Further weakness as OSE Immunotherapeutics (EPA:OSE) drops 11% this week, taking three-year losses to 54%

It is a pleasure to report that the OSE Immunotherapeutics SA (EPA:OSE) is up 51% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 54% in the last three years. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Since OSE Immunotherapeutics has shed €10m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for OSE Immunotherapeutics

OSE Immunotherapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

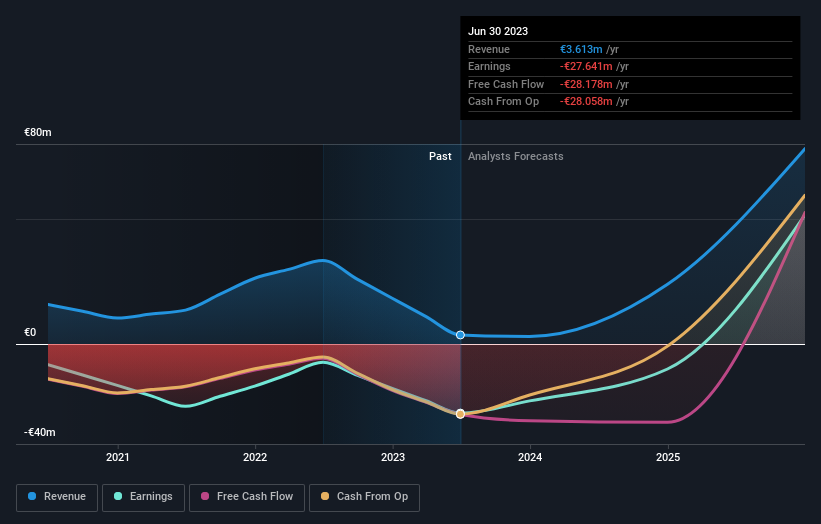

In the last three years, OSE Immunotherapeutics saw its revenue grow by 4.7% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 15% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. After all, growing a business isn't easy, and the process will not always be smooth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

OSE Immunotherapeutics shareholders are down 40% for the year, but the market itself is up 7.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand OSE Immunotherapeutics better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for OSE Immunotherapeutics (of which 2 are significant!) you should know about.

We will like OSE Immunotherapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OSE

OSE Immunotherapeutics

A clinical-stage biotechnology company, develops immunotherapies in the areas of immune-oncology and immune-inflammation in France and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives