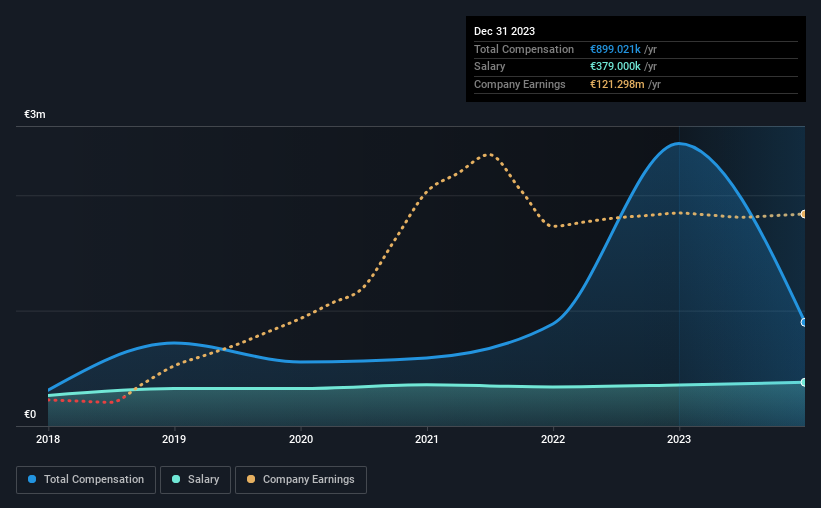

At the time of writing, our data shows that Virbac SA has a market capitalization of €2.8b, and reported total annual CEO compensation of €899k for the year to December 2023. We note that's a decrease of 63% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at €379k.

In comparison with other companies in the French Pharmaceuticals industry with market capitalizations ranging from €1.9b to €6.0b, the reported median CEO total compensation was €1.4m. Accordingly, Virbac pays its CEO under the industry median. What's more, Sebastien Huron holds €1.2m worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €379k | €355k | 42% |

| Other | €520k | €2.1m | 58% |

| Total Compensation | €899k | €2.4m | 100% |

On an industry level, roughly 51% of total compensation represents salary and 49% is other remuneration. It's interesting to note that Virbac allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Virbac SA's Growth Numbers

Over the last three years, Virbac SA has shrunk its earnings per share by 3.5% per year. It achieved revenue growth of 2.5% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Virbac SA Been A Good Investment?

Virbac SA has generated a total shareholder return of 23% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

Whatever your view on compensation, you might want to check if insiders are buying or selling Virbac shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIRP

Virbac

Manufactures and sells a range of products and services for companion and farm animals in Europe, North America, Latin America, East Asia, India, Africa, the Middle East, and the Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)